If you’re tossing up what to give your kids who are a little more grown up for Christmas this year, there’s a gift that will keep on giving for years and years to come; in fact, you can rest assured they’ll be thanking you for it after they’ve retired. Make a contribution to their super fund.

One of the most powerful forces in finance is compounding – earning interest on your interest. And the longer you allow something to compound the bigger it gets. One of the attractions of giving your child a contribution to their super fund for Christmas is that they can’t touch it until they retire, so it’ll have decades to grow, and grow.

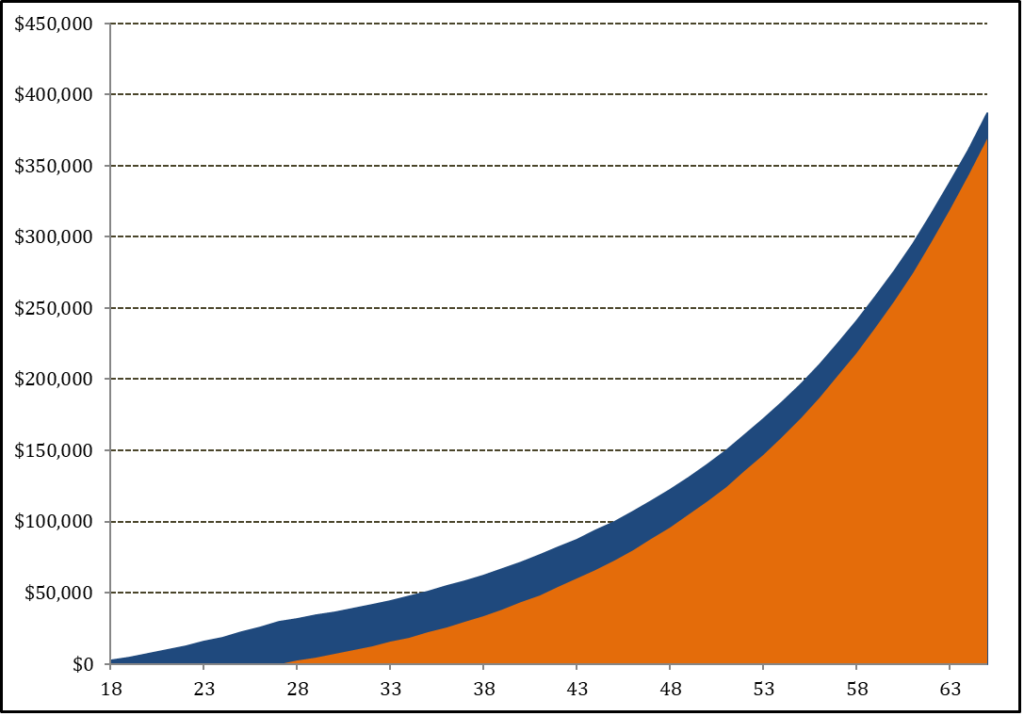

To illustrate the power of compounding, and the benefit of starting early, consider this classic example, represented in chart 1. Let’s say we find an extraordinary 18-year-old who decides to build up her nest egg by investing $2,000 a year for the next ten years at a return of 7% p.a. By the time she reaches 65, that $20,000 she invested has grown to be worth just shy of $387,000, as shown by the blue in the chart.

Now let’s say her friend finds out about the plan after year ten and says, hey that’s a great idea, but you know what, I’m going to put away $2,000 every year until I’m 65 in that same 7% investment. By the time he hits 65 the $72,000 he’s invested over those 36 years has grown to be worth only $369,000. And as the orange part of the chart shows, he never catches up to our early starter. That’s the power of compounding.

Chart 1: Despite investing more the late starter never catches the early bird due to compounding

If your child has a superfund already set up, which could be from as young as 15 with a part time job at a supermarket or something, you could make a contribution that starts working today and will pay off hugely in their future. (Another big tip, do them a favour and make sure there aren’t any fees for things like life insurance being deducted, which will just devour any returns.)

For example, if you were to contribute $1,000 to your 20 year old child’s super fund and it earns 7% per annum, by the time they reach 65 it will be worth $23,123; at 8% per annum it would be worth $36,164. You can work in multiples of that amount, so if you deposit $100 at 7% it’ll be worth $2,312 and if you deposit $10,000 it’ll be $231,235. It would be a great way to kickstart their retirement savings.

You should also, of course, make sure your child hasn’t hit their contribution caps.

For anyone looking to give something they can be sure won’t go out of fashion or never be looked at a second time, boosting your kid’s superfund really is the gift that will keep on giving.