Steward Wealth September 2020 quarterly outlook

Welcome to our Steward Wealth quarterly outlook video, a brief overview of where we see markets now and how we’re positioned.

Welcome to our Steward Wealth quarterly outlook video, a brief overview of where we see markets now and how we’re positioned.

A study by the Reserve Bank of Australia (RBA) earlier this year found the average home loan that is more than four years old is paying an interest rate 0.40% higher than what is currently available for new loans. This may not seem like a lot but on a $500,000 loan it means you are paying $2,000 of extra interest each year that you could probably avoid. During the current pandemic, clients have been looking at ways to reduce their expenses and refinancing activity has reached historical highs. Is now the right time for you to refinance?

Reducing your interest repayments may not be the only reason you could look to refinance. Depending on your personal circumstances, refinancing can also help you to:

Refinancing requires you to complete a full application for the new loan. The lender will assess whether you can afford the loan based on your current circumstances, so if you have had a recent reduction of income, or increased expenses, it may affect whether the loan application is approved. Lenders have also adjusted their credit policies in light of the current pandemic and the rules that applied when you were first approved may have changed. You must also consider what has happened to the value of your property since you purchased it. If the value has fallen, it may mean that you are unable to borrow the same amount that you had previously. Conversely, if the value has risen it may present a great time to release equity.

Another factor to consider in refinancing your home loan is the costs associated with moving to another lender. Whilst you may save on repayments, the costs of discharging your current loan and the application fees for the new one may leave you worse off. This becomes more prevalent if you have a small balance or when you are on a fixed rate.

Depending on the change in funding costs of the borrower, it can be very expensive to break a fixed loan before maturity. When they mature, fixed loans will revert to variable which are often less competitive to others in the market. This is an excellent time to assess whether you can move to not only a lower rate, but a loan with the right features for you.

Lenders have recognised that the associated costs of refinancing may hinder your ability to change loans and regularly offer ‘cash back’ incentives of up to $4,000 to overcome this barrier. Whilst it certainly helps, it is important to do the analysis on each scenario. Often those lenders without a cash back offer, but a slightly lower rate, will save you far more over the medium to long term. This is where a mortgage broker can help assess your options.

I always suggest that clients review their loan every two to three years simply to ensure they have the most appropriate product available. Often it will not be the right time to change lenders, but doing the research gives you confidence that you are not overpaying.

I was recently having a chat with a prospective client who mentioned t her mother had put her house up for sale and was looking to downsize. Her thoughts were to simply add a portion of the proceeds from the sale to her existing share portfolio.

This had me thinking that many people, including advisers and accountants, were unaware of a relatively new part of legislation which allows those over 65 years old who meet certain eligibility requirements, to choose to make a ‘downsizer’ contribution into superannuation of up to $300,000 for each person from the proceeds of the sale of their home.

The eligibility criteria in making a downsizer contribution are:

If your home that was sold was only owned by one spouse, the other spouse may also make a downsizer contribution, or have one made on their behalf, provided they meet all of the other requirements.

The downsizer contribution can still be made even if you have a total super balance greater than $1.6 million. What’s also important to note is that this contribution will not affect your total superannuation balance until the end of the financial year. Because this is not considered a ‘non-concessional’ super contribution, if you are still eligible to make a contribution to super before the end of that financial year, you may do so.

However, it will eventually count towards your transfer balance cap (TBC), currently set at $1.6 million once the end of year accounts are completed.

You can only access the downsizer scheme once. This means you can only make downsizing contributions for the sale or disposal of one home, including the sale of a part interest in a home, and it can’t be more than the proceeds from the sale of your home.

There is no requirement for a couple to make equal downsizer contributions. For instance, one spouse could make a $250,000 contribution while the other spouse may make a $130,000 contribution.

You must make your downsizer contribution within 90 days of receiving the proceeds of sale. You may apply for an extension if there are situations beyond your control for making the payment.

You will need to complete the Downsizer contribution into super (NAT 75073) form. You need to provide this to your super fund when making – or prior to making – your contribution.

And then within 90 days of receiving the proceeds of sale, make sure you make the contribution.

An extension of time should be requested before the 90-day period from the date of settlement has expired.

Fractional property investment firm, DomaCom received binding advice from the ATO that people may sell part of their home and still qualify for the downsizer contribution.

DomaCom have a platform whereby investors can purchase a portion of a property asset from sellers. Its Seniors Equity Release Platform provides this as an option for seniors looking to access cash through the sale of part of their home.

