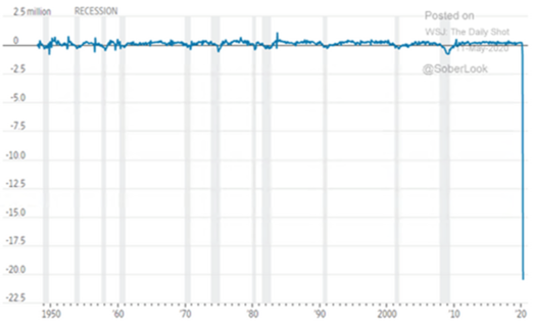

Over the past eight weeks, the number of Americans signing on for unemployment benefits has risen by a staggering 36.5 million, equivalent to an almost unbelievable 25% of the eligible US work force. There has never been anything like it before – see chart 1, not only does it make the GFC look like a blip, it makes the whole chart look kind of broken. Similar miserable statistics have come out about retail sales, down 23% over the past two months, which is more than double the total decline we saw during the GFC, including clothing sales down 90%! Consumer sentiment saw its biggest ever monthly drop, business conditions are rated the worst on record and manufacturing has declined by more than it did during the Great Depression.

Chart 1: US economic data is so bad it’s making charts look broken: this one is monthly changes in non-farm payrolls

And yet amidst all that gloom, the US share market has been on a tear, with the S&P 500 rising 32% from its bottom on 23 March to Monday 18 May. Other share markets around the world have also been surprisingly resilient in the face of what will certainly be the worst global recession in memory, which is leaving a lot of investors scratching their heads and asking: how can there be such a complete disconnect between economic reality and financial markets?

As the usual fog of confusion surrounding any event that causes such volatility, if not outright panic, clears, the benefit of hindsight provides some straightforward explanations.

The market is not the economy

The composition of a country’s stock market usually bears little resemblance to the overall economy, which means that, while over the long-term the two will head in the same direction, over the short-term they can be completely disconnected.

For example, the financial sector, like banks and insurance companies, account for 27% of the Australian share market, which is about double their weight in the overall economy. CSL alone is 10% of the ASX 200, but, of course, nothing like that in the economy.

Likewise, in the US, the tech sector accounts for 26% of the S&P500, which is way more than its weight in the overall economy, healthcare is 15% and financials is about 10%. It’s a similar story across individual countries and entire regions, for instance, financials make up 19% of the European index and 26% of the Emerging Markets.

So while we read about small service businesses like hairdressers and physios, pubs and restaurants, shops and anything to do with travel and leisure suffering a catastrophic reduction in business, the fact is they have a tiny presence, and therefor almost no influence, on most stock markets.

Why the US share market has done so much better than ours

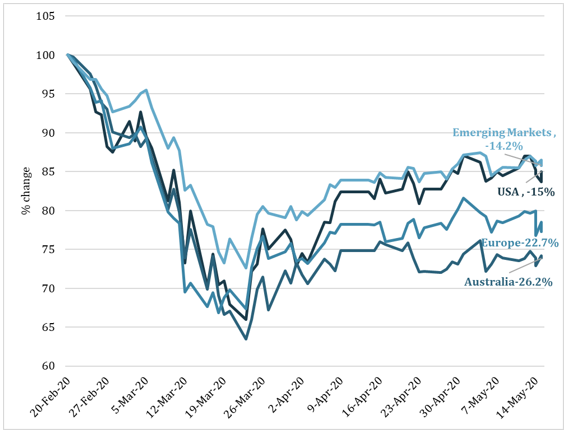

As of Friday 15 May, the US share market was down 15% from its peak, while the Australian market was still down 26% – see chart 1. The difference in the performance of the US compared to the Australian and European markets is largely because of its high weighting to tech, which has flourished during the lockdown. People all over the world are working from home and logging on to Microsoft products, and it could hardly have been a more ideal situation for Amazon: people are confined to their homes, the government has given them money, and 95% of the competition is closed.

By contrast, and again not surprisingly given the horror stories you hear about companies and households requesting loan forbearance from their banks, or even defaulting altogether and forcing higher provisions for bad and doubtful debts, financials have been amongst the worst performing sectors across global stock markets.

Similarly, the Emerging Markets have done relatively well. While the index is 26% financials, it’s also 20% tech, and the three largest companies are all big, dominant tech companies, Alibaba, Tencent and Taiwan Semiconductor.

