This article appeared in the Australian Financial Review.

After news of a promising COVID vaccine hit financial markets on 9 November, those sectors that had been shunned like last week’s fish dinner while economies were at risk of ongoing lockdowns suddenly became flavour of the month.

Investors pounced on the stocks that should benefit from people returning to ‘normal’, which saw sectors like energy, banks, retail property trusts, hospitality and travel shoot up. At the same time, the companies that had starred during lockdown, that benefited from people shopping, working and exercising from home, surrendered some of their astonishing gains.

This has left smart investors facing the usual challenging questions: has the market already priced in the return to normal? Should you be erring on the side of caution and selling into these strong markets?

We continue to advise clients to remain fully invested in the allocation to growth stocks their risk profile allows.

Strong outlook for the economy

There are several indicators pointing to the possibility of a strong economic environment in the year ahead. First, the Australian government injected stimulus equivalent to 13% of GDP in the form of JobKeeper, JobSeeker and other direct payments. The $34 billion worth of early super withdrawals added another 2.5% to that.

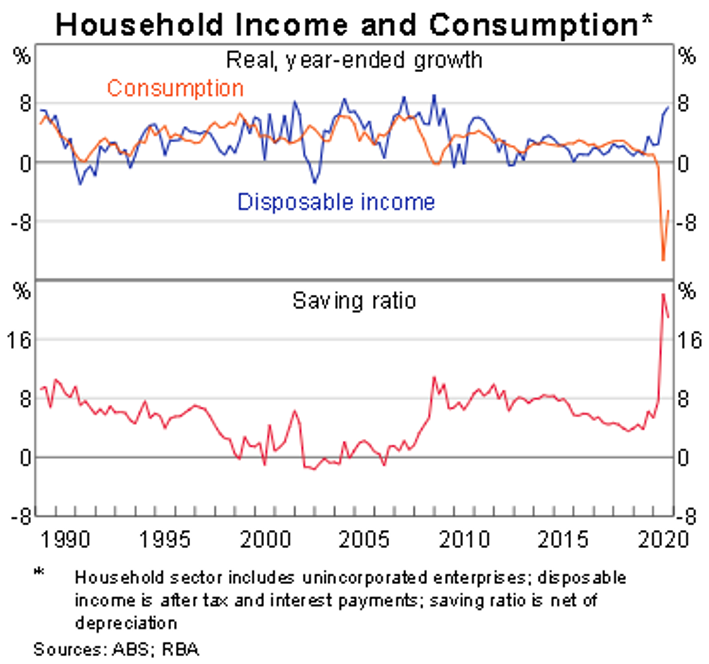

A lot of that stimulus has already been spent, which was the whole idea, but much of it has been saved, with Australia’s household savings ratio hitting 19.8% in the June quarter, almost eight times higher than a year ago and only 0.5% below its peak of the last 60 years. That’s a serious amount of spending power.

And spending is exactly what it looks like Australian consumers are doing after confidence levels jumped to 10-year highs. The Commonwealth Bank reports its credit card data showed spending in the week to 13 November was up 11% compared to last year. Restaurants in New South Wales enjoyed seated dining numbers 55% higher than a year ago, while Queensland was a whopping 79% and even shellshocked Victoria was up 54%.

Retailers will be eyeing off that pool of savings in anticipation of a bumper Christmas and companies in general should expect a lot of that money to work its way around the economy for a while yet.

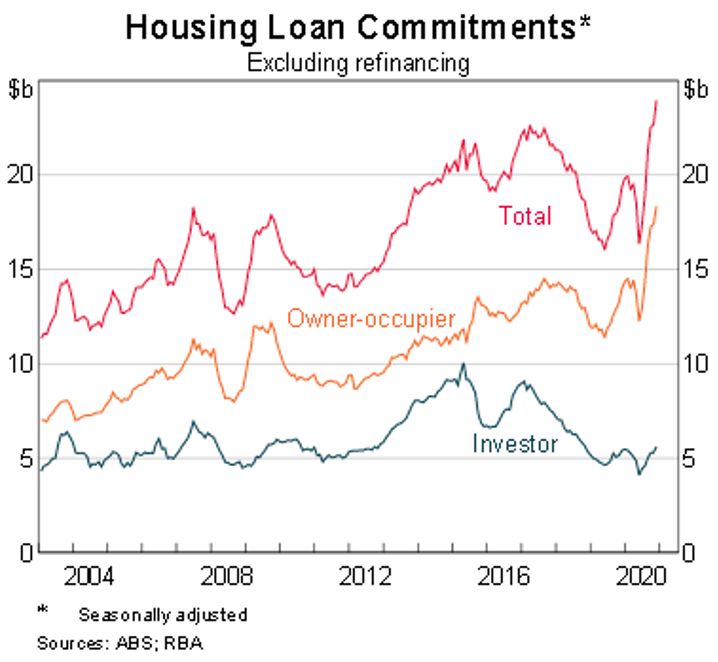

The US is in a similar position, with a 13% stimulus package pushing the personal savings rate to almost double what it was at the start of the year. Although a fresh stimulus package has been trapped in a political standoff for the time being, it is expected the new Biden administration will make it a priority. Meanwhile, record low interest rates have ignited the housing market, with home values at record highs, homeowners’ equity at record levels and monthly new home starts challenging their all-time highs.

If the new vaccines are as effective as they appear, the Chinese economy has shown how quickly things can bounce back. China’s manufacturing and services sectors have rebounded strongly, pushing annualised GDP growth to 5% and retail sales are almost 5% higher than a year ago.

What about the markets?

Whoever would have thought the US share market would already be at a record high the day a COVID vaccine was announced? Let alone that it would hit that high amidst COVID cases being reported at record rates across the globe. And that strength is being seen in stock markets around the world, with 52-week highs in China, Europe, the emerging markets and even Japan is at 30-year highs.

2020 has been a great reminder that share markets do not necessarily follow economies, so it’s entirely possible we will see an economic rebound and poor markets. And there are plenty of sceptics ready to point to elevated valuations as a warning signal.

So how do those valuations stack up? Australia’s ‘forward PE (price to earnings) ratio’, so based on earnings forecasts for next year, is at 19 times compared to a 32-year average of 14, and the MSCI World Index is at 21 times compared to 16.

On the face of it, that makes shares look pretty expensive. However, I’ve argued for a long time that low inflation supports higher PE ratios. 30 years ago, Australia’s inflation rate wasn’t far off 10% and it’s been trending downwards ever since. So, with inflation currently below 1%, it makes perfect sense that the PE ratio would be higher. In fact, comparing today’s PE ratio to any period as far back as 40 years ago, when inflation peaked at close to 18%, is like comparing the proverbial apples and oranges.

Further, high growth companies such as the tech sector have defied any gravitational pull of lower PE ratios. I’ve argued before that it makes little sense to value a software company whose earnings can grow exponentially without requiring any further capital outlay the same way you’d value a company whose earnings can only grow in proportion to how much they spend on building new factories.

Bond yields have also been steadily declining and, likewise, it’s well established that falling bond yields underwrite higher equity valuations. The typical way to value a share is by working out what a company’s future cash flows are worth today by applying a ‘discount rate’, which is normally based on the 10-year bond yield. The closer bond yields get to zero, the more valuable are those future cash flows in today’s money.

With interest rates at levels designed to punish savers and prospects of a vaccine unleashing a post-COVID spending spree, it’s little wonder global equities just saw the biggest week of inflows ever. Now is not the time to be sitting on cash.