Forgot to make that super contribution? Don’t despair, you may ‘catch-up’

It’s not uncommon to meet prospective clients who either forgot to make a concessional super contribution the previous year, or didn’t feel it was necessary.

However, all is not lost, with a little understood strategy which, in some circumstances, allows you to make ‘catch-up’ contributions.

So what are ‘catch-up’ contributions?

The rules around catch-up, or more accurately known as ‘Carry-forward’ contributions, simply allow super fund members to use any of their unused concessional contributions cap (or limit) on a rolling basis for five years.

So, if you didn’t make the maximum concessional contributions ($25,000 in 2019/2020), you can carry forward the unused amount for up to 5 years. After 5 years, any unused concessional contributions will expire.

The first year these rules came into force and concessional contributions could be accrued from was the 2018/2019 financial year.

Why were they introduced?

The Federal Government introduced carried-forward contributions to help those who have had interrupted working lives to get more money into superannuation. Those who had time off work to have children, care for children or loved ones, or even those who previously didn’t have the financial capacity to contribute to superannuation all benefit from these rules.

Who is eligible to make carry-forward contributions?

Anyone who has a total superannuation balance under $500,000 as at 30th June in the previous financial year is eligible to make catch up contributions.

What are concessional contributions again?

Concessional contributions are those made from pre-tax dollars. It includes:

- employer contributions of 9.5% pa of your salary

- Salary sacrifice contributions.

- Lump sum contributions to superannuation which you notify your superfund provided that you intend to claim a personal tax deduction.

There is an annual $25,000 limit for concessional contributions.

How does it work?

This can best be illustrated with an example.

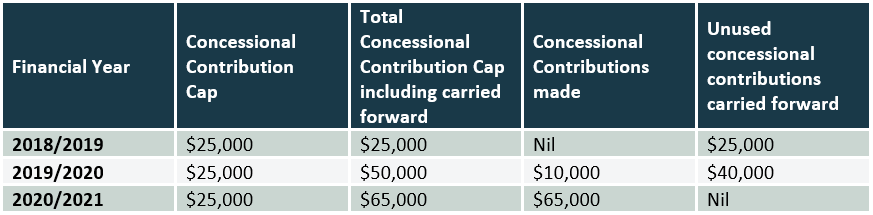

Tina has a total superannuation balance of $300,000. After taking a couple of years leave, she returned to work in July 2019.

During the 2019/2020 financial year, Tina was eligible to carry forward her concessional contributions she didn’t make in 2018/2019, however, she chose to not make an additional contribution above her employer contributions of $10,000.

So, for the 2020/2021 year, Tina has a total of $65,000 of eligible concessional contributions. She has done particularly well from her holding in Afterpay shares and decides to sell them giving rise to a significant capital gains tax liability. Tina has a meeting with her adviser at Steward Wealth about how she may reduce this tax liability. Her adviser recommends making full use of the carry-forward provisions and advises her to make concessional contributions totaling $65,000 (including her employer contributions). Not only will she receive a tax deduction for the contribution, but she will also grow her superannuation balance.

In summary

Carry-forward provisions are a real opportunity for those who haven’t been in a position to make contributions to superannuation, or who have simply forgotten to do so.

While it can assist in building up your retirement benefit, as you can see from our case study above, careful planning can also make it a very effective tax planning tool.

Superannuation can be very complex and advice really needs to be tailored to each individual. If you would like to discuss further, the Steward Wealth team are more than happy to assist you.

Want an assessment as to how this strategy could work to maximise your financial well-being?

Call Steward Wealth today on (03) 9975 7070.