This article was published by The Australian Financial Review.

The Australian sharemarket. like many others around the world, had left many shell-shocked investors scratching their head. After a gut-wrenching fall of 36.5 per cent in just over a month to March 23, the S&P/ASX 200 had rebounded 35 per cent to early June only to start falling late last week.

Many shell-shocked investors are left scratching their heads, wondering how it’s possible financial markets could be within reach of levels that were last seen before COVID-19 forced the world’s economy to a grinding halt and with so many questions still unanswered. As the dust settles, there are a few explanations that, if not simple, are at least logical.

The sharemarket is not the economy

It makes intuitive sense to conclude that if the economy is doing badly, then so too should the stock market. However, the composition of the stock market actually bears little resemblance to the overall economy and although the two will head in the same general direction over the long-term, over the short-term they can diverge enormously.

For instance, financial companies make up about 26% of the ASX200 but only about 10% of the broader economy, resources are 19% of the index but about 9% of the economy, and CSL on its own accounts for 9% of the Australian share market but is a tiny fraction of the overall economy.

While we hear dreadful reports of businesses that have either shut down entirely or are very close to it, most often small service-oriented businesses like cafes and restaurants, hairdressers, gyms or travel agents, which are simply not represented on the stock market at all and so have very little influence on it.

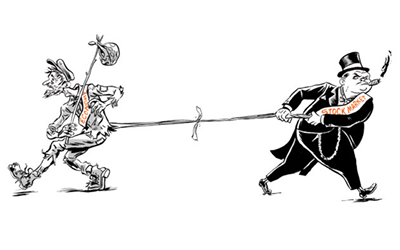

Government and central bank rescue packages make a HUGE difference

The flow of credit is like the lifeblood of modern economies, and central banks, like the Reserve Bank of Australia, learned valuable lessons from the GFC about how critical it is to make sure the financial markets’ plumbing doesn’t get clogged up.

The US’s Federal Reserve stepped in quickly and aggressively when global markets panicked about having access to cash in March, and our own Reserve Bank followed right behind making it clear it would backstop the flow of money, cutting interest rates to new lows, offering enormous lines of credit to the banks for business lending and embarking on its first quantitative easing measures. Financial markets heaced a sigh of relief.

The Australian government likewise acted quickly and aggressively. Having orderedd the economy to be shut down it knew it had to abandon any hopes of delivering a balanced budget and instead step in to fill the economic hole it had created. A range of support packages amounting to a world-leading 10% of GDP have been announced, all aimed at helping households and businesses ride out the storm. Importantly, the government’s support spending is injected directly into the economy, so we know exactly how much of an inpact it should have, whereas the central bank measures rely on the banks to distribute it, meaning we can’t be sure of the final effect.

Economist, Tim Toohey, calculated the government’s support package is so large it will actually increase national income in the June and September quarters. This is backed up by Kristine Clifton, an economist with Commonwealth Bank’s Global Economics and Market Research team, who confirmed the bank is finding the reduction in wages and salaries going into accounts is being more than offset by the increase in government benefits, such that overall inflows are up about 10% year on year.

Valuations

The ASX 200 is trading on a Price to Earnings (PE) ration of about 18x, which compares to a 15-year average of about 14x, prompting many commentators to warn the market is absurdly expensive given ‘the elevated uncertainty.’

Firstly, there is never, ever a time where markets are certain. What changes is how people perceive the consequences of that uncertainty, but that is something we cannot know.

Also, despite analysts slashing their earnings forecasts by about 25% they are still absolutely guessing. It begs the question of why you would even look at forecast earnings when the companies themselves barely have any idea what the next 6-12 months holds.

Finally, super low inflation and interest rates change how assets are valued. When the return you get from risk-free assets, like government bonds, is basically nothing after inflation, then investors are left with little choice but to look elsewhere.

If you swithc off the economy, it’s inevitable you’ll see some ugly economic data – you might be shocked, but you shouldn’t be surprised. The price you pay for an investment is always critical, but as usual, the market is looking forward and balancing a complex host of probabilities, including the old adage, ‘don’t fight the Fed’, to which you might now add, ‘don’t bet against government spending.’