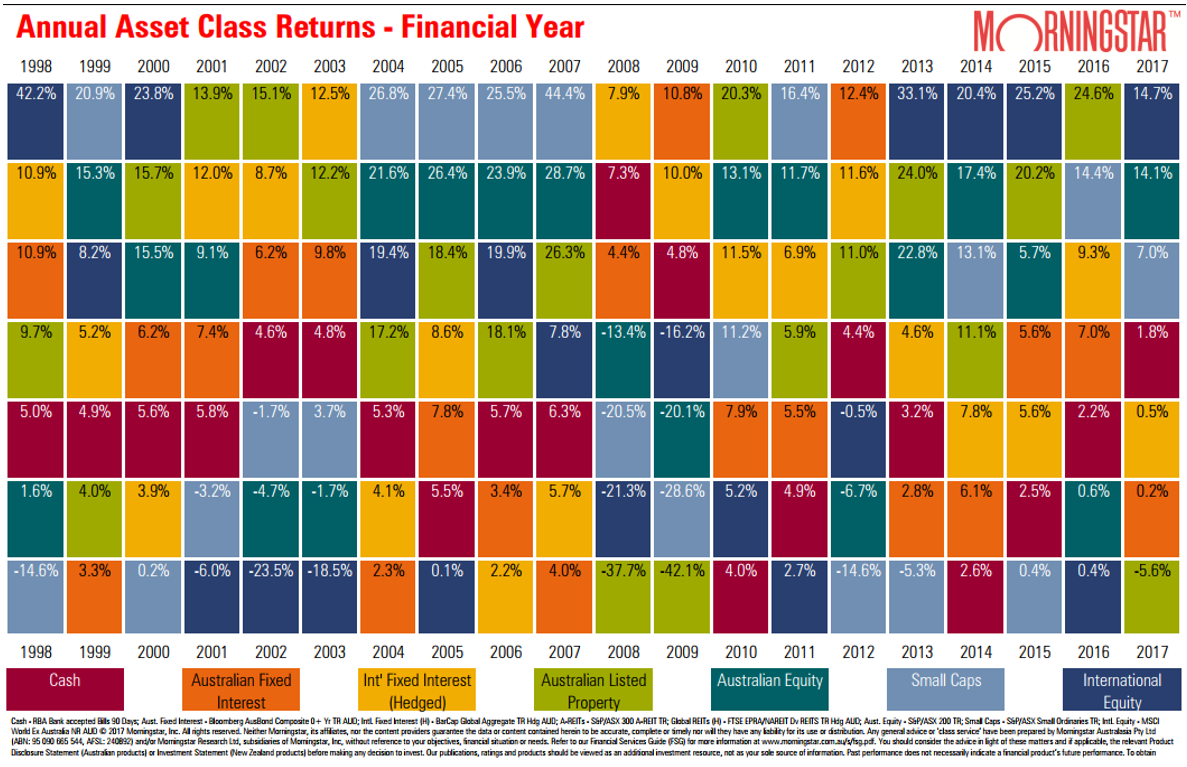

‘Asset allocation’ is arguably the most important determinant to a portfolio’s long-term performance, and the table below, published by Morningstar Australia at the end of every financial year, is a great reminder of why that is. The table ranks the returns of seven different asset classes over the previous 12 months going back 20 years; everything from cash to domestic and international shares, bonds and property trusts. My favourite question is: can you spot the pattern?

Obviously the trick to the question is there is no pattern. If you look carefully it’s not unusual for the top performing asset class in one year to be the bottom of the pile the next year – just check out international equities in 2017 versus 2016. It’s been proven time and time again that 12 month returns on asset classes are what’s come to be called a “random walk”.

There are valuable investing lessons to be taken from this. First, trying to pick the winning sector on a short-term, year to year basis is next to impossible to do accurately and consistently. The best way to compensate for that is to make sure you have a diversified portfolio, which the father of modern portfolio theory, Nobel Laureate Harry Markowitz, called the only free lunch in investing.

The second lesson boils down to a philosophical view: should your asset allocation model be static (never changing over time) or dynamic (adapts to forecast changes), There are devout advocates on both sides, and given studies have found asset allocation accounts for as much as 90% of the variability of a portfolio’s monthly returns, it’s a really important question.

We do believe in dynamic asset allocation, which is another way of saying we believe you can make effective and meaningful forecasts about expected returns from different asset classes. But we also believe those forecasts need to be based on a long-term view.

“But if you can’t forecast one year out how can you forecast 10?” I hear you ask. For something as cyclical as financial markets, over the longer-term you are able to rely on the irrefutable law of mean reversion.

We also believe those forecasts should be based on forward-looking data, not backward looking. Markets change over time and the drivers of different market cycles are rarely the same, so looking to mean revert to what conditions were like five years ago can lead to very distorted outcomes. Just look at interest rates in this cycle, and the big one: at their peak in 1989 Japanese equities accounted for some 50% of global stock market indices (right before they fell 80% over 23 years) and now it’s 8%.

The asset allocation model we use, which comes from Farrelly’s, is based on forward looking, rolling 10 year annualised forecast returns and has proved to be impressively accurate, as shown by the table below comparing their September 2006 10 year forecasts to the actual outcome in 2016:

With the exception of Australian REITs (listed property trusts, which got smashed in the GFC and had to issue almost their entire equity base in new shares to recapitalize), the forecasts were outstanding.

Asset allocation is a key part of portfolio construction, if not the key part. Whichever method or model you use, make sure it’s looking in the right direction and is unlikely to fall victim to randomness.