anyone had have told you US companies would report 26% earnings growth in 2018, which is about four times their long-term average, and profit margins would hit record highs, most people would have guessed the stock market would go up, possibly by a lot. Instead, of course, the S&P500 fell almost 5%.

How did that happen? The PE ratio (price to earnings), which is simply a measure of sentiment – the higher it is the more enthusiastic investors are – started 2018 at 21 and fell to 16 by the end. Another way of looking at that is in 2017 the market anticipated the earnings growth coming down the pipeline and (presumably) in 2018, anticipated earnings growth will slow.

2017 was also the least volatile year ever for US stocks, with the volatility index (VIX) averaging 6%, and the market went up every single month for the first time in history. In 2018 volatility almost tripled to 17%, which actually just brought it back to the long-term average and there were four negative months averaging a hefty 5.5%.

There’s no shortage of reminders that this year’s started with a lot of uncertainty, with geopolitical issues taking centre stage: the ramifications of Trump’s trade war is definitely top of the pops, but the astonishing mess that is Brexit is wreaking its share of havoc too. Throw in concerns about debt levels in both Chinese and US companies and it’s no wonder markets are skittish.

I have absolutely no idea if stock markets have seen their near-term bottom, and for that matter, neither does anyone else. What is certain though is the market selloff at the end of last year has restored value and we’ve had a couple of hints, in the form of ‘contrarian indicators’, that returns could be ok for the next year or so.

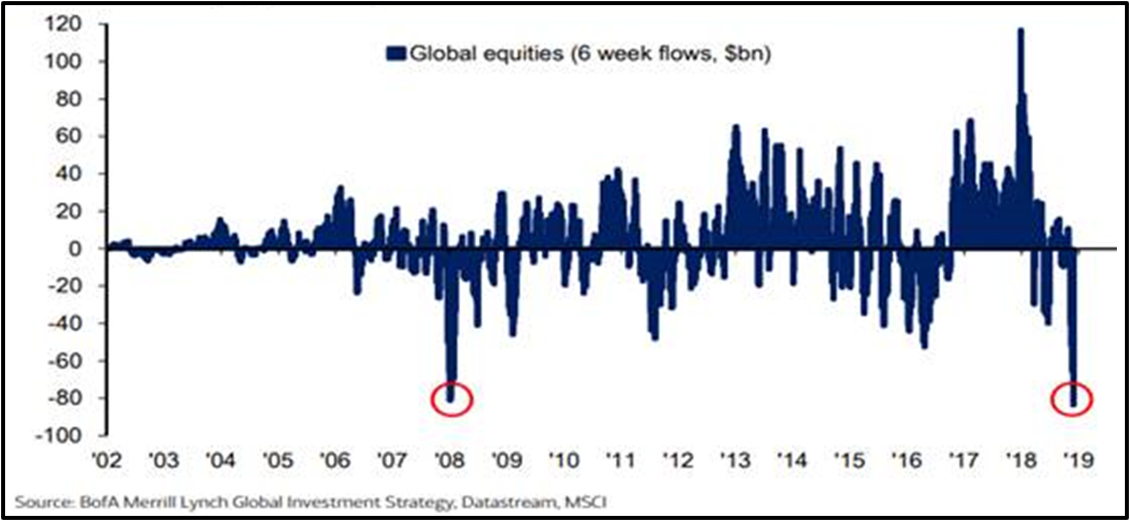

First, at the end of last year equity managed funds in the US experienced their biggest outflows since 2008 as people panicked that markets were going to keep falling – see chart 1.

Chart 1: in late 2018 money poured out of US equities funds at the highest rate since 2008

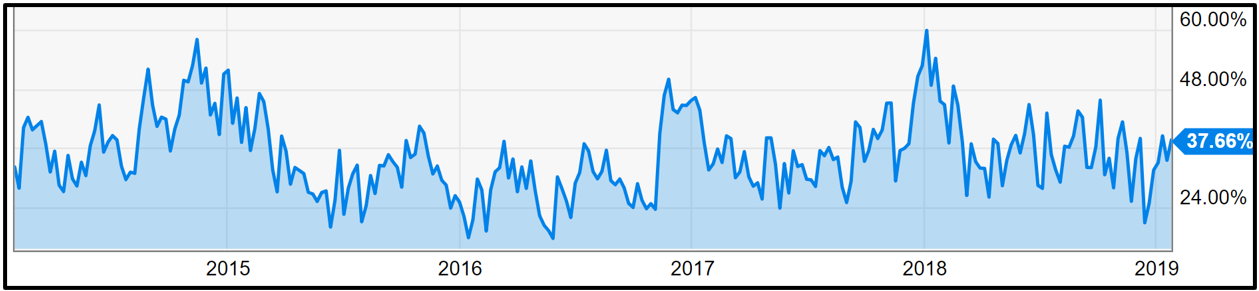

Perhaps counter-intuitively, when you get big outflows from equities it’s typically a harbinger of an improved market – it’s simply a classic example of Warren Buffett’s aphorism: be fearful when others are greedy and be greedy when others are fearful – see chart 2.

Chart 2: Money flows into US equities vs S&P 500 returns

The second hint is the US investor sentiment survey, which hit a multi-year bottom in December 2018 and has since bounced back to be close to its long-term average – see chart 3. Interestingly, just over 12 months ago it was at a multi-year high. Investor sentiment is more like a weather vane, telling you which direction the wind is blowing right now, rather than giving you any idea where it’s about to go.

Chart 3: US investor sentiment hit multi-year lows in December

At best these two ‘hints’ are indicators and there are dozens you can point to on both sides of the bull and bear arguments. At the end of the day the primary determinant of whether you should invest in growth assets is whether they represent good value. Right now the Australian equities market has an earnings yield (that’s the inverse of the PE, so earnings divided by price, and it tells you how what return you’re getting on a dollar invested in equities) of about 7%, which compares to a term deposit of about 2.5%. In Europe, the same equation is about 7.5% vs 0.25%. While value is in the eye of the beholder, you’d have to be pretty cock-eyed not to think that’s attractive.

One thing’s for sure, if you’re waiting until the uncertainty has cleared before investing in equities, by the time the newspapers are telling you the coast is clear the market will be a long way from where it is now.