Bitcoins: are they the latest in a long line of bubbles that will end badly or are they genuinely transformative? I suspect everyone who works in finance will have been asked about that question. Here’s a primer: a very basic guide to what they are and the arguments as to whether or not it’s a bubble waiting to burst or the latest technology that will change the world forever.

A meteoric price rise

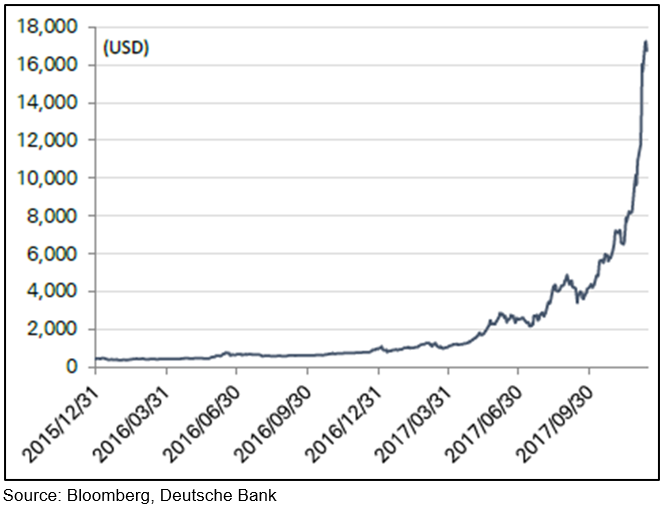

Just to put things into perspective from the start, here’s a price chart for Bitcoins to Friday 15 December:

There’s an old saying in finance that ‘trees don’t grow to the sky’. In other words, the Bitcoin price is not going to keep going up like that for ever. At some point the rate of increase will definitely slow right down or possibly stop and may even go into sharp reverse, but nobody on the planet can tell you when or by how much.

What is Bitcoin?

Bitcoin was invented in 2009 and was the first ‘cryptocurrency’: a decentralised, unregulated, global payment system in the form of a digital currency.

Who created Bitcoin?

The inventor of Bitcoin is a person or group known as Satoshi Nakamoto, who published a paper in November 2008 about it having registered the domain name bitcoin.org a few months earlier. The first Bitcoins came into existence in January 2009.

In what could go down as one of the great mysteries of our time, the identity of Nakamoto is unknown. There have been analyses that he/she/they own 980,000 Bitcoin, which at current prices is worth close to US$17 billion.

How many Bitcoins are there?

The total number of Bitcoins that can ever be available is limited to 21 million, though there are assertions that number might be increased by a change in the underlying protocols. According to blockchain.info, as at 15 December there were currently around 16.74 million in circulation.

Why were Bitcoins created?

It’s difficult to pin down a purpose for creating Bitcoins, but it certainly appears one of the motivations was a mistrust of so-called ‘fiat currencies’, which are created and controlled by governments or government institutions like central banks.

There are many examples through history of governments manipulating the value of currencies, often to the detriment of the man in the street. Just think of the Weimar Republic in 1920s Germany where the uncontrolled printing of currency saw annual inflation hit the trillions of per cent, obliterating the value of peoples’ lifetime savings.

Because Bitcoins are neither created nor controlled by any kind of government institution, there is little if any risk of their value being manipulated like that.

If you can’t hold Bitcoins in a bank account how do you verify ownership?

This is another part of the genius of the whole cryptocurrency structure: ownership is verified by something called ‘the blockchain’. This is the underlying technology that could be truly transformative.

The blockchain is a public ledger, meaning anyone can see it, that is managed on a network of computers. It uses sophisticated cryptography, making it almost impossible to corrupt, that is capable of recording all kinds of transactions or verifying ownership of all kinds of assets, not just cryptocurrencies.

For example, the ASX recently announced it’s exploring using blockchain technology for transacting shares, which will do away with the CHESS system and should make settlement much faster.

Goldman Sachs recently did a terrific infographic animation explaining how the blockchain works.

If you do own Bitcoins you actually hold them in an online ‘wallet’.

How do you make a Bitcoin?

