We’ve written recently that US share markets have been remarkably un-volatile, which is normally interpreted as investors feeling perhaps a bit too comfortable. This has been confirmed by the Wall Street Journal which writes that the average daily move on the Dow Jones index over the past quarter was the lowest in 55 years, at 0.3185%, and for the S&P500 it was the lowest in 50 years, at 0.3172%.

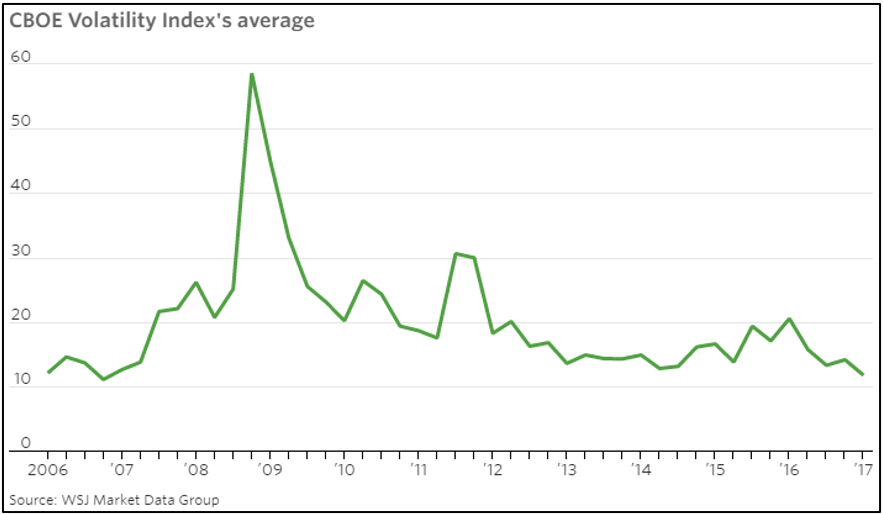

Investors also seem to think the outlook for volatility is low as well, given the VIX index, which attempts to measure the expectations of future turbulence, has posted its second lowest quarterly average ever – see the chart below.

As we’ve written before, periods of complacency inevitably end with a break out of volatility. The unfortunate thing is, nobody can tell you when.