Amidst the carnage of one of the worst starts to a calendar year for share markets around the world, ‘growth stocks’ have taken a ferocious beating.

Growth stocks are those companies whose earnings are expected to be able to grow independently of the broader economy. The classic example is tech companies, where global reach of products and platforms can underwrite revenue and earnings growth even when economic growth is negligible.

The other broad grouping is ‘value stocks’, which are those whose earnings go up and down with the economic cycle.

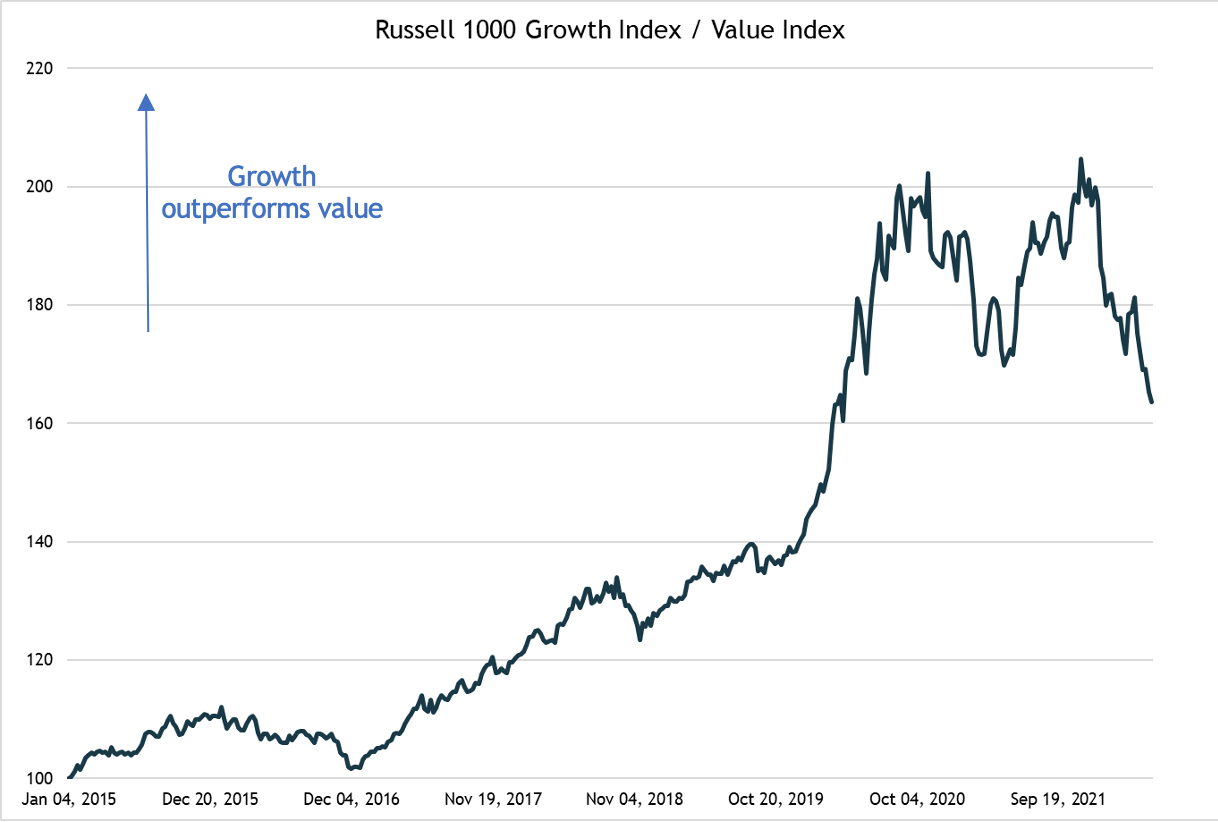

In the aftermath of the GFC, global growth rates were consistently low and growth stocks dominated share market returns to the point where value stocks experienced their worst ever period of relative underperformance. In the United States, the Russell 1000 growth index more than doubled the return of its value counterpart between the start of 2015 and November 2021.

However, since late 2021, that has sharply reversed with the growth index lagging the value index by around 40 per cent. Some of the highest profile growth stocks that peaked during the COVID lockdown period, such as Peloton and Shopify, fell by more than 90 per cent.

After the shakeout we’ve seen, any smart investor who is remotely contrarian will be sniffing potential bargains. However, before piling into heavily sold growth stocks it’s worth looking at some history and what made the growth stocks perform so strongly in the first place.

First, the history: growth stocks smashed value in the late 1990s until the bursting of the dotcom bubble, and then underperformed for more than a decade. So these cycles can go for a long time. Much depends on the macro factors at work.

And those macro factors, in particular what’s happening with inflation, help explain why growth did so well over the past 10 years. When inflation is declining it will normally mean that interest rates and bond yields are also going down. It is also well established that lower inflation helps to support higher PE (price to earnings) ratios, which is what happened through to late last year.

Also, lower bond yields will help support higher share price valuations. When analysts do a discounted cash flow (DCF) valuation on a company’s shares, they will typically base their discount rate on the 10-year bond yield (plus or minus a bit for risk). The lower the discount rate, the higher is the current value of future cash flows, meaning the higher is the price you’re prepared to pay for the shares today.

When inflation started rising sharply, those tailwinds reversed into mighty headwinds. The US 10-year bond yield shot up from lows of about 0.5 per cent to a recent peak of 3.2 per cent, radically transforming the valuation equation for growth stocks, which has been very clearly reflected in plunging share prices.

Over the past 10 years, every time the growth stocks suffered a setback they quickly bounced back, conditioning investors to buy the dip. What might be different this time is the outlook for inflation. If inflationary pressures persist, that will continue to be a headwind for growth stocks.

It’s frustrating to be told the arguments for inflation persisting are pretty equally stacked, but that’s the case. For example, the increase in globalisation that helped to reduce costs over the past 20 years may well be reversing as companies reassess the benefits of more robust supply chains. Also, the very low unemployment level in both the US and UK has seen wages growth settle at around double the pre-COVID level.

Similarly, if Europe follows through on reducing its reliance on Russian gas and oil, that could impact energy prices, plus resources could be diverted to building more renewable energy generation.

On the other hand, the more renewable energy capacity that gets built, the lower will energy costs be, reducing the cost of production. Plus, over the past 50 years betting against technology has not been wise and technologies such as AI and 5G could be transformative.

The upshot is nobody can be certain where inflation will be in a year or two, meaning nor can we be certain that growth stocks will bounce back like we’ve seen in the past. There are definitely bargains, and we may well see a bounce back from oversold levels, but for sustained performance, smart investors could be well advised to hedge their bets by retaining a balance between growth and value stocks.