The way the Turnbull government introduced the new bank ‘levy’ was really pretty clever. It was almost the only surprise that came with this year’s federal budget, given the government carefully stage managed the pre-release of just about every other idea.

Unlike the disastrous mining tax introduced by the Rudd government in 2012, the banks had no chance to marshal their lobbying resources to beat it down. That hasn’t stopped them having a red hot go since its announcement, trying to arouse public sympathy and support by claiming the costs of the tax will be borne by consumers, that our local banks will no longer be competitive against their foreign counterparts, that it threatens ongoing economic growth, and that it creates a ‘dangerous precedent’.

We should not be at all surprised the banks have been making a racket; they presumably feel that meekly accepting the levy would open the risk of the government come back for a second bite. And, of course, every other big business will support them because they too would fear some kind of similar levy.

What has, however, been unimpressive is the government’s response to the banks’ claims about the levy being unfair: there is a really good argument to say it’s not. The big Australian banks benefit tremendously from the explicit government guarantee of deposits up to $250,000 as well as the implicit guarantee of their funding. It’s been estimated that benefit is as much as a 17 basis point (or 0.17%) reduction in their cost of funding, which feeds directly into how competitive they can be and what margins they make. So compared to a 6 basis point levy (0.06%), they’re still coming out of it very well.

In fact Deutsche Bank estimates the levy will reduce bank profits by between 2.2-3.6%, depending on the bank. As one leading Australian fund manager commented, he would not be impressed if a business cut its dividend substantially on that kind of profit reduction.

The banks’ claim that the government was being opportunistic in the timing of the levy is just as spurious, given there are academic papers going back to 2011 arguing in favour of such a tax to compensate the public for underwriting the banks’ profitability.

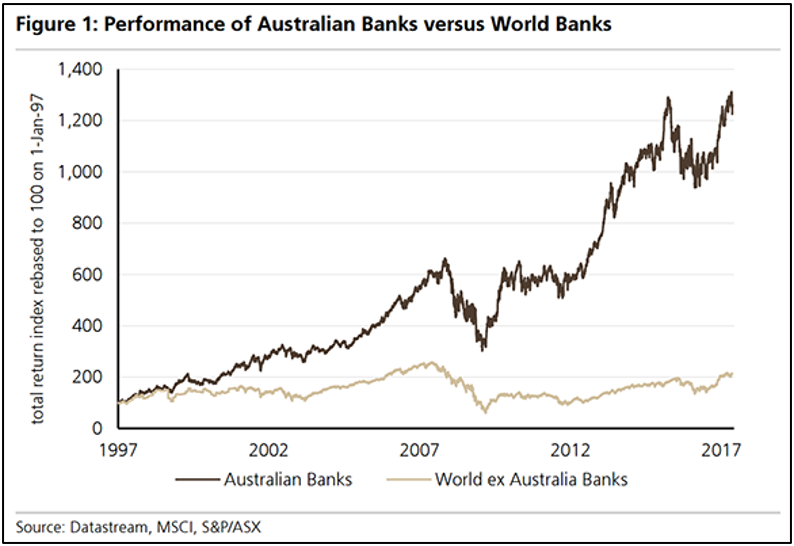

Also, the big four banks benefit from an entrenched oligopolistic market that not only sees them dominate lending, but gives them the firepower to create vertically integrated financial empires that help make them arguably the most profitable banks in the world, reporting more than $15 billion in collective profits for just the first half of the 2017 financial year. Australian banks enjoy returns on their equity of between 14-17%, which is close to double many of their overseas counterparts, a point well illustrated by the chart below.

Meanwhile, the smaller Australian banks don’t get the same benefit of taxpayer subsidised reduced funding costs, so the levy may actually help ever so slightly to level the playing field.

Australia does indeed benefit from having one of the most secure banking sectors in the world, but likewise so do the banks. Without the occasionally heavy hand of regulators like APRA, heaven knows there’s plenty of evidence they would gorge at the proverbial trough until they made themselves, and the economy, very ill.

From an investor’s point of view the bank levy should have little consequence. Bank share prices are down about 10% in the past month but bear in mind they started falling before the budget, they’ve gone ex-dividend in that time plus overseas banks have also corrected, so it’s very difficult to work out how much, if any, of that is due to the levy. Without the levy, yes bank profits would be higher, but some of that benefit would be swallowed up by commensurately higher executive pay.

At the end of the day we have a serious budget deficit hole that needs to be plugged and, yes, the government will sometimes need to be opportunistic in finding funds to do that. There are sound economic, ethical and fairness grounds for the 0.06% levy and you can rest assured self-interest lies firmly behind the squealing from the banks. Keep calm, the big Australian banks will carry on being enormously profitable.