The entire world has benefited from the Chinese economic miracle and is praying it will continue. This article by US hedge fund Crescat Capital calls China the world’s biggest ever credit bubble, and argues, like all credit bubbles, it is bound to finish ugly, with serious knock on effects to those countries leveraged to Chinese growth – like Australia.

“The China growth story is not likely a miracle of communist government central planning; it’s a massive credit bubble, almost certainly the largest ever. China’s impressive growth has come overwhelmingly and almost exclusively from unsustainable credit expansion combined with extensive, largely unprofitable domestic infrastructure expansion. In the last two decades, China has seen the largest construction boom in any country ever.”

It’s worth pointing out the article ‘talks Crescat’s book’, that is, their funds are positioned to profit if China falls over. Nevertheless, on an objective view some of the numbers they quote give pause for thought:

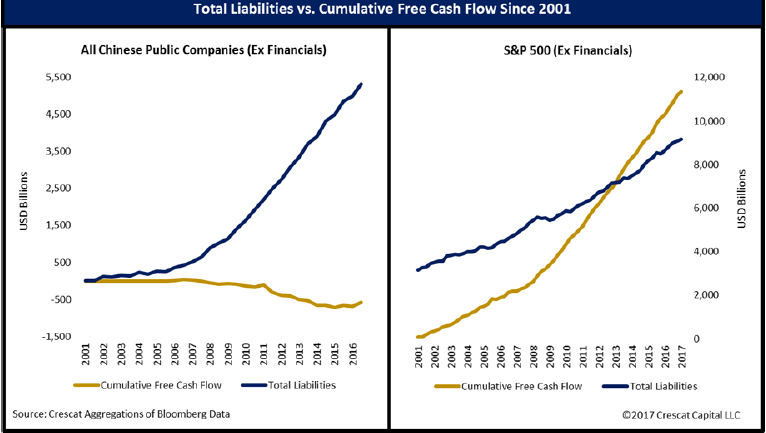

- Much of China’s economic growth has been founded on an enormous expansion of credit, with household and corporate debt rising from 110% of GDP in 2009 to 210% today.

- They argue there has been an enormous misallocation of capital to often unprofitable Fixed Asset Investment, that is, infrastructure projects, to prop up growth, starting at 23% of GDP in 2000 to 87% in 2016.

- Much of that capital allocation has been in the form of loans to inefficient State Owed Enterprises (SOE’s).

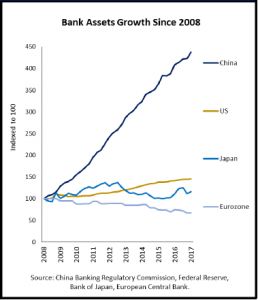

- Between 2008 to 2017 the assets in China’s banking system (that is, loans made to customers that sit on their balance sheets), increased four-fold to US$35 trillion.

- Based on banking assets as a proportion of GDP, China’s “banking bubble” is three times the size of the US’s just prior to the GFC.

- Using what they consider to be conservative estimates, non-performing loans that have to be written off could be almost US$9 trillion. That would wipe out the Chinese banks’ capital base twice over, and government reserves are currently US$3 trillion. To recapitalize the banks through money printing would require the government to issue 37% of the total money supply.

As we’ve said in the past, China could carry on for years. But it pays to be vigilant.