Federal Budget Oct 2022 Summary

This year’s Federal Budget focuses on providing relief for those with children, homebuyers and social security recipients whilst maintaining pre-election commitments.

Note: These changes are proposals only and may or may not be made law.

Summary

Personal taxation

- No changes to personal income tax: The Budget did not contain any measures announcing changes to personal income tax. This includes:

- no changes to the Stage 3 tax cuts which will take effect from 1 July 2024, and

- no extension of the Low and Middle Income Tax Offset, which ended 30 June 2022.

- Helping enable electric car purchases: For purchases of battery, hydrogen, or plug-in hybrid cars with a retail price below $84,619 (the luxury car tax threshold for fuel efficient vehicles) after 1 July 2022, fringe benefits tax and import tariffs will not apply. Note: Employers will still need to account for the cost in an employee’s reportable fringe benefits.

Home ownership

- Housing affordability measures: A key focus of the Budget were measures to help individuals secure housing. This is expected to occur largely via the Housing Accord – which will bring Federal, State and Local Governments together to work on housing affordability and homelessness. Measures announced include:

- A commitment to the ‘Help to Buy’ scheme which will support first home buyers to buy a home with the Federal Government being a part owner, resulting in a lower balance to be funded by the individual themselves.

- A Regional First Home Buyer Guarantee from 1 October 2022 which, similar to the existing First Home Deposit Guarantee scheme, is expected to provide up to 10,000 first home buyers with a guarantee over their mortgage, removing the need for lenders mortgage insurance.