As mentioned previously, sellers are only able to use the downsizer contribution once, so once they sell a portion of their home and utilize it, they cannot do so again.

The contributions would still be capped at $300,000 per spouse and could be made as several contributions over a period of 90 days from settlement of the property.

With many Australians having large amounts of their wealth tied up in their home, the downsizer contribution may be very effective in allowing them to boost their income in a tax effective structure, regardless of whether you are over 65 and cannot meet the work test rule.

As with all these strategies, it’s important to get the right advice as each person’s situation may be different and there may be implications which affect you.

Find out how this can work for you on 03 99757070 or at info@stewardwealth.com.au

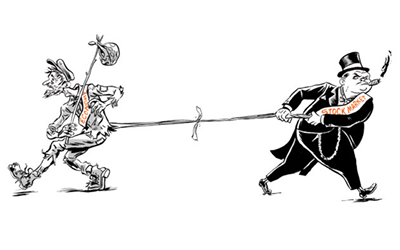

The classic ‘60/40 portfolio’ allocates a 60% weighting to growth assets, being shares, and 40% to defensive assets, being bonds. Over time, the allocation to bonds has offered two important benefits: a return from both the income the bonds pay as well as capital growth, and a cushion against volatility in the share market.

However, with yields on 10-year Australian government bonds at 1%, many smart investors are questioning whether the case for having such a large allocation to bonds still stacks up.

With the yield well below the medium-term average inflation rate, it’s obvious why the income benefit isn’t particularly attractive.

As for the capital growth, the price of bonds goes up when their yield goes down, and yields follow inflation. Australian bonds have been caught in an almost 40-year bull market with 10-year yields falling from 17% in 1982 as inflation steadily declined. While it’s entirely possible Australian yields could go negative as they have in other parts of the world, it’s not unreasonable to question how much lower they will go, especially when governments appear to have rediscovered the power of fiscal policy, which has stoked the debate about the possible resurgence of inflationary pressures.

That means you run the risk of locking the defensive portion of your portfolio into a paltry yield that could easily be wiped out by falling prices.

What about the second benefit of providing a cushion against share market volatility? Since 1980 bonds have played a wonderful defensive role in portfolios. When Australian shares plunged 40% in 2008, bonds returned 15%, and over February and March this year, while share markets dropped 28%, the Bloomberg Composite index rose by about 0.5%.

However, bonds have not always had the same negative correlation to falling shares. Damien Hennessy of Heuristic Investment Systems points out that, “During the bear markets of the 1970s and early 1980s, bond yields actually rose (prices fell), which suggests they may not provide the same uncorrelated protection against falling shares in an inflationary environment.”

He goes on to add, “To offset a 10% fall in the value of growth assets in a 60/40 portfolio would require bond yields to decline by 200 basis points (2%). In Australia that means going from a yield of +1% to -1%.”

If you don’t use bonds for the defensive portion of your portfolio, what can you use? There is a variety of candidates, but you first need to be clear about what you mean by a ‘defensive’ asset. Do you require it to pay you a yield? Do you want it to just protect capital in a share market decline, or to actually rise when shares fall? Your response to these questions determines what assets best suit your portfolio.

Cash: according to the 2020 SMSF Investor Report from Investment Trends, Australian investors have increased their cash and cash-like holdings to 27% of their portfolio. With the best term deposit rate currently at 1%, having more than a quarter of your portfolio invested like this is creating a tough headwind for portfolio performance in return for the certainty of a government guaranteed reduction in volatility. With such low returns, the best you can say about cash is it gives you optionality to jump on other opportunities as they arise, but there are other investments that provide good liquidity while offering better returns.

Fixed income: Government bonds are only one part of the fixed income market, with others including corporate bonds and loans. Michael Blomfield of Investment Trends suggests the fact Australian SMSF investors have no plans to increase their overall exposure to fixed income investments indicates a lack of understanding of their role in strategic asset allocation.

There are relatively low risk fixed income funds with track records of not reporting a single negative month, that have returned around 3% per year, and others that have never seen a negative 12 month return delivering closer to 4% per year. Because these funds invest in high grade corporate bonds, when shares go down, it’s very unlikely their funds would go up, but it’s also very unlikely they will lose a lot of capital.

I also recently wrote about the hidden gem of private debt (loans) which can pay interest of between 7-9%, backed by strong levels of security. Since these loans are not traded on a market, the value of the asset doesn’t change, meaning the capital value is stable.

Gold: has rocketed toward its all time high recently, but exactly what’s driving it is a matter of debate. It used to be argued gold is a hedge against inflation, but that’s clearly been debunked, and now gold bugs will tell you it’s hedge against deflation.

