After my first ride in a Tesla, climbing back into my diesel car felt very much like I’d gone back in time – noisy, slow, and those fiendish fumes coming out of the exhaust. I only know a few Tesla owners, but they all swear by them and claim they will never go back to an internal combustion driven car.

I don’t think there’s any doubt Tesla is at the forefront of an inexorable change in the auto industry, and that we are on the way to a car market dominated by electric vehicles. What I am far less certain about, is whether the seven-fold increase in the share price over the past nine months, which includes a 50% jump in the past five weeks, makes sense.

Chart 1: Tesla’s share price has risen 7x in 9 months

I make absolutely no claim to any expertise about Tesla as an investment, and if you own the shares I’m sure as hell not suggesting you should sell them. What I am wary about, though, is that there are pockets of the share market, in particular the tech-heavy NASDAQ index, that appear stretched at the moment, to the point where you could say they have the whiff of bubble about them. To be clear, by no means the whole of the market – it’s like there are micro bubbles.

I certainly don’t think it’s reminiscent of the dotcom bubble that popped so spectacularly in early 2000, when the NASDAQ index fell 78% between March 2000 and October 2002, the biggest tech companies are reporting phenomenal earnings and sales growth that are clearly backing their astonishing performance. However, there’s no shortage of bears among the commentariat, and I recently listened to a conversation between two US-based bloggers whom I respect, because they are generally level headed and not prone to hyperbole, where they straight up called the book going on in parts of the NASDAQ a bubble,

Here are a few of the things that have caught my eye:

- In the US there are a few online trading firms that charge zero brokerage, and they have apparently ignited a retail (as in private investors) trading boom. In its earnings report last week, TD Ameritrade reported average client trades per day had risen to 3.4 million during the June quarter, a 65% increase on the March quarter, and more than three times higher than a year ago. Its top 15 trading days had all happened in the June quarter and 10 of those were in the month of June.

- Probably the best known of the free trading platforms is Robinhood. It has gone from 1 million users in 2016 to now 10 million, more than half of all accounts are opened by first time investors and its median customer age is 31. It too has seen trading activity triple in 12 months, with reports abounding about young investors punting their COVID stimulus cheques, and others drawn to the stock market through boredom because casinos were closed and sports betting has all but stopped.

- Robinhood investors are becoming recognised for chasing fads. A recent example is Eastman Kodak, which announced it had been given a $765 million loan from the government to produce pharmaceutical components, and 60,000 account holders bought into the stock on a single day in which the price soared as much as 500%, having already risen 200% the day before. The shares were up 1,430% over the week.

Chart 2: Shares in Kodak jumped more than 1,400% in a week after Robinhood investors piled in

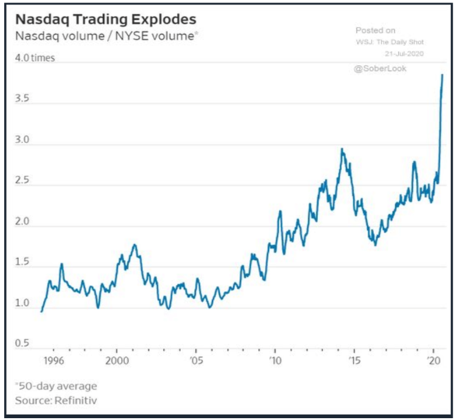

- As an indicator of the level of retail trading activity, trading volumes on the NASDAQ compared to the New York Stock Exchange (NYSE) have recently rocketed.

