Make sure you draw the minimum pension

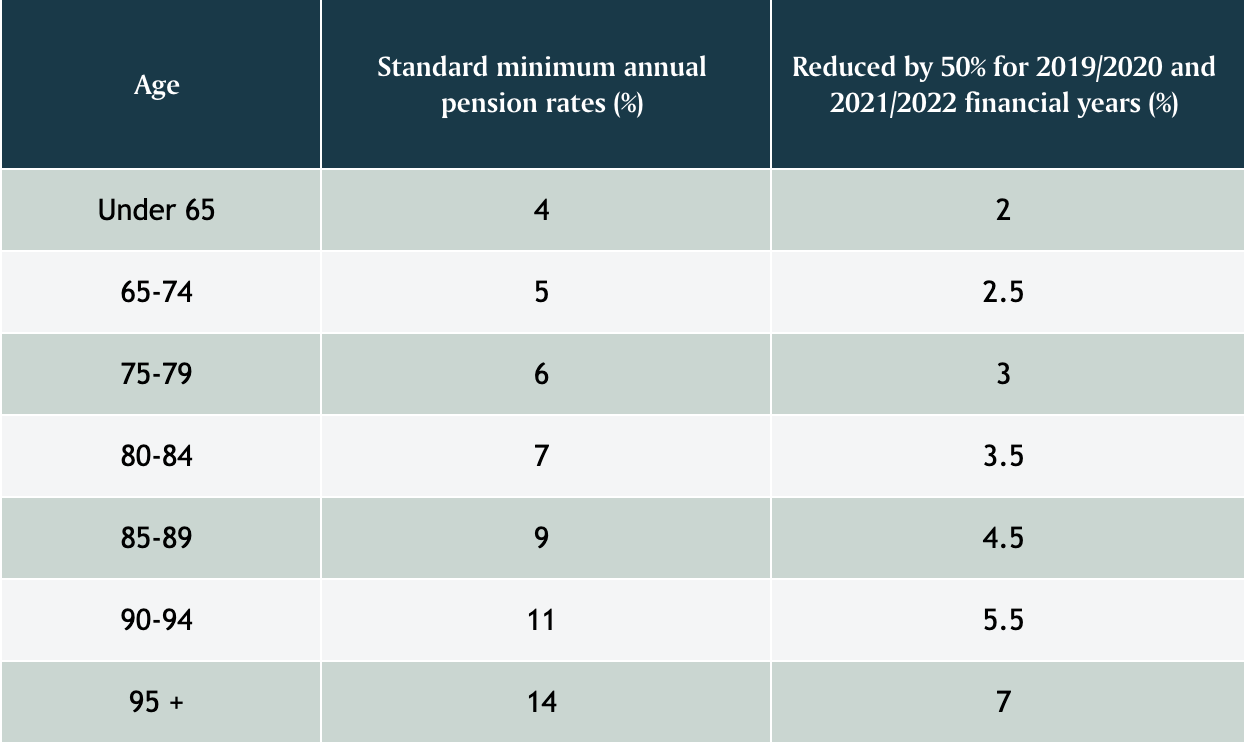

With 30 June only 2 weeks away, it’s important to check if you have made the minimum pension payment from your account based pension in your SMSF. For those with an industry fund or a retail super fund, it’s all done for you, so you have nothing to worry about.

Remember, you only need to draw 50% of your regular minimum annual pension. This has been extended again for 2022/2023.

If you have maxed out your Transfer Balance Cap (TBC) and taken the discounted minimum annual pension, it’s often a good idea to take any additional payments from your accumulation balance.

Super contributions

You should be checking the level of concessional contributions you, or your employer, have made. If you do need a tax deduction, you may consider topping this up to $27,500 prior to 30 June.

If you are wanting to continue to build up your superannuation balance, it may also be appropriate to make a non-concessional contribution up to $110,000 for the year. Or, should you bring forward the next 2 years’ contribution this year and make it $330,000?

Remember, from 1 July 2022, changes to contribution rules may mean you can contribute up to 75 years of age without satisfying the work test.

Ways to contribute

Your contributions may be simply a cash contribution, or you may transfer investments like shares into your fund. Remember, any transfer is regarded as a sale, so it will give rise to a capital gain or capital loss. This could also be advantageous.

Super co-contributions

If you meet the eligibility criteria, you could guarantee yourself a guaranteed return of up to 50% by making a personal (after-tax) contribution (also known as a non-concessional contribution) of up to $1,000.

The co-contribution from the government is to support low or middle-income earners.

The amount of government co-contribution you receive depends on your income and how much you contribute.

You don’t need to apply for the super co-contribution. When you lodge your tax return, they will work out if you’re eligible. If the super fund has your tax file number (TFN) they will pay it to your super account automatically.

Plan your super/pension strategy for 2022-2023

Planning early for the next financial year is important. Your plan should include:

- Level of contributions to be made for 2022-2023.

- The best time to make these contributions.

- Should you commence an account based pension?

- Updating your SMSF Investment Strategy up to date.

- For those exceeding their TBC and running an account based pension within their SMSF, have members sign a notice to take the minimum pension with any surplus to be taken from the accumulation account.

Superannuation can be very complex, and while it presents excellent opportunities for retirement, each person’s situation is very different. So, before acting, you should seek personal advice from your adviser.