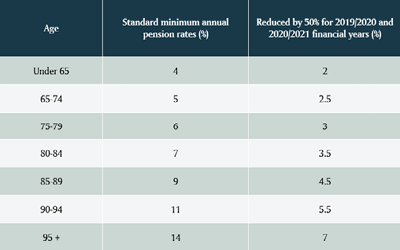

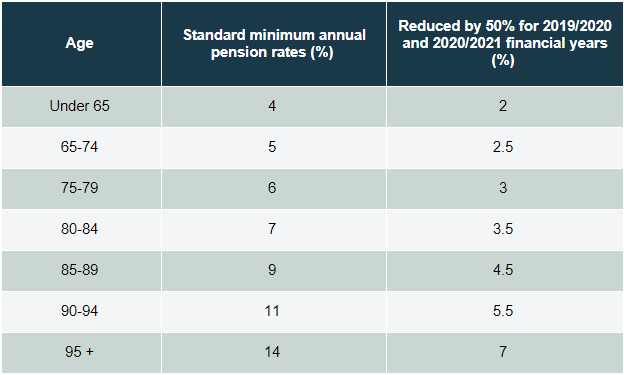

The government has announced measures to help preserve superfunds by temporarily halving the minimum pension drawdown requirements for account based pensions and similar products for 2019-20 and 2020-21.

Similar to actions taking during the GFC, this measure will benefit retirees by providing greater flexibility as to how they manage their superannuation assets.

Unfortunately, if you have already taken more than the minimum pension for the 2019/2020 financial year, you WILL NOT be able to put money back into your superannuation account.

How can we help?

If you need assistance with understanding any of these recent announcements, please feel free to give us a call so we can discuss your particular requirements in more detail.