Bitcoins are ‘mined’ using computers. The miners actually perform a kind of record-keeping service, keeping the blockchain consistent, complete and unalterable by constantly verifying transactions, and in doing so they are ‘rewarded’ with newly minted Bitcoins.

There’s quite an ingenious algorithm underlying the creation of Bitcoins which is designed to make it progressively more difficult to create a new one. The algorithm is designed to adapt to the amount of computing power being used to mine the Bitcoins so that it limits the production to one new coin about every 10 minutes.

The system gradually reduces the amount of the reward so that the number of newly mined Bitcoins drops by half every four years until all 21 million are in circulation. At that point the miners are just administrators and will be paid a fee for performing that task.

Mining is an expensive business. First you need a lot of computing power, in fact people now fill warehouses with computers for the purpose, and all those computers suck an awful lot of power and need to be kept nice and cool. So there are lots of miners set up in cold climate places like Iceland, which also has cheap power. Below is a photo of one part of a Bitcoin mining operation.

A Bitcoin mining operation based in Iceland

Who controls Bitcoin?

That’s kind of the point, nobody controls Bitcoin. It is totally unregulated: no government can set rules for how Bitcoins are created or traded. I suspect the inventor going missing is part of the plan: to prove that Bitcoin is not controlled by anyone.

The rules governing Bitcoin are all hard coded into the underlying software. Governments can, however, declare that Bitcoins are not going to be recognised as legal tender in their country, or they can try to ban their citizens from trading in cryptocurrencies, like China did in September this year (and which by all reports has not been particularly successful).

Are there security risks to owning Bitcoins?

There have been a number of instances of Bitcoins being stolen from exchanges, the most famous being the theft of 850,000 from the Mt Gox exchange in Japan in 2014, which forced it to file for bankruptcy. At the time Mt Gox accounted for up to 70% of Bitcoin transactions.

Like anything, where there’s big dollars and computers involved, there will be really smart bad guys trying to steal them. Bitcoin transactions can’t be reversed or unwound, much like cash, so once they’re gone you’re screwed.

Aren’t Bitcoins just facilitating crime?

This is a popular argument against cryptocurrencies because of the absence of any government agencies in regulating or controlling the Bitcoin market. In fact, police investigators have used the blockchain to piece together the financial history of criminals. It was by tracing blockchain transactions that the FBI located the mastermind behind the Silk Road dark web.

By the same token, while there’s a perfect record of all the transactions you still have to work out the identity behind them and that can be the hard part.

So how can a Bitcoin be worth anything?

Technically, Bitcoins have no intrinsic value at all. The only reason they can have any value is because of trust: people trust they will be paid and can pay in Bitcoin.

In that sense it is absolutely no different to any country’s currency: the only reason anybody accepts dollars is because they trust the government will stand behind them. If it weren’t for that trust, a $5 note would just be a piece of fancy looking plastic.

And that brings us to the biggest question of all…

Is Bitcoin a bubble?

Arguments in favour of Bitcoin being a bubble

- The main argument is the fact that the Bitcoin price was US$980 at the start of 2017 and as at 18 December it’s $19,152, an increase of more than 1,850%. The price has doubled in the last month alone. Given it’s been around since 2009 to suddenly take off like that smacks of bandwagon-ism.

- The fact that Bitcoin generates no earnings or dividends means it is literally impossible to value, that is pretty much the definition of speculating. If something can’t be valued then logically the only reason to buy it is because you think/hope someone will buy it off you at a higher price (also known as the ‘greater fool theory’). Not everything that’s speculative ends up in a bubble, but most bubbles are characterised by some new form of technology or product that has people claiming it defies standard valuation methods. The dotcom bubble is the most obvious example of that when it was proposed new internet companies should be valued based on ‘potential eyeballs’.

- Anything with the stomach churning intraday volatility of 20%+ is hardly investment grade.

- The number of ‘ICOs’ (initial coin offerings), which is where a new cryptocurrency is floated, has exploded from about 50 at the start of 2017 to more than 1,300 now. At the start of the year $318 million worth of cryptocurrencies had been sold, by the end of November that had reached $6.4 billion. This is a brilliant infographic that illustrates the growth.

