The principal of our asset allocation consultant, Tim Farrelly, published the article below on his LinkedIn page. To come within 1% of forecasting the rolling 10 year return for Australian equities over a decade as tumultuous as September 2006 to 2016 is really impressive and speaks volumes not only for the model but for long-term forecasting as well.

Since asset allocation is by far the most influential aspect of long-term portfolio performance, it follows that the more accurate our asset allocation consultant’s forecasts are, the better should our asset allocation be, and so the better should long-term portfolio performance be.

An extraordinary decade. A forecaster’s nightmare!

In September 2006 the world was cruising through the great moderation; low inflation, low and stable interest rates, rising stock markets and prosperity seemingly everywhere. And then the calm was shattered. The US sub-prime crisis erupted and spread to Europe and the rest of the world as financial institution after institution either collapsed or was bailed out. The world experienced its biggest financial crisis since the great depression.

Since the GFC we have seen interest rates at all-time lows and, in many countries, go below the so-called zero bound. We have seen quantitative easing employed at unimaginable levels by Central Banks desperate to stave off recession and deflation.

A forecaster’s nightmare?

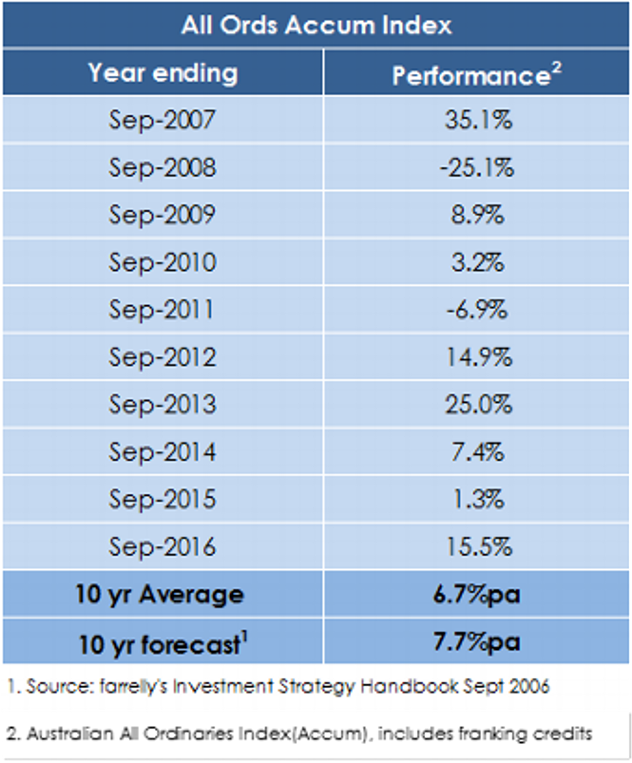

Not really. Using Jack Bogle’s simple forecasting method where we add dividends to the expected growth in EPS and the impact of expected changes in PE ratios we published a 10 year forecast for Australian equity returns in September 2006 of 7.7%pa. The actual return came out at 6.7%pa. Not too shabby.

With the right model, this forecasting business is really not that difficult. The secret? Go long term. It is dramatically easier to forecast 10 year returns than 1 year returns.

The table shows the year by year returns over the decade ending September 2016. The chance of forecasting those returns within 1 or 2 percent? Zero. That really is a mugs game. Long term forecasting? Not too hard at all.

Just saying…