The variable versus fixed mortgage rate decision will affect a homeowner for years to come and could be the difference in thousands of dollars of accrued interest.

At its May meeting, the Reserve Bank of Australia acted to curb soaring inflation by raising the official cash rate by 0.25%. With Governor Lowe warning that this is expected to be the first of many rate hikes over the next 12-18 months, many are wondering if they should fix their home loan to safeguard against rising rates. The right answer depends on your unique situation and tolerance for risk.

Let’s start by looking at the advantages and disadvantages of each.

Variable rate loans

Advantages

- The main advantage is flexibility.

- Unlimited extra repayments which will help you pay your loan off sooner.

- It takes advantage when interest rates are decreasing by lowering interest repayments.

- Allows you to refinance or restructure your loan at any time, for example, by accessing excess equity for renovations.

- Variable home loans generally come with more features such as a redraw facility or offset account.

Disadvantages

- When interest rates rise, so too do your repayments.

- As interest rates can change at any stage you lack a level of certainty over what your repayments will be in the future. This can make detailed budgeting quite challenging.

Fixed rate loans

Advantages

- The main advantage is payment certainty, allowing you to budget your repayments for the foreseeable future. This leads to a greater sense of financial security.

- Your interest repayments will be lower if, during the term, the variable rises above the fixed rate.

Disadvantages

- Most fixed rates limit extra repayments to around $5,000 per year therefore if you benefit from a lump sum of cash, like an inheritance or bonus, you cannot place this directly onto the loan without penalty.

- You do not benefit when interest rates go down during the term of the fixed loan.

- There are penalties for breaking a fixed rate before maturity which makes restructuring or refinancing to another lender much more expensive. These penalties also apply if you sell your property within the fixed rate term.

- Fixed rates generally do not come with additional features such as a redraw facility or an offset account.

As you can see, there is a lot more to consider than simply a bet on where interest rates are heading.

After considering these characteristics, if the certainty of fixed rate repayments is still appealing you should then consider whether you will likely be better off with the fixed rates on offer.

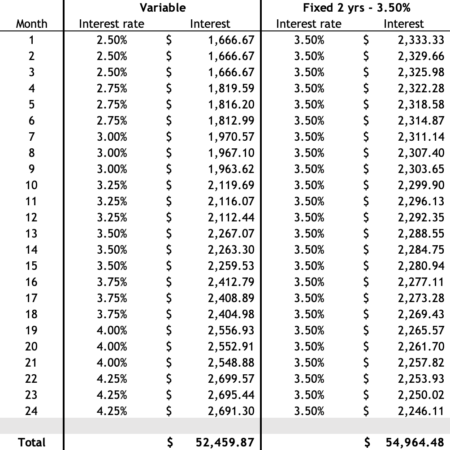

A common misconception is that if the variable interest rate rises higher than the fixed rate over the term of the loan then you will pay less interest. Of course, there are periods during the term when the variable rate will be lower so you must instead consider the average rate over the term. Take an example where a rate was fixed 1% above the current variable rate for a period of 2 years. After 1 year the variable rate had steadily risen to meet the fixed. To break even, the variable would need to continue to rise another 1% (approx.) over the final year of the term. When calculating the exact breakeven point, you must also consider the timing of the rate rises and that the loan balance may steadily decrease over the term.

The calculations in the table above are based on a 30 year $800,000 loan with monthly principal and interest repayments.

Hedge your bets

Often borrowers are drawn towards the certainty of fixed repayments but do not want the additional payment restrictions that come with it. By splitting the loan, you can essentially enjoy the benefits of both. To calculate the variable split, you should consider how many extra repayments you are likely to make over the term of the fixed rate as well as how much your balance will reduce by your regular payments. A good mortgage broker can help you with this calculation. You may also consider an even split if you are undecided which rate will work best for you.