Chart 2: The US and Emerging Markets have outperformed because of how their indices are made up

The stock markets are reflecting reality pretty well

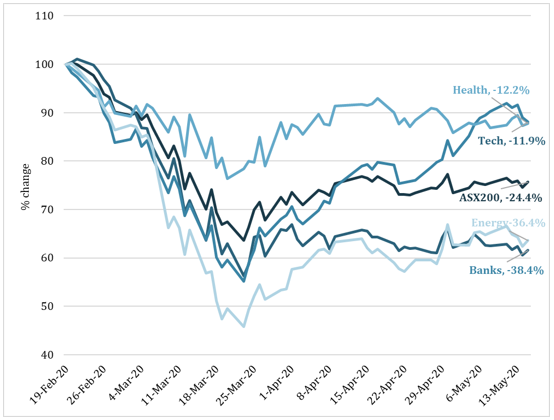

While investors might still be scratching their heads wondering how share markets could possibly be rising in the face of such bad economic data, the movements of the underlying sector indices tell a more nuanced story. Chart 2 shows those areas of the Australian economy that you’d expect are doing well, like health and technology, are way outperforming those sectors that are hit hardest, like the banks. So, in that sense, the stock market is not doing a bad job at all of reflecting economic reality.

Chart 3: The underlying sectors of the ASX200 are doing a good job of reflecting economic reality

It’s the same in the United States: Microsoft and Amazon might be hitting new highs, but the major airlines just hit a new 52 week low (in fact in one amazing sign of the times, the market cap of Zoom, the now ubiquitous provider of video conferencing software, is equivalent to all the US airlines put together), JPMorgan and Bank of America are both still down 38%, Hyatt Hotels is off 49%, and GE just hit an almost 30 year low.

Government and central bank rescue packages make a HUGE difference

‘Unprecedented’ is becoming a pretty tired word, but it’s very apt when talking about the global response from central banks and governments to the Coronavirus Crisis. Having learned valuable lessons from the GFC, the US Fed stepped up quickly and aggressively to reassure markets that liquidity would be maintained. Indeed, it was the announcement from the Fed on 20 March that it would open unlimited US$ swap lines with other central banks (meaning the Fed would exchange as many US$ for other currencies as those other central banks needed) that started the bounce in global markets.

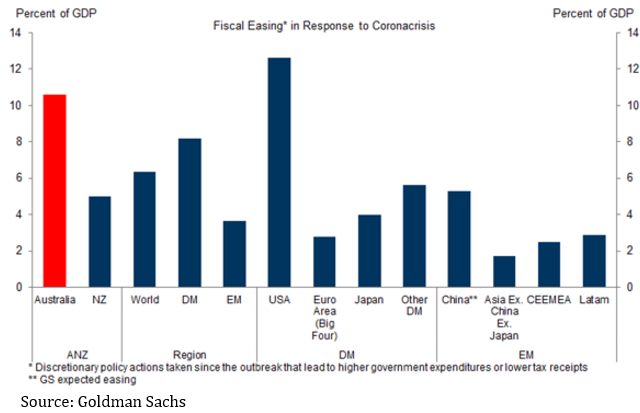

Governments too have announced support packages that dwarf what was spent during the GFC – see chart 4. Indeed, UBS has calculated the combined central bank and government packages adds up to a total of almost US$16 trillion, or more than 18% of global GDP! That’s more than three times what was spent following the GFC and it’s being done over six months instead of three years. And there’s the prospect of more to come.

Chart 4: Governments have announced massive economic support packages

As we said above, there’s plenty of anecdotal evidence that entire sectors of the economy have seen revenues all but wiped out. The well informed might argue that while the hairdressers, waiters, barmen and travel agents might not come from businesses that have much influence on the stock market, they are all consumers, and consumer spending accounts for 60-70% of a modern economy. At some point, it has to have a knock-on effect.

However, Goldman Sachs of the US and Yarra Capital Management here in Australia, have each calculated that the total respective government packages announced to date are so enormous, they will more than offset the drop in national income. That’s right, governments are spending so much that national income is set to increase in the June and September quarters. And there is the prospect of more to come.

But have markets run too far too fast?

There are plenty of compelling arguments to say markets have risen too far too fast, but likewise, there are some very good counter arguments. Below are a few of the popular ones:

Bear argument 1: the risk of a second wave and more shutdowns creates too much uncertainty

You don’t have to look very hard to find a chorus of well-informed commentators arguing share markets have factored in too much of a recovery. They point to the disastrous unemployment data, the rising number of firms declaring bankruptcy, the uncertainty of how soon economies can go back to ‘normal’ and the ever-present risk of a second wave of infections forcing governments to shut economies down again.

One argument is that markets are reacting as if economies can be reopened as quickly as they were shut down, as if it’s as easy as flicking a switch, yet we’re seeing it’s far more gradual and incremental than that, and entire sectors, like international travel and hospitality, are likely to remain closed down for months to come: it’s an event compared to a process. Indeed, one commentator used the clever analogy that it was off by the switch and on by the dimmer.

Counter argument 1:

First, it was always bleedingly obvious we would see a string of disastrous economic data. Share markets dropped 30-40% to factor that in, but when governments and central banks stepped in, it turned in to a new ball game. Broader markets are still substantially below where they were before the crisis struck, and that reflects the extent to which markets are allowing for a less than complete recovery.

