In the lead up to the last federal election the issue of first homeowner’s inability to enter the property market was poignant with voters and Scott Morrison released details of a new First Home Loan Deposit Scheme. From 1 January 2020, eligible Australian first home buyers with a 5% deposit can get home loans without lender’s mortgage insurance (LMI) through a government scheme.

Previously a borrower would need to save a 20% deposit in order to avoid paying LMI, which is an insurance, paid for by the borrower, to protect the lender against loss if the borrower defaults. If the lender is forced to sell the property and the full amount of the loan is not recovered, the insurance guarantees the difference. The additional expense of LMI has been a barrier to entering the property market in the past as, for example, the estimated LMI on a $400,000 property with a 5% deposit is around $12,700.

Whilst the first homeowner must still repay the full loan amount, the scheme allows them to enter the market earlier as they can spend less time saving for the deposit. This can be combined with other existing state-specific schemes such as the First Homeowners Grant (FHOG) and relevant stamp duty concessions.

The scheme is further restricted to:

- Owner-occupied loans on a principal and interest repayment schedule

- The applicant(s) cannot earn more than $125,000 a year as a single or $200,000 as a couple

- Access to the scheme is limited to the first 10,000 applicants per year on a ‘first in first served’ basis.

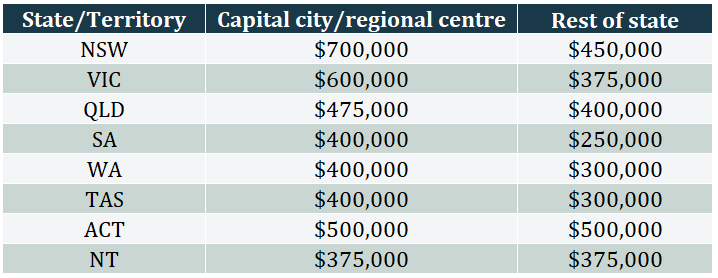

- The maximum value of the purchased home under the scheme varies by state to state and between city and regional areas.

Whether the scheme will in fact increase first homeowners’ access to the market is being widely debated. Arguments are focussed on whether those people who could benefit from access to this scheme may struggle to be able to gain approval for a loan of that size based on current banking regulations. The effectiveness of capping the scheme to 10,000 applicants has also been drawn into question as this only represents around 10 percent of all Australians who bought their first home last year. Banks have also indicated that they are considering charging higher interest rates for the applicable loans. Their justification is that a borrower who has only been able to save 5% is at greater risk of default than one who has displayed a better saving history and saved more. Only time will tell.