Source: JP Morgan

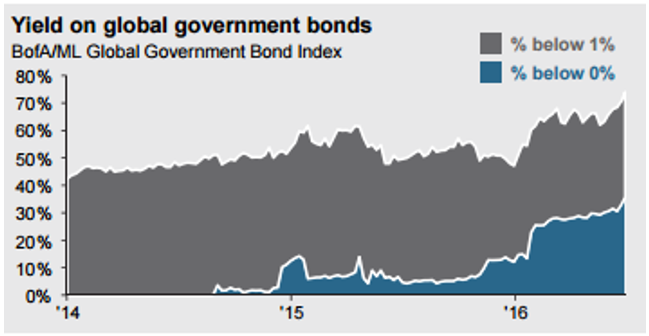

It’s one of the great mysteries of our time: how on earth can we have negative interest rates? Right now about 40% of global sovereign bonds are trading on a negative yield – you have to pay the government issuing the bond to look after your money. There are even some companies that are able to borrow at negative interest rates. It’s an entirely counter-intuitive situation.

I’ve read lots of articles commenting on how bizarre, if not absurd, the situation is but Tim Farrelly’s article below is the first to offer a rationale for negative interest rates.

Interest rates are low, naturally.

Economists have a concept of the natural rate of interest which was first developed by Swedish economist Knut Wicksell in 1898. Today the natural rate of interest is generally considered to be the rate of interest where employment is full but inflation is contained. If interest rates are below the natural rate, then economic activity picks up and unemployment falls until wage inflation breaks out. If the rate of interest is above the natural rate, economic activity slows and unemployment rises.

With this definition in mind, what can we make about the claim that interest rates are artificially low in Europe, the United States and here in Australia? Well, if we accept that artificially low means unnaturally low, then we should be seeing resurgent inflation, a rapid pickup in business activity and very low unemployment. In fact, we see none of these things.

The closest we get is in the US where unemployment is getting back to normal levels, inflation is contained and GDP growth remains slow. In fact, in the US you could make a good argument that interest rates are at their natural level, and, in Australia and Europe, rates are still too high.

Why the natural rate is so low is another story. High global debt levels and poor demographics are likely suspects. But regardless of the cause, it seems fanciful to argue that interest rates are unnaturally low.

They are what they are. We should get just used to them.