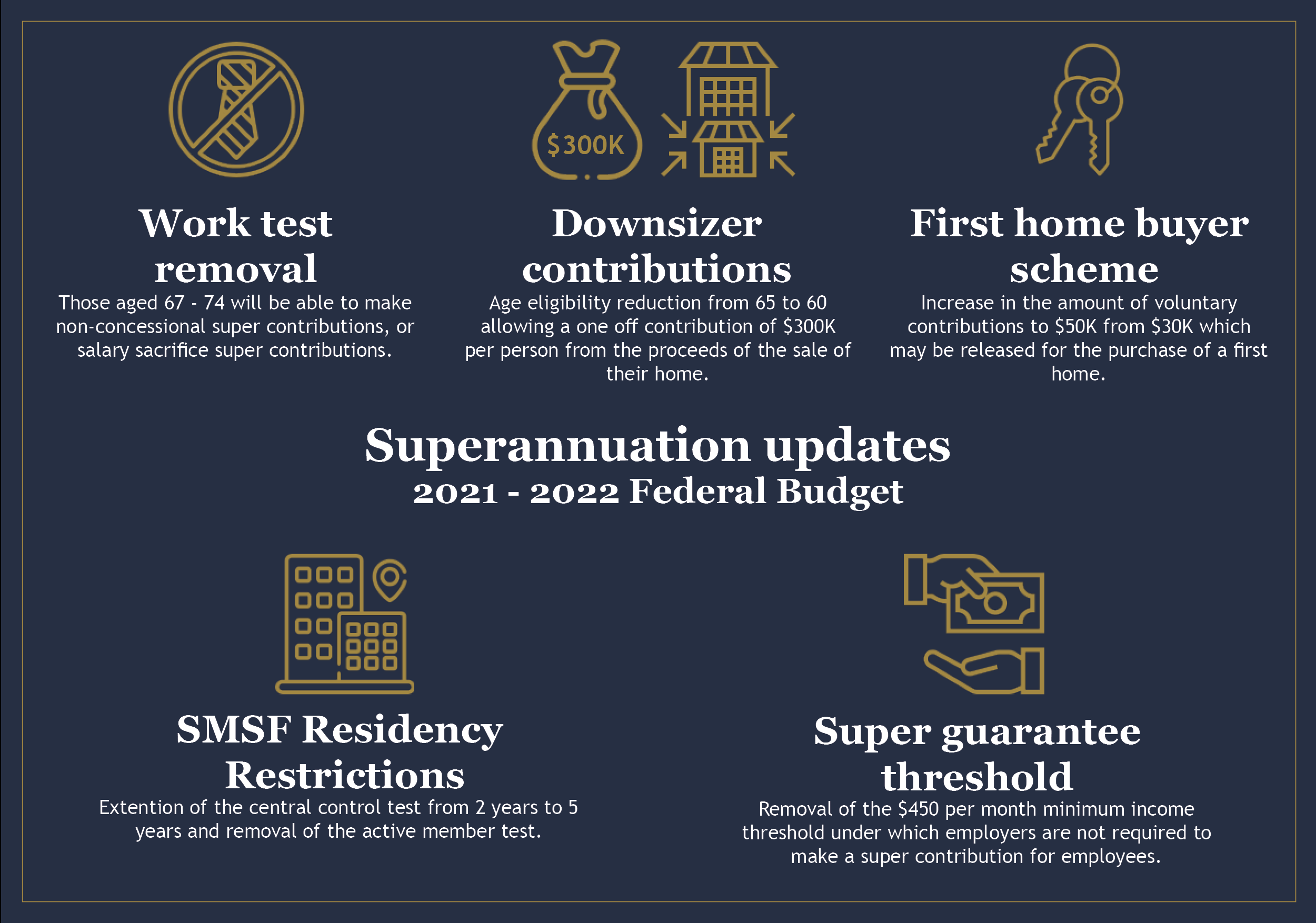

Superannuation

- Expanding eligibility to downsizer measures: Legislation has been introduced to reduce the downsizer eligibility age from 60 to 55. This measure will take effect from the first quarter after passing into law, which is expected to be 1 January 2023.

- SMSF and tax residency: The Government confirmed its intention to continue with the 2021/22 Budget measure of extending the temporary trustee absence period from two years to five years and removing the ‘active member’ test. These changes will help SMSFs continue to maintain their Australian tax residency even while members are overseas, and allow them to continue to contribute to their funds even if they become non-tax residents.

- Three-year audit cycle for SMSFs not proceeding: Originally announced as part of the 2018/19 Budget, it was confirmed the current Government will not proceed with this measure.

Social Security

- Child care subsidy changes: As part of a package of reforms to encourage parents to return to the workforce, the maximum child care subsidy from 1 July 2023 will increase to 90% for families earning less than $80,000. For every $5,000 earned over this threshold the subsidy will reduce by 1% – reducing to zero for incomes $530,000 or above.

The higher rate of subsidy for families with multiple children in care will continue under its current arrangements, ceasing once the eldest child reaches six years old or has been out of care for 26 weeks.

- Paid parental leave increases: Announced before the Budget, from 1 July 2024 the Paid Parental Leave Scheme will increase the maximum period of leave by two weeks each year – reaching a maximum of 26 weeks by 1 July 2026.

Further, from 1 July 2023 both parents will be able to access leave at the same time or enter into more flexible arrangements than currently available under the limited Dad and Partner Pay limits, and requirements to take 12 weeks as a continuous period. The paid parental leave income test will also be extended to include a $350,000 family income test, which can be used to help families who do not meet the individual income test.

- Reducing assessment of former home proceeds: For individuals on social security benefits, the temporary assets test exemption of home sale proceeds is to be extended from 12 months to 24 months. Additionally, these proceeds will only be deemed to earn a return at the lower deeming rate (currently 0.25% per annum) for this period. Note: This exemption only applies to the portion of the proceeds expected to be used in a new home purchase.

- Work Bonus deposit for older Australians: Announced as an outcome from the Jobs and Skills Summit, age pensioners and veterans over service pension age are expected to receive a one-off credit of $4,000 into their Work Bonus income bank. The Work Bonus typically offsets $300 per fortnight of income earned from employment or self-employment activities, allowing pensioners to receive a higher age pension whilst still working.

- Increased income thresholds for Commonwealth Seniors Health Card: The Government has committed to increasing the income thresholds for the Commonwealth Seniors Health Card to $90,000 for singles and $144,000 combined for couples.

- Deeming rate freeze: The Government has also confirmed its intention to retain the current deeming rates until at least 30 June 2024.

- Plan for cheaper medicines: From 1 January 2023, the general patient co-payment for Pharmaceutical Benefits Scheme treatments is expected to reduce from $42.50 to $30.

Source: budget.gov.au / Actuate Alliance Services

Business owners

- Self-assessment of depreciating assets: The Government will not proceed with the measure to allow taxpayers to self-assess the effective life of intangible depreciating assets, announced in the 2021-22 Budget.

- Reversing this decision will maintain the status quo – effective lives of intangible depreciating assets will continue to be set by statute. This will avoid the potential integrity concerns with the previously announced measure and contribute to budget repair.

Source: Macquarie