The latest statistics coming out of the Australian residential property market indicate we’re seeing a remarkable rebound, with approvals and finance applications soaring and prices likely to follow. For now, the real driver is free standing houses being bought by owner occupiers.

Record construction approvals

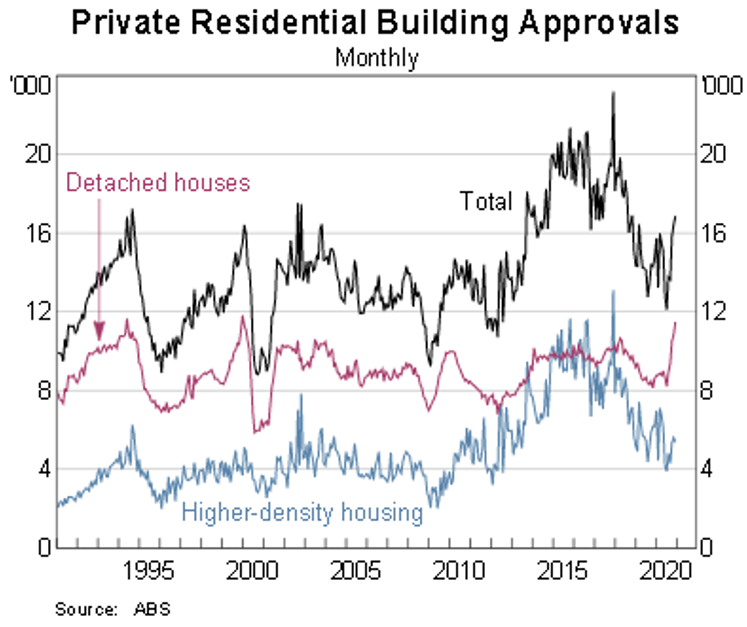

Approvals to construct new houses jumped 15.8% in December to a record high, with strength seen right across the country. CBA’s economics unit pointed out that compared to December 2019, housing approvals rose “an incredible 55%” – see chart 1.

Chart 1: Dwelling approvals were strong across the whole of Australia

While apartment approvals are nowhere near as impressive, being 19% below a year ago, they are still 44% above the low point reached in June last year when the market had been crushed by national COVID lockdowns and forecasts were for housing markets to collapse.

Residential propery prices expected to follow

While CoreLogic reports that national home prices have risen a relatively modest 1.5% compared to a year ago, with Sydney up 2% and Melbourne down 2.2%, those markets that have enjoyed less COVID disruption were stronger: Perth was up 3.7%, Brisbane 5.3% and Adelaide 6.7%.

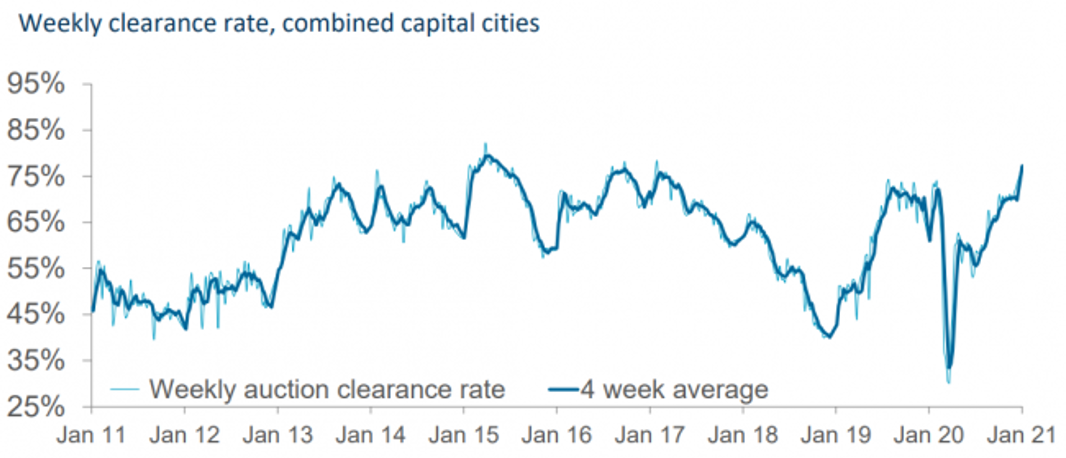

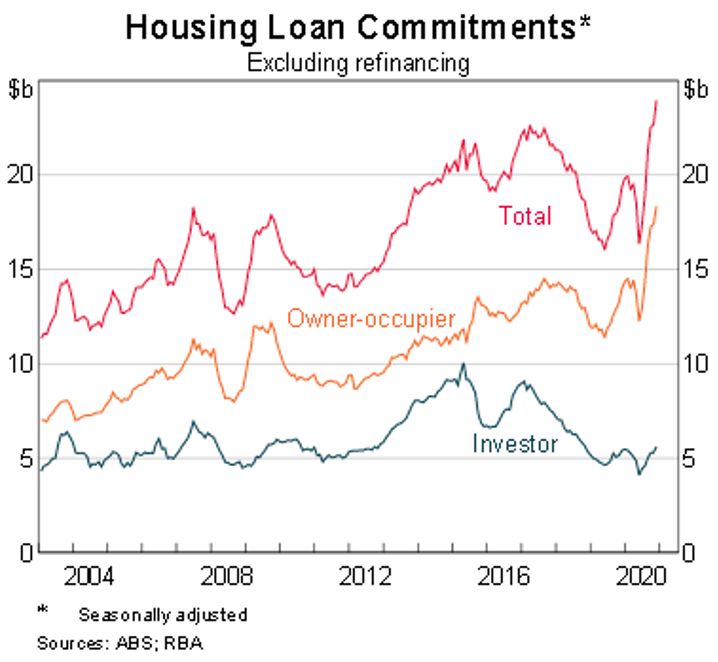

However, given weekly auction clearance rates and loan applications tending to be a reasonable leading indicator for house prices, the outlook for prices, especially for free standing homes, appears to be very positive. Clearance rates have roared to a four-year high – see the chart 2 below – and the value of new housing loan commitments in December jumped 9% to hit a record high of $26 billion, putting it 31% higher than a year ago.