There may well be a second wave of infections, and it may require full or partial lockdowns again, but share markets don’t normally get priced on a worst case scenario, rather, it’s more a balance of probabilities. It’s also worth noting that share markets have effectively gone sideways now for at least a month; it’s sure been a volatile month, but you can readily argue that’s the markets are accounting for the uncertainty.

Also, if economies get shut down again, we’ve already seen governments step up with aggressive rescue packages, why would they not do it again? (and before you ask ‘how are they going to pay for all this?’, have a read of this.)

One final point, you hear the argument ‘there’s never been so much uncertainty’ a lot; not just now, but all the time. The simple fact is, there has and will never, ever be certainty in financial markets. What changes is how people perceive the consequences of that uncertainty, but that is something we can not know. ‘Hindsight bias’ plays a nasty trick on us: when we look back on events it seems the explanation for them is so straightforward we think ‘how could we have missed that?’ and it fools us into thinking things are actually more predictable than they are.

Bear argument 2: stock market valuations are way too high

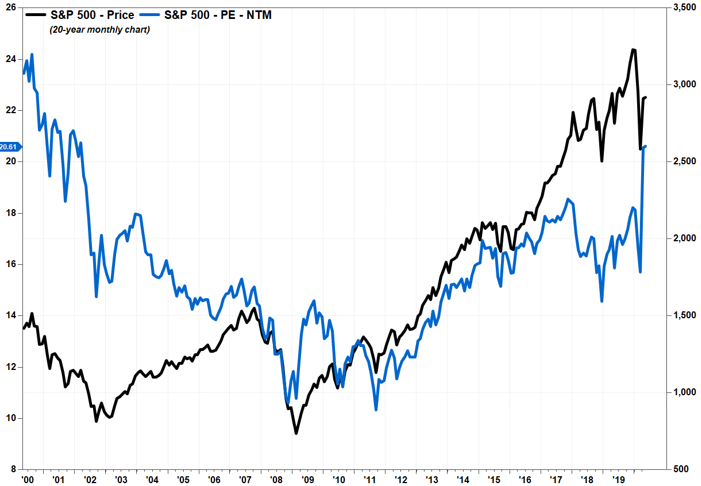

Then there’s the valuation argument. The S&P500 is now trading on a ‘forward PE ratio’ (that’s the ratio of what price you’re paying for stocks versus the next 12 months’ (NTM) forecast earnings) of 20.6, which is the highest it’s been since 2002 – see chart 5. Analysts have slashed their second quarter earnings forecasts by more than 40%. Surely paying such a high price in the face of such uncertainty is utter madness!

Chart 5: The S&P500’s forward PE ratio is at an 18-year high

Counter argument 2:

You have to question the point of looking at a forward PE ratio when the companies themselves, let alone the analysts, have no idea what the near-term outlook is for earnings. When the economy’s been shut down, near-term earnings reports are going to be all but meaningless as an indicator of long-term earnings potential.

Also, when inflation is very low, as it currently is, markets historically have traded on higher PE ratios. So arguing today’s PE ratio is x% higher than the average for the last 10, 20 or even 40 years, is a non-sensical comparison, because over that entire timeframe inflation was much higher than what it is now. You’re not comparing apples with apples.

Similarly, when the risk free bond return is effectively zero, it will support higher valuations for equities, firstly because the super low bond yields means the current value of future cash flows goes up, and secondly, because the marginal dollar that gets invested will still be looking for a return.

Bear argument 3: billionaires are telling us not to buy shares

Some of the highest profile investors in the world are calling the current market as uninvestable. Hedge fund titan, David Tepper, said last week this is the second most expensive market he’s ever seen behind the dotcom boom of 1999-2000. Then he admitted he’s only 10-15% invested. It might be cynical, but he’s clearly talking his book, in other words, he has a vested interest in talking the market down.

The legendary Stanley Druckenmiller also last week described the risk-reward for equity probably as bad as he’s seen it in his career and described the V-shaped recovery as a fantasy. When you look back though, Druckenmiller has a record of making bearish calls over the past 6-7 years, going so far as saying ‘get out of the stock market’ in 2016. Also, he’s a trader and has reversed his position in the blink of an eye.

And most telling of all, the best investor that’s ever lived, Warren Buffett, has been selling into the market and apparently not buying back in. He sold his airline stocks, and recently sold some of his bank shares. Selling airlines? That should be no surprise. Selling banks, well, part of that is because he tends to trim holdings when Berkshire’s stake gets above 10%, and perhaps the other part stems from the troubles facing the banks described above.

Conclusion: don’t fight the Fed?

There’s an old saying in financial markets that you don’t fight the Fed. For years some have argued that with interest rates at close to zero the central banks are ‘running out of ammo’, but their collective response to the COVID crisis, especially the US Fed’s, has shown they have a whole arsenal of weapons they can use, cash rates is only one.

This article isn’t about arguing you should be bullish or bearish, and I’m sure as hell not saying markets are a one way bet, it’s simply intended to shed some light on why the market’s doing what it’s doing.