Global markets have recently hit new all-time highs and only last week the Australian All Ordinaries hit a post-GFC high – pretty impressive stuff. Within that though there has been an interesting switch in the underlying drivers of the Australian market in the past few months: resources had been leading the charge and have now pulled back, while yield-sensitive stocks softened for a while but have now staged a recovery.

Bonds

Bond yields across the world rose sharply from the beginning of September 2016 and peaked in March 2017, but have since experienced a reasonably significant retracement – see the charts below:

Australian 10 year bond yields

US 10 year bond yields

Exactly what caused that rally and reversal is, quite surprisingly, not altogether clear, but when bonds move like that there is going to be some fallout in the equities markets.

Yield stocks (bond proxies)

Stocks that are considered high yield plays, or bond proxies (that is, they are bought for their (usually) high and consistent yield) experienced a similar cycle to bonds: they peaked in July 2016 when US bond yields started rising and began to recover the lost ground once bond yields started falling sharply in mid-March. This can be seen in the charts below of the Australian listed property trusts (REITS) and Transurban, as a proxy for the infrastructure sector:

Australian property trust index

Transurban – as a proxy for the infrastructure sector

Commodities

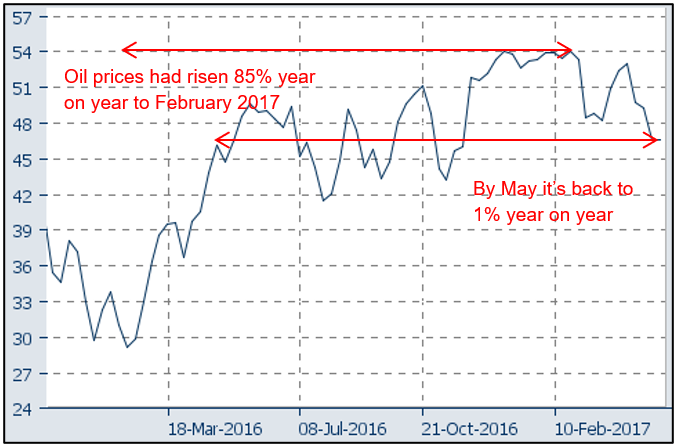

We’ve also seen a sharp fall in some of the key commodities prices recently: oil has dropped 17% in the past three weeks and iron ore is down about 35% in the past two months – see the charts below.

The oil price

The iron ore price

So whereas only three months ago we were experiencing year on year oil price rises of 85%, now it is less than 1%; similarly for iron ore, three months ago year on year prices had doubled, now it’s all but flat – as we’ve written before, that has a significant effect on inflationary pressures.

Resources stocks

With expectations that global economic growth was on the rise last year resources stocks rose strongly as part of a global rally in the so-called cyclical stocks, whose earnings are seen as being leveraged to economic activity. Now, partly on the back of falling commodities prices and partly because of a tempering of growth expectations (the two of which could easily be linked), those resources stocks have weakened considerably, with the resources index down 12% from its recent peak – see the chart below – but within that sector BHP has fallen 19%, RIO 17% and Fortescue 33% all in the space of two to three months.

The ASX200 Resources Index

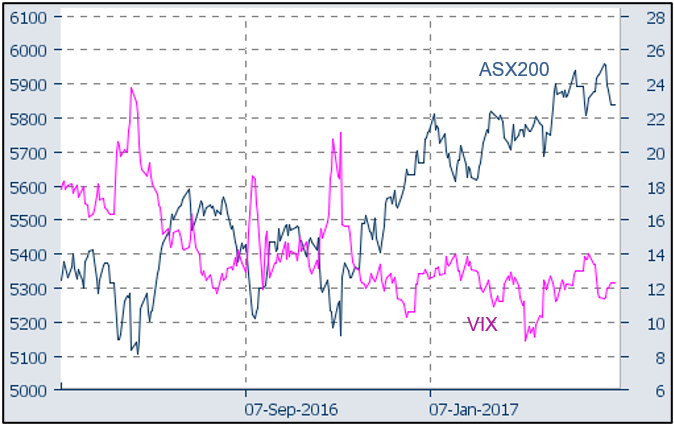

ASX200 unruffled

Interestingly, while this so-called ‘rotation’ from resources back to the bond proxies has been going on, the underlying sectors have seen significant moves while the volatility of the overall Australian share market has remained fairly low. The upshot has been a market that has remained in a positive trend while volatility, in the form of the Australian VIX index, has remained in a sideways trend.

ASX200 – staying positive Australian VIX – staying sideward

While these make for interesting observations, unfortunately there’s not much guidance to be gained for forward-looking tactical asset allocation. This is because the rotation described has come about from short-term changes in things like bond yields and commodity prices, which are almost impossible to reliably forecast, meaning you could easily get it wrong. Instead, we prefer to stick to our diversified, long-term model and remain alert to the underlying currents of the markets.