“Expert forecasts” are a strange thing: many investors clamor for guidance on what’s going to happen in markets over the next year without realizing that those forecasts are rarely worth paying any attention to. The shorter the timeframe of the forecast the less reliable it is.

12 months ago Bloomberg released a table showing the consensus analyst forecasts for 14 different stock markets, so that’s the average of all the forecasts they could find. You’d think if the wisdom of crowds is anything to go by these numbers should be more accurate.

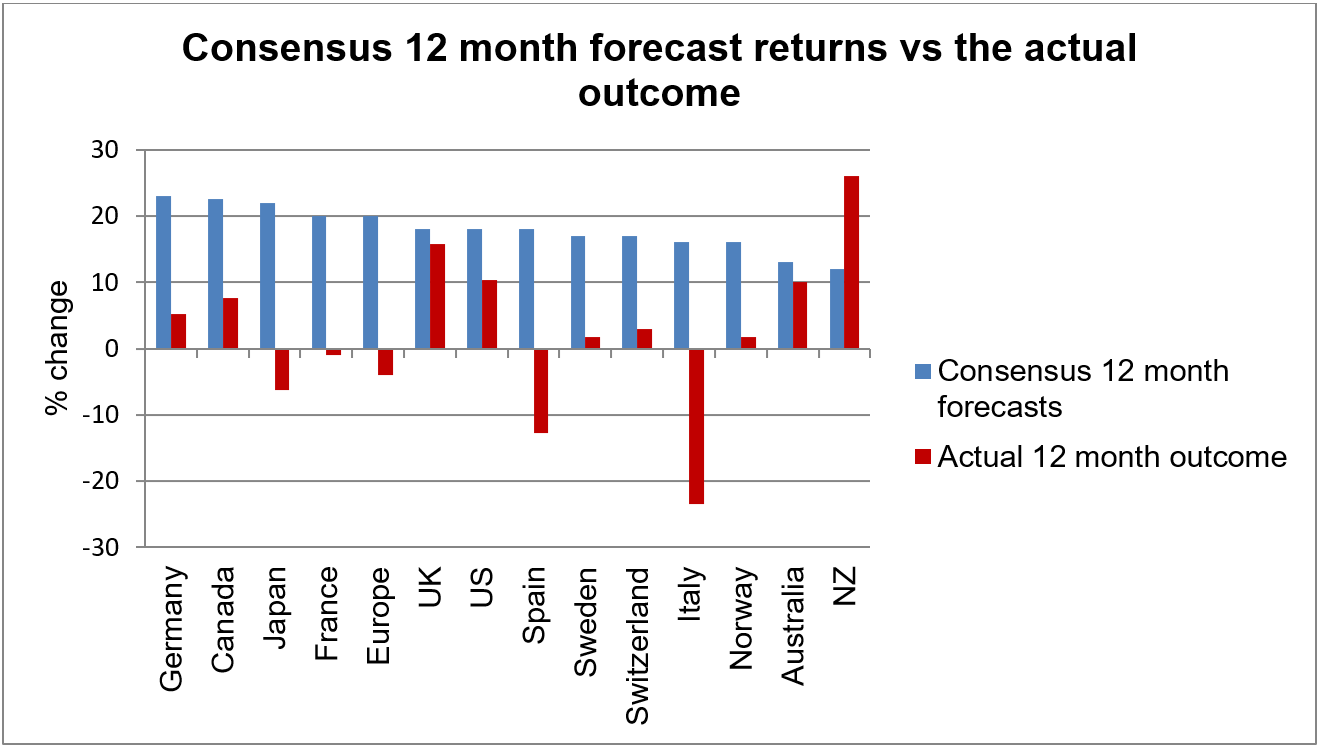

The chart below shows how badly the analysts got it wrong, with the forecasts in blue and the actual outcome in red.

The obvious thing is the analysts were way too optimistic, with an overall average forecast of 18% growth compared with an actual outcome of 2.4%. This is a classic example of the herding that you see amongst analysts: they tend to cluster around a mean, that way if they get it wrong they’re not alone.

It’s also a good example of why Steward Wealth prefers to use 10 year forecasts, because, almost counter-intuitively but due to the magic of mean reversion, the longer the forecast period the more accurate you can be.