Chart 3: trading volumes on the NASDAQ compared to the NYSE have rocketed

- Michael Batnick, one of those US bloggers, points out there are 170 names in the Russell 1000 index that are up by 100% or more from their March bottom. Some of those include:

Wayfair, 835%

Tesla, 326%

Wendy’s, 211%

Docusign, 194%

Zillow, 165%

Chipotle, 144%

Roku, 140%

Beyond Meat, 140%

GrubHub, 130%

Zoom, 124%

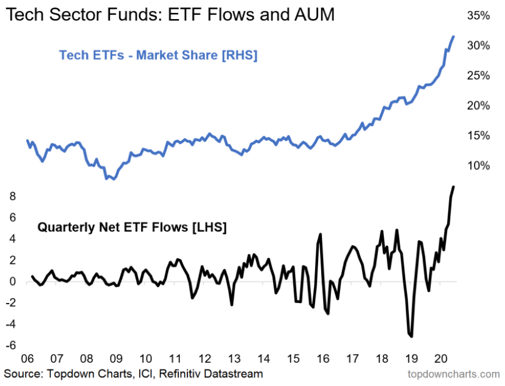

- It’s not all just retail investors punting individual stocks, inflows to tech sector ETFs and managed funds has also exploded higher:

Chart 4: tech ETFs and managed funds are seeing huge inflows as well

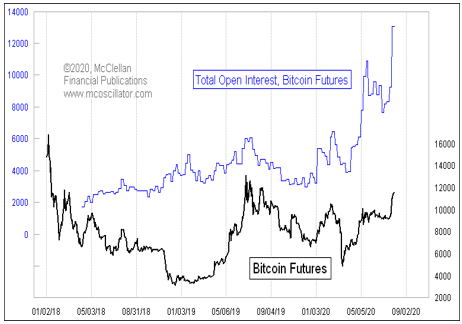

- There are other assets that have been associated with speculative bubbles in the past that are once again attracting punters, such as Bitcoin and gold, which has just hit a new all-time high.

Chart 5: Bitcoin futures have attracted speculators

Chart 6: gold has just hit a new all-time high (in US$)

- Another favourite US blogger of mine, Josh Brown, recently pointed to the re-emergence of Special Purpose Acquisition Companies (SPACs) as a sign of a bubble, or, as he put it, an excess of credulity on the part of investors. A SPAC is where investors hand over money to someone who promises to invest it in an acquisition, but there are no details whatsoever of what they’ll buy, or when. It’s pretty much investing on a wing and a prayer. Just recently one SPAC attracted US$4 billion.

- Australia, of course, doesn’t have anything like the number of tech companies, but there have been some eye-popping rises among the few we do have. For example, Afterpay has risen 125% so far this calendar year, and Kogan is up 120%. Yes, I get there are strong reasons as to why, and I agree a company like Afterpay looks set to grow its international user base numbers enormously, it’s just how far forward is it reasonable to drag earnings?

Chart 7: Afterpay has risen 125% so far in 2020 alone

Chart 8: Kogan is up to 120% in 2020

To reiterate, I don’t include the five tech giants, Facebook, Apple, Microsoft, Amazon and Google, in this. While there is growing consternation that they represent an historically high proportion of the S&P 500 at 22%, they also represent 18% of total earnings, and their earnings are growing way faster than the rest of the market. So while they have seen spectacular rises since the March correction, it is, I believe, much easier to rationalise, especially in an environment of super low interest rates.

I also readily concede the basis of the US dotcom boom of 1999-2000, that the internet would be transformative of how we live and do business, was dead right, it was just wrong about how they should be valued and retail investors ended up getting carried away – and then carted out backwards. This time around it’s again entirely possible the market is right about the impact of electric vehicles, small pharmaceutical companies and other online business models, it’s again a question of what valuation you put on them now, and there are signs some retail investors are once again getting carried away.

As unusual or extreme some of the above stories and examples might be, the thing about a bubble is it can go up a lot higher, and last for a lot longer, than you would ever think possible. Alan Greenspan, who at the time was the Chairman of the US Federal Reserve (their central bank), famously referred to the ‘irrational exuberance’ of the stock market in November 1996, more than three years before it peaked. It’s entirely possible if there is a correction it’s confined to a specific part of the market, leaving the rest of it largely unaffected.

As I said, this is not a suggestion to sell your tech shares, but it is a recommendation to be very careful.