It’s difficult to argue that gold is not beautiful – that deep lustrous shine seems to appeal to something very basic in us. Perhaps that is what influences some commentators to maintain that a fully rounded portfolio should always have some gold. The problem is, other than looking at it, gold isn’t all that good for much else and as an investment it can be a downright scary ride.

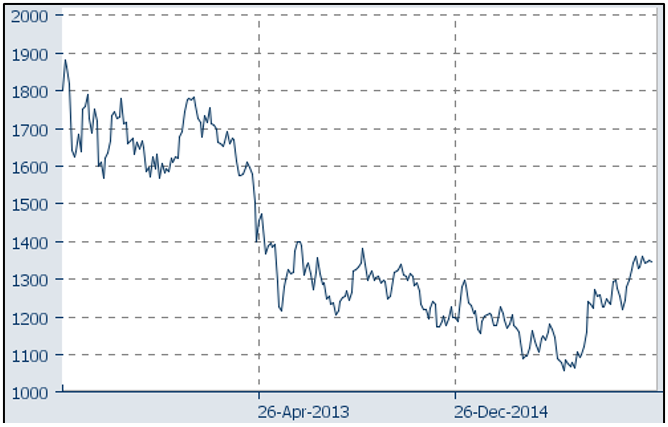

Having fallen 44% from its high in September 2012, since the start of this year the price of gold has risen 27%, and the bizarre thing is, nobody can really tell you exactly why.

Gold price over the last 5 years

Source: IRESS

Gold bugs come up with a variety of reasons as to why you should always own a bit of gold, but how do those arguments stack up?

1. Gold is a hedge against inflation

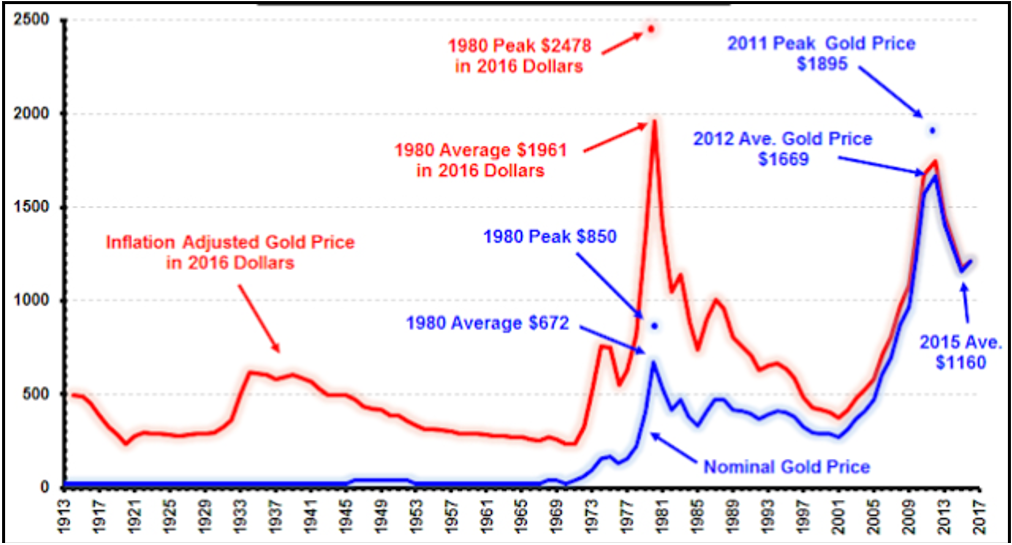

If gold was a good hedge against inflation the red line in the chart below, which is the inflation adjusted price of gold, would be flat. As you can see, it’s far from it.

Inflation adjusted annual average gold prices (in May 2016 U.S.$)

Source: www.inflationdata.com

In fact, from its inflation adjusted all time high of $2,478 an ounce in 1980, the gold price lost more than 80% of its value to a low of just $364 in 2001. Over that same 21 year period the U.S. CPI more than doubled.

A lot of gold’s reputation as a hedge against inflation came from the 1970s, when inflation rocketed upwards at the same time as the gold price. But there were other factors at work there: the gold price had been heavily regulated until the abandonment of the gold standard for determining currency values, which is reflected in the somewhat steadier lines in the chart from 1913-1972. After the regulations were relaxed and people were allowed to buy gold demand surged and took the price with it.

Finally, if gold really was linked to inflation why would it be running now when there is collectively more concern about deflation?

2. Gold is a safe haven

Gold enthusiasts argue that when fear levels rise around the world so too does the price of gold. Two researchers from Harvard studied gold’s performance as a hedge during financial crises and economic disasters and found that:

“during the 56 disaster periods investigated between 1880 and 2011, gold price gains – after inflation is taken into account – averaged 2.1% a year, not much better than in normal periods, when it rose 1.5%.

In fact, Mssrs. Barro and Misra’s figures show that gold prices swing around almost as much as stock prices – meaning it isn’t the stable investment many think it to be – and yet their return is much closer to what ultrasafe U.S. Treasurys offer.”

In fact, gold lost about 20% of its value in the six weeks after Lehman Brothers collapsed in September of 2008. And just think of all the disasters that happened during gold’s three year decline to the end of 2015: financial crises in Europe, the Russian invasion of Crimea, Chinese debt issues as well as sabre rattling in the South China Sea, the rise of ISIS with terrorist attacks in Europe, to name a few.

3. Gold is a store of value

A couple of commentators have called gold ‘the ultimate currency’, because it’s scarce, it can’t be fabricated, it’s perfectly divisible and is widely accepted.

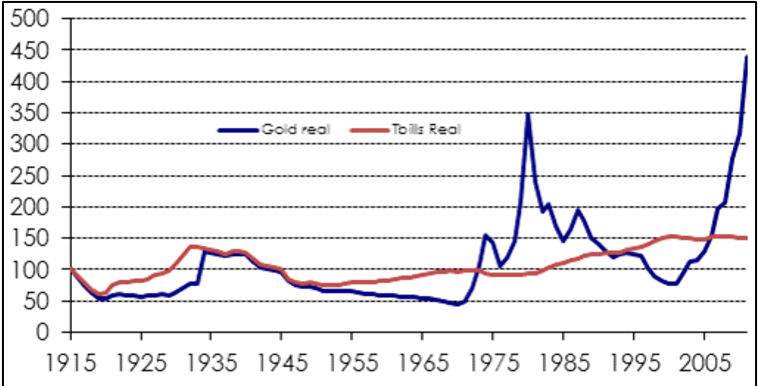

The thing is, between 1980 and 2000 gold lost 79% of its purchasing power while US Treasury Bills gained 50% and then in the last 15 years went the exact opposite way – see the chart below. That kind of volatility is hardly what you’d want from a currency.

Gold vs. Treasury Bills – purchasing power

Perhaps the final word can be given to Warren Buffett, who has said he can’t see the point of owning gold, which doesn’t pay any kind of yield but just sits there looking pretty, leaving you beholden to what seems to be a purely sentiment-driven commodity.