Obviously gold pays no yield, in fact it costs you to hold and store it, and it appears to be uncorrelated to everything. But in terms of preserving your capital, historically it is even more volatile than shares. Rather than set and forget, it’s more of a hold and hope.

Currency: the Australian dollar has a good record of weakening when share markets drop, which is usually more of a function of a rush to the safety of the US dollar. Whether the average investor has the stomach to trade currencies is quite another thing.

Other alternatives for defensive investments include option strategies, hedge funds and unlisted trusts, or you might decide to stick with bonds. They all have their advantages and disadvantages, the key is to have a diversified portfolio that matches your risk appetite.

Welcome to our Steward Wealth quarterly outlook video, a brief overview of where we see markets now and how we’re positioned.

This article was published by The Australian Financial Review.

The Australian sharemarket. like many others around the world, had left many shell-shocked investors scratching their head. After a gut-wrenching fall of 36.5 per cent in just over a month to March 23, the S&P/ASX 200 had rebounded 35 per cent to early June only to start falling late last week.

Many shell-shocked investors are left scratching their heads, wondering how it’s possible financial markets could be within reach of levels that were last seen before COVID-19 forced the world’s economy to a grinding halt and with so many questions still unanswered. As the dust settles, there are a few explanations that, if not simple, are at least logical.

It makes intuitive sense to conclude that if the economy is doing badly, then so too should the stock market. However, the composition of the stock market actually bears little resemblance to the overall economy and although the two will head in the same general direction over the long-term, over the short-term they can diverge enormously.

For instance, financial companies make up about 26% of the ASX200 but only about 10% of the broader economy, resources are 19% of the index but about 9% of the economy, and CSL on its own accounts for 9% of the Australian share market but is a tiny fraction of the overall economy.

While we hear dreadful reports of businesses that have either shut down entirely or are very close to it, most often small service-oriented businesses like cafes and restaurants, hairdressers, gyms or travel agents, which are simply not represented on the stock market at all and so have very little influence on it.

The flow of credit is like the lifeblood of modern economies, and central banks, like the Reserve Bank of Australia, learned valuable lessons from the GFC about how critical it is to make sure the financial markets’ plumbing doesn’t get clogged up.

The US’s Federal Reserve stepped in quickly and aggressively when global markets panicked about having access to cash in March, and our own Reserve Bank followed right behind making it clear it would backstop the flow of money, cutting interest rates to new lows, offering enormous lines of credit to the banks for business lending and embarking on its first quantitative easing measures. Financial markets heaced a sigh of relief.

The Australian government likewise acted quickly and aggressively. Having orderedd the economy to be shut down it knew it had to abandon any hopes of delivering a balanced budget and instead step in to fill the economic hole it had created. A range of support packages amounting to a world-leading 10% of GDP have been announced, all aimed at helping households and businesses ride out the storm. Importantly, the government’s support spending is injected directly into the economy, so we know exactly how much of an inpact it should have, whereas the central bank measures rely on the banks to distribute it, meaning we can’t be sure of the final effect.

Economist, Tim Toohey, calculated the government’s support package is so large it will actually increase national income in the June and September quarters. This is backed up by Kristine Clifton, an economist with Commonwealth Bank’s Global Economics and Market Research team, who confirmed the bank is finding the reduction in wages and salaries going into accounts is being more than offset by the increase in government benefits, such that overall inflows are up about 10% year on year.

The ASX 200 is trading on a Price to Earnings (PE) ration of about 18x, which compares to a 15-year average of about 14x, prompting many commentators to warn the market is absurdly expensive given ‘the elevated uncertainty.’

Firstly, there is never, ever a time where markets are certain. What changes is how people perceive the consequences of that uncertainty, but that is something we cannot know.

Also, despite analysts slashing their earnings forecasts by about 25% they are still absolutely guessing. It begs the question of why you would even look at forecast earnings when the companies themselves barely have any idea what the next 6-12 months holds.

Finally, super low inflation and interest rates change how assets are valued. When the return you get from risk-free assets, like government bonds, is basically nothing after inflation, then investors are left with little choice but to look elsewhere.

If you swithc off the economy, it’s inevitable you’ll see some ugly economic data – you might be shocked, but you shouldn’t be surprised. The price you pay for an investment is always critical, but as usual, the market is looking forward and balancing a complex host of probabilities, including the old adage, ‘don’t fight the Fed’, to which you might now add, ‘don’t bet against government spending.’