As at yesterday the S&P 500 had gone 252 days without experiencing a 3% correction, which is the longest streak on record and last Friday marked the 24th time the three major US stock market indices, the S&P 500, Dow Jones and NASDAQ, closed at simultaneous record highs.

If you listen to the market commentary a key reason for the steady climb is the anticipation of tax cuts from the Trump administration. I was recently talking to a friend and said I thought tax cuts have got nothing to do with the market’s record breaking run, which is, of course, a silly thing to say.

There is always a bunch of factors that go together to make the market, and anticipation of tax cuts could well be one of them. What I should have said is I reckon it’s only a small one – though that’s almost impossible to prove.

It’s pretty easy to mount an argument that the two most influential factors on share prices tend to be corporate earnings growth and sentiment, and hopefully the charts below illustrate at least the first of those.

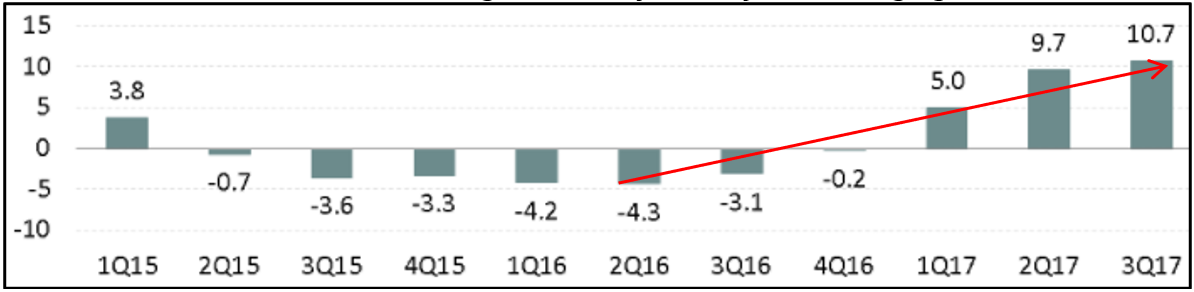

Chart 1, courtesy of Brandywine Global, shows the year on year earnings growth for the US and I’ve added the red line to emphasise the very healthy positive trend over the past five quarters, since it bottomed in 2Q 2016.

