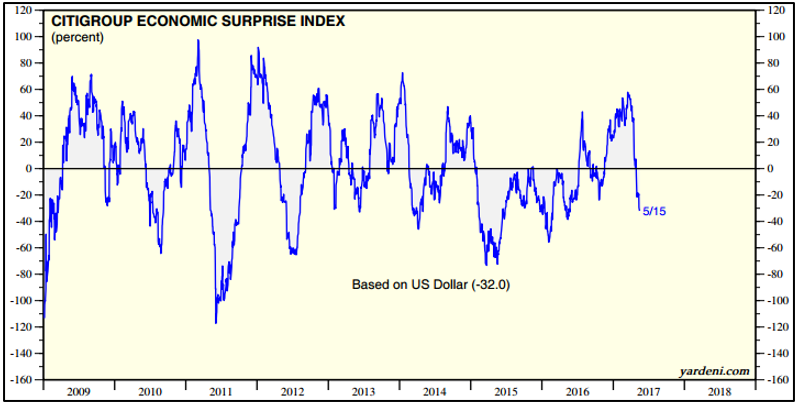

At the end of last year we argued the rise in global equities markets had a lot more to do with a string of positive economic surprises, reflected in the Citigroup US Economic Surprise Index (CESI), than the election of Donald Trump. Now we’re seeing those surprises turn negative – see the chart below – does that mean global equities markets will fall? Not necessarily, but it could help explain why the rate of growth has eased off.

Economic surprises have turned negative

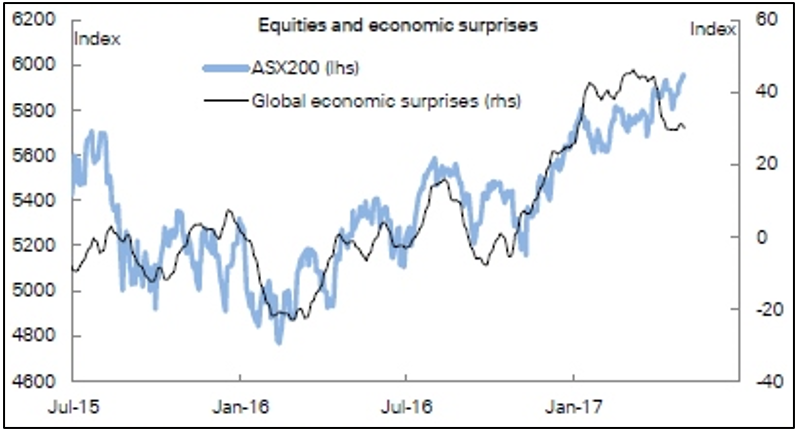

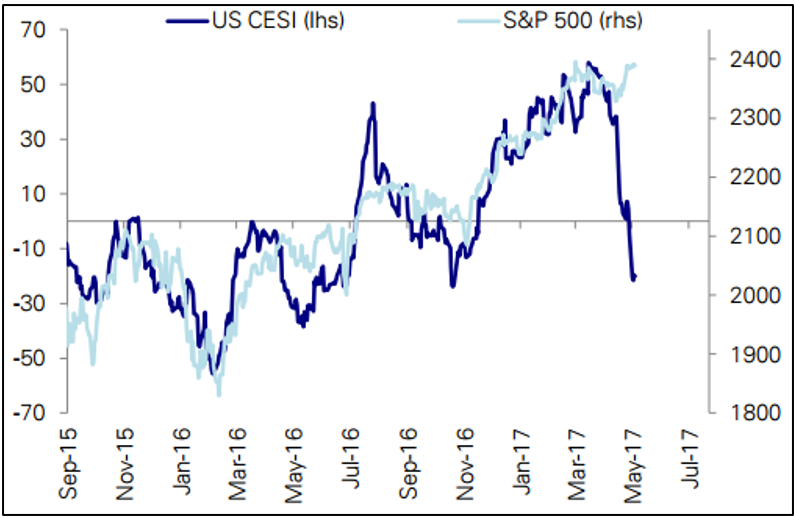

There is some short-term correlation between the economic surprise index and equities markets, as illustrated in the two charts below. The first chart overlays the ASX200 with the global economic surprise index and the second overlays the S&P500 against the US economic surprise index.

Over the short-term there is some correlation between equities and economic surprises

You can see there is some similarity between share market performance and the economic surprise indices. Two further observations you can make from the above charts: one, the global economic surprises have yet to turn as negative as the US, and two, you wouldn’t be surprised if the US equities market pulls back a bit in the near term.

However, over the longer-term the economic surprise index is not a good indicator of the direction of equities markets. This is because the CESI by definition fluctuates around zero, another way of saying it mean reverts, which is well illustrated in the first chart above. This makes sense: economists see positive surprises come through and respond by increasing their forecasts until they become too optimistic and, lo and behold, the data start coming in below the raised forecasts and we swing back to getting negative surprises.

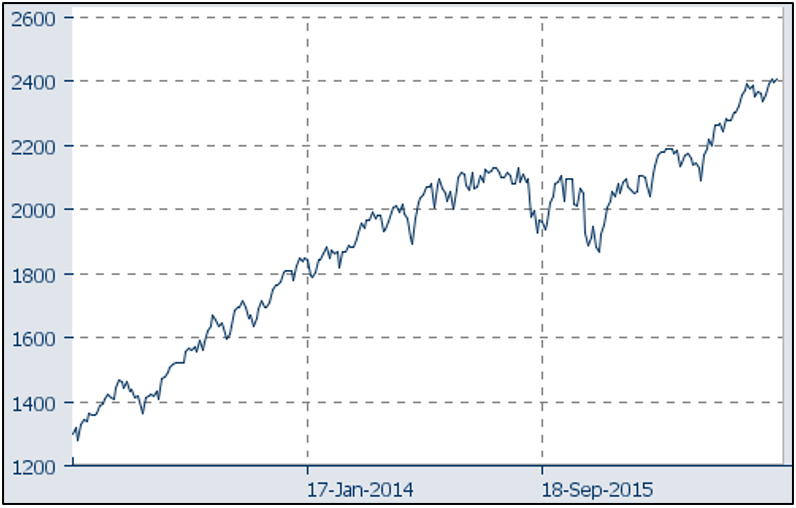

By contrast, equities markets trend upwards over time as companies grow.

The S&P500 – equities trend upwards over the long term

So the longer the time frame you look at the more the equities trend will assert itself.

If we do see a downturn in the US share market how much will it be? Deutsche Bank estimates 2-3%, but that is really just a guess, nobody can know. As it is, we still can’t see a particularly strong reason for a meaningful correction, as in there are no sectors that are outrageously overvalued (like the dotcom boom) or a conspicuous excess of debt (like the US property sector pre-GFC), though there is nothing stopping something coming out of left field (debt problems in China?).

The bottom line: the CESI is an interesting indicator, but it’s still not a crystal ball.