Beware of experts on yesterday

This article appeared in the Australian Financial Review.

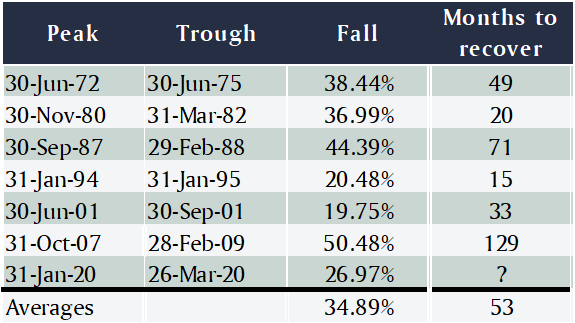

The amazing events of 2020 have been a great reminder that no two share market cycles are the same. The word ‘unprecedented’ has come to be all but worn out, whether it’s to describe the worldwide sell off in February and March, or the rebound in April and May, or the level of government and central bank support doled out along the way.

One thing that doesn”t change, however, is there is no shortage of experts competing to use history as a guide to explain why things just don’t make sense right now or will all end badly. Whether it be warnigns that valuations are too high, share markets are too reliant on a handful of companies, or market signals are being confused by central banks and governments, smart investors need to be wary of what have been called “experts on an earlier version of the world.”

Of course, there are some rules of investing that will always apply, but you also need to allow that markets are a constantly shifting mix of factors. Like ingredients in a recipe, if they are mixed in different proportions, you’ve got a whole new dish on your hands. Some new factor can seem to come out of nowhere and exert such profound influence that it all but squashes the last big trend into insignificance.

Take, for example, the common warning that share markets are expensive based on current price to earnings (PE) ratios compared to long-term historical averages. The price you pay for a share divided by how much that share will earn next year gives you a basic measure of how expensive it is: the higher the number the higher the valuation.

Based on earnings forecasts for the next 12 months, global shares are trading on a PE of 21, versus a 32-year average of 16. Likewise, Australian shares are on 18 versus 14, and the US is 23 vs 16. Nobody likes paying too much for something, and it can take years to recover from overpaying for investments.

However, it’s long been accepted that low inflation is supportive of higher PE ratios, and right now, inflation is much, much lower than it has been over the last 38 years. In fact, inflation and interest rates peaked around 1980 and have been in decline ever since. So it makes perfect sense that PE ratios would be higher now than they were over that long-term average.

One of the most commonly used techniques to value a company’s share is to do a discounted cash flow, or DCF, valuation. To do that you apply a ‘discount rate’, which is usually based on bond yields, against forecast earnings to see what they’re worth in today’s dollars. The lower your discount rate, the higher will be the present value of those future earnings and thus the higher the share’s valuation.

Right now, 10-year bond yields across the world are about the lowest they’ve ever been. So, again, it makes sense that valuations are higher today than they would have been at any time over the past 40 years.

What about those over-stretched US tech companies we keep hearing about? Again, the comparison needs to be kept in context. Once upon a time the market was dominated by companies whose costs went up in proportion with their sales. Industrial companies required bigger factories, supply chains and distribution networks to sell more widgets.

But now some technology-based businesses can expand their sales enormously without their costs increasing at all. That means the return on equity, which is a basic measure of profitability, for those businesses can be exponentially higher than their industrial counterparts, so it makes sense they will trade on vastly different metrics.

The problem here is an investor with a forty year career of investing in stocks with low PEs, because that’s what worked best for the previous 40 years, will understandably struggle to accept those high PEs are anything but an aberration from sensible valuations. Such an investor is almost undoubtedly an expert in an earlier version of the world.

They would never have bought Amazon shares five years ago when they were on a PE of 741, yet over that period the shares have risen more than six-fold and are still on a PE of 119. Evidently, when it comes to a company like this, a PE ratio is not the right valuation measure to use, and it’s ridiculous to argue the market has got it wrong for five years.

That doesn’t mean those investors won’t make money, it’s just that they’re unlikely to make as much money in today’s version of the world. With bond yields so low, an investment that offers apparently huge scope for growth with high profits becomes extremely attractive.

2020 will be remembered as an extraordinary year, with lessons for both the short and long term. The short-term lesson is just how difficult it is to second guess the market. No matter how certain we might be that something doesn’t make sense, Mr Market really doesn’t care what you think. The long-term lesson is that structural shifts in markets, like inflation and interest rates grinding lower and lower, can be hard to see while they’re happening, but the effects on markets can be profound.

While it’s smart to take on board the lessons from each cycle, we’ve seen time and time again it’s not so smart to presume history will simply repeat itself.