If you hear or read a market commentary these days it seems the oil price is constantly being quoted to explain day to day moves. Once again we seem to be in one of those strange, counter intuitive episodes where the markets are celebrating when the oil price goes up. So what’s going on?

Crunch

We’ve published the oil price chart (see below) many, many times, but it never fails to amaze.

Oil price over the last 5 years

The price collapsed by two thirds after the Saudis decided to put the squeeze on U.S. shale producers by not reducing their output.

The problems

One issue is that the oil exporting nations are suffering a real squeeze on revenues. For example, Saudi Arabia is now running a deficit of 15% of GDP. Nobody’s going to be weeping for them, but those producers are in a vicious circle: the price has fallen so their revenues go down, so they have to increase production to maintain revenues, which increases supply and makes the price fall, and so on. That’s putting pressure on sovereign credit ratings and government budgets and has forced some sovereign wealth funds to sell assets, like shares.

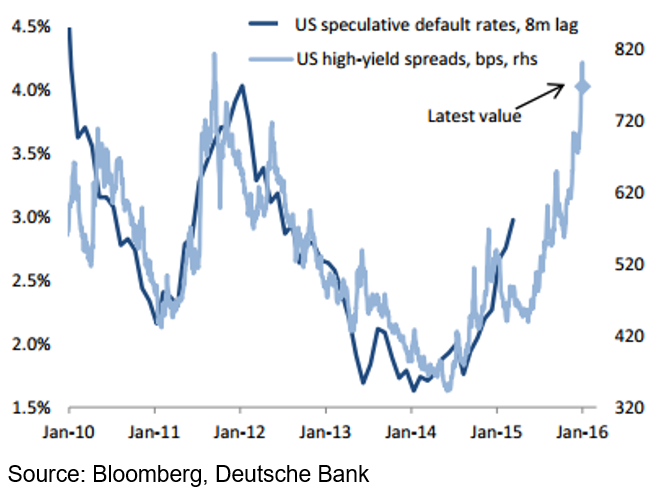

The other big issue is that there were a lot of energy-related companies that raised debt over the past seven years by either issuing corporate bonds or taking out loans. Clearly, those debts become harder and harder to service when the price of the company’s underlying commodity is falling. Consequently the markets are now worried we’re going to see a spike in defaults, so those loans and bonds are being dramatically repriced. You may have read about ‘spreads’ on high yield bonds rising, what that means is the gap between the cash rate and the interest rate people demand to compensate for the increasing risk of default is going up, so the gap, or spread, between the two rates is widening – see the chart below.

Why is the widening spread a problem?

Companies have been using the credit market (bonds and loans) to raise money to fund operations, capex or, in quite a few cases, to buy back their own shares. If the credit market tightens up, or even worse shuts down, there’s going to be a lot of companies that will struggle to get the finance they need to conduct business as they would like to. That would, of course, eventually be reflected in company profits. Share markets, as always, are trying to look in to the future and reflect what could happen.

Can’t they just borrow from the banks?

Whilst some banks have lent money to energy companies, by and large the sector has been trying to rebuild their balance sheets since the GFC, so they’re not particularly enthusiastic to lend. A couple of weeks ago some of the big U.S. banks announced increased bad debt provisions for energy company loans, so it’s very unlikely they’ll be taking more on right now.

What’s going to happen?

This is the classic situation where analyst forecasts will be fervently quoted in the media. Whilst some of them will sound very knowledgeable, at the end of the day they’re guessing, because nobody really knows what’s going to happen. What we can say is that both equity and high yield credit markets have corrected heavily and a lot of value has been restored. When banks are offering 2-3% interest rate, being able to get 9-10% from the right loans looks very attractive.

What are we doing with portfolios?

Fortunately we got rid of our exposure to the credit market and at risk debt midway through 2015. We have also spoken to the low risk debt fund managers we deal with and we’re satisfied they have very little, if any, exposure to the high yield sector. The correction across equity markets has also made forecast 10 year annualised returns look very attractive. While there is value returning to the credit markets, we are not hurrying to reinvest right now as we’d prefer to wait to see if the default rates do in fact creep up.