Chart 1: S&P 500 trailing 12 month year on year earnings growth

Source: Bloomberg, Brandywine

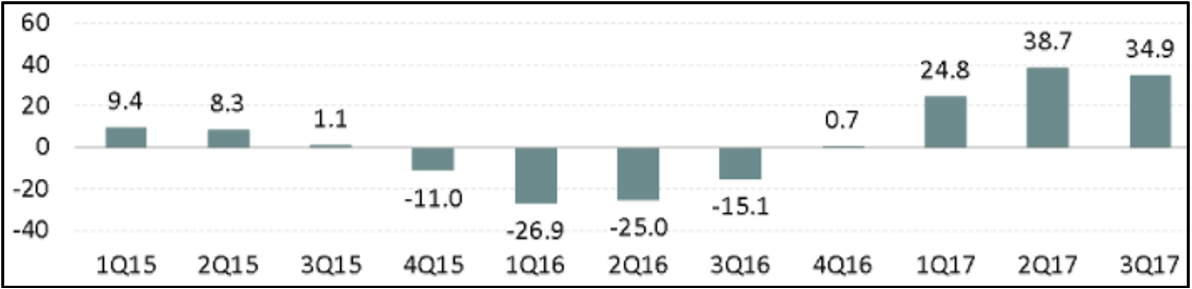

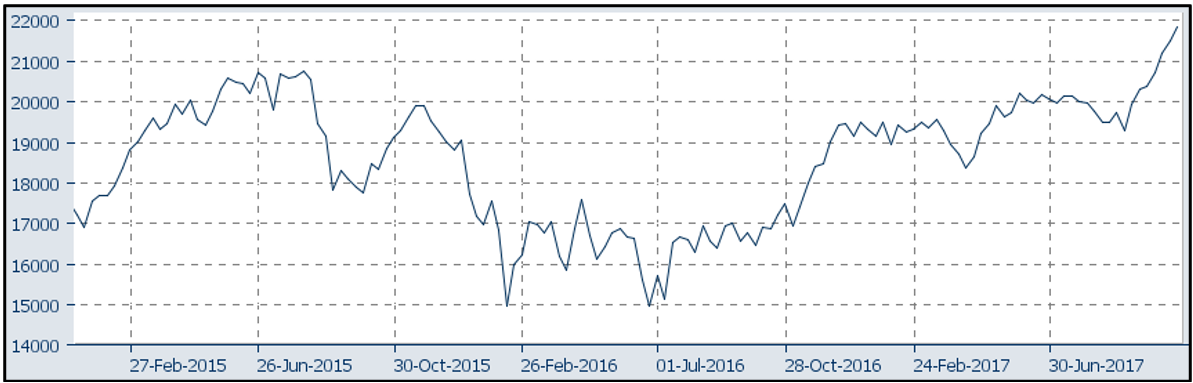

If you accept that markets tend to be forward-looking, it shouldn’t be a surprise that the S&P 500 bottomed in 1Q 2016, just ahead of the change in direction of earnings growth, see chart 2, and has risen in line with that healthy positive trend since.

Chart 2: S&P 500

Source: IRESS

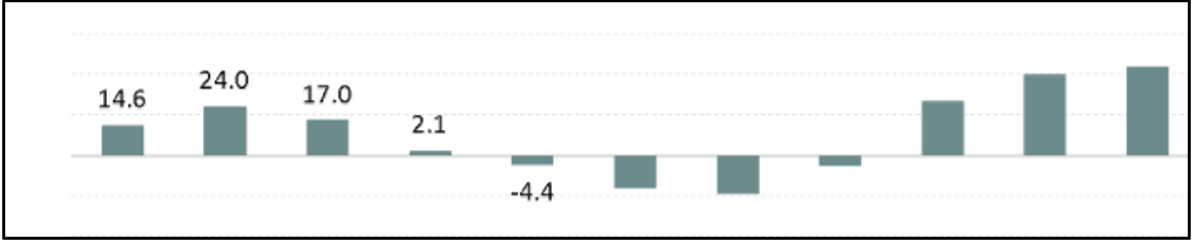

The same applies to Europe, where stock prices again bottomed just ahead of the decline in earnings growth around 1Q 2016 and then rose in line with the positive trend that followed – see charts 3 and 4. Interestingly, you can see the European index flattened off in the last couple of quarters just as the pace of earnings growth backed off a little, unlike in the US where the rate of earnings growth has continued to go up, as have share prices.

Chart 3: Stoxx 600 (Europe) trailing 12 month year on year earnings growth

Source: Bloomberg, Brandywine

Chart 4: Morningstar Eurozone Index

Source: IRESS

Likewise, the wave pattern traced out by the Nikkei in Japan also follows the rate of year on year earnings growth – see charts 5 and 6.

Chart 5: Nikkei 225 (Japan) trailing 12 month year on year earnings growth

Source: Bloomberg, Brandywine

Chart 6: Nikkei 225 Index

Source: IRESS

US tax cuts are a long way away, if they’re going to come at all and of course they’ve had zero effect on corporate earnings growth so far. Attributing the market’s rise to investors anticipating their arrival is what’s called a ‘narrative fallacy’, in other words, someone gets a microphone shoved under their nose and asked ‘why did the market go up today?’ They look around and latch on to the most obvious piece of news to hand, in this case, tax cuts, or it could just as easily be elections, or geopolitical events. Just ask yourself, why should potential US tax cuts underwrite a rise in European and Japanese stocks?

When it comes to explaining why share prices are going up, things like company earnings, business confidence and economic surprises tend not to be in the headlines so are that much harder to see, but they make a lot more sense.