Chart 2: Auction clearance rates have hit a four year high

Chart 3: Owner occupier borrowing has shot up

UBS forecasts Australian house prices will rise by 10% in 2021, while CBA is calling for an 8% increase.

Perfect storm

What we’re seeing is the culmination of various factors that, when combined, amount to a huge tailwind for the property market.

Interest rates: the Reserve Bank has cut cash rates to an all-time low of 0.1% and indicated they have no intention of raising them any time soon. Borrowers could have two to three more years of super low interest rates up their sleeve.

In addition, the big banks are benefiting from the Reserve Bank’s Term Funding Facility that enables them to borrow a total of $200 billion for home lending at the same rock bottom rate of 0.1%.

Banks have responded by offering fixed rate loans as low as 1.75%, with no fewer than 25 different loans currently below 2%. Not surprisingly, fixed rate loans now account for 40% of new loans, up from 15%.

Relaxed lending standards: In October last year the government announced the removal of the bank regulator’s responsible lending laws, which required banks to undertake thorough due diligence on a borrower’s capacity to repay a loan. The Treasurer said at the time the move was aimed at providing easier access to credit to help Australia’s recovery from its first recession in more than 30 years.

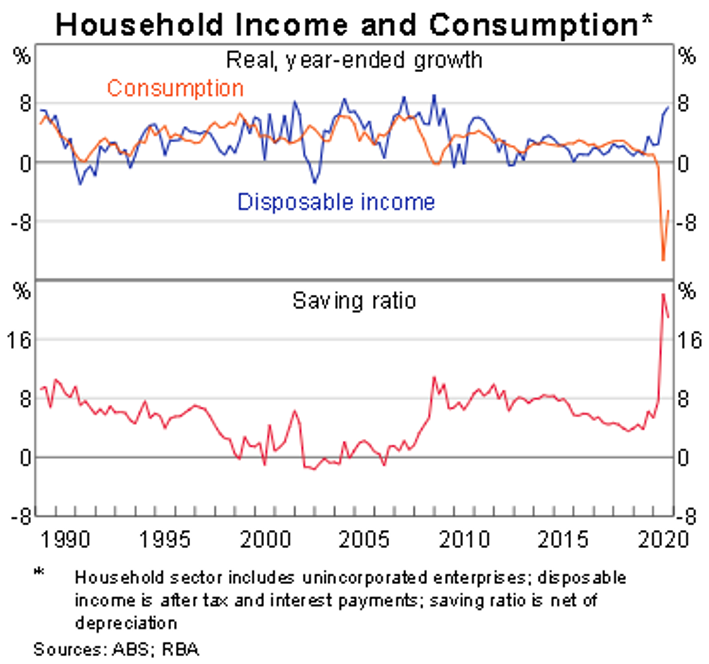

Stimulus spending: the stimulus packages announced in the wake of the COVID pandemic by the Australian government added up to 13% of GDP – newly created money shoved into the economy. That saw household savings jump to an almost 60-year high in June last year – see chart 4.

Chart 4: Household savings hit an almost 60-year high

HomeBuilder Grant: the Federal Government also announced grants of $25,000 to qualifying borrowers who were either buying or renovating a home to live in. By the end of 2020, 75,000 applications had been received, blowing past the government’s forecast of 30,000. The scheme has been extended until March, although it’s been reduced to $15,000.

Stamp duty concessions: New South Wales and Victoria announced stamp duty concessions of between 25-50% on residential property purchases up to $1 million.

Job security: thanks largely to the stimulus juicing the economy, the NAB Business Survey shows business confidence and business conditions have rebounded to be well above their average for the last 30 years. That’s in turn prompted the labour participation rate to jump to a 35-year high and the underemployment rate to drop to its six-year average, while job vacancies are at the highest for at least 12 years.

Not as great for investors

While property prices are tipped to do well over the course of 2021, rental markets are not looking as promising for property investors.

Nationally, CoreLogic reports rental rates went up by just over 1% for the year to the end of January 2021. That means they failed to keep pace with property prices, meaning the yield on an investment property, already notoriously low in Australia, was even worse.

Rents in apartments were markedly worse, possibly reflecting a sharp fall in international students and immigrants. In Melbourne, unit rents dropped 8% over the past year while in Sydney it was 6%.

Key takeaways

- For those looking to buy a home, the market looks set to rise over this year.

- While capital gain for investors is always attractive, there may well be risks in finding a tenant at current market rates.

- Qualifying borrowers can still benefit from the federal government’s HomeBuilder grant until March.

- For those looking to borrow to buy a home, rates are at all-time lows.

- For those already with a mortgage, now is a great time to refinance.

Looking to buy a residential property or refinance your existing home?

Call Steward Wealth today on (03) 9975 7070 to find out how we can help you achieve a highly competitive home loan rate.