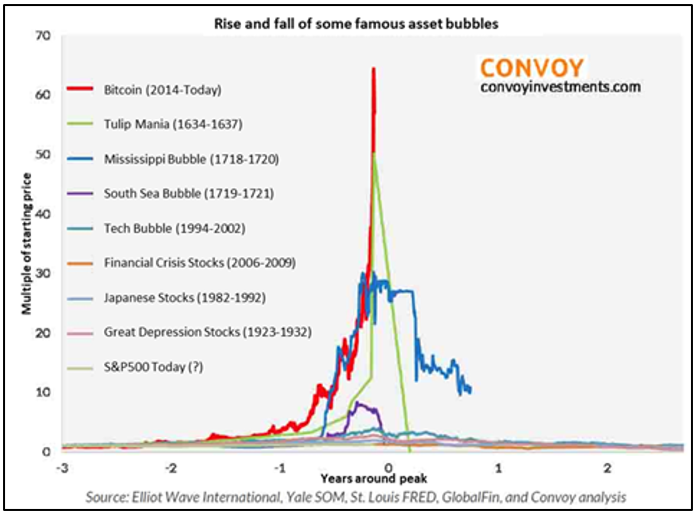

- Charts like this one have been appearing lately, declaring Bitcoin to be “the biggest bubble in history”.

- The financial luminaries that have lined up saying Bitcoin is a bubble reads like a who’s who:

- Jamie Dimon, CEO of JP Morgan: called it a “fraud” and anyone who owns it is “stupid”

- Ray Dalio, CEO of Bridgewater Associates: called it a “bubble”

- Warren Buffet, CEO of Berkshire Hathoway: called it a “mirage” and the idea it has some “huge intrinsic value is just a joke in my view”

- Bob Shiller, Nobel-winning economist: said it’s the “best example” of a bubble right now

- Howard Marks, co-founder of Oaktree Asset Management: referred to it as “an unfounded fad”

- Larry Fink, CEO of BlackRock: said the Bitcoin price “is an index of money laundering”

- Paul Krugman, another Nobel-winning economist: proclaimed it to be “evil”

- Philip Lowe, Governor of the RBA: described Bitcoin as a “speculative mania” and most attractive to criminals

- The President of the North American Securities Administrators Association claims some people are borrowing to buy Bitcoin, even on credit cards – considered to be a sure sign of a frenzy.

Arguments against Bitcoin being a bubble:

- It is new technology, introducing a new means of exchange that has global reach. Its total ‘float size’ at the moment is about US$320 billion, which is a tiny fraction of the value of global fiat currencies.

- Those who live in a country where rule of law prevails, or under a government that is trustworthy, may find it conceptually difficult to trust something as radical as an unregulated currency that exists only inside computer networks. But for those who live under a government that is able to confiscate your possessions at whim and has a record of doing so, it is a godsend.

- When both Google and Amazon were floated they were pilloried by the likes of the Wall Street Journal, the New York Times and Barrons as being overhyped and overpriced.

- Bill Miller, a legendary fund manager in the US who’s an avowed ‘value investor’, first bought Bitcoins in his hedge fund at less than US$500 and still owns them.

- Shyam Sunder, a professor at Yale, has described money in our wallets as a bubble, since the intrinsic value of the paper or plastic it’s printed on bears no relation to its purchasing power and the government can produce unlimited amounts of it. Likewise gold, which has been accepted as a medium of exchange for thousands of years, has no earnings or yield. And think of Da Vinci’s “Salvator Mundi” painting, which sold for US$450 million; fundamentally what’s the canvas and paint worth?

- Marc Andreeson, one of the most well-regarded early stage tech venture capitalists, said with reference to the who’s who of financial luminaries above: “the historical track record of old white men who don’t understand technology crapping on new technology is, I think, 100 percent.”

Final thoughts

There is no one on the planet that can tell you what any cryptocurrency is worth. I suspect it’s very likely there will be a shaking out of the ICO market, but even if Bitcoin loses 90% of its value from here it will still be worth multiples of what is was only a couple of years ago.

It’s arguable the current frenzy around cryptocurrencies, and it really can’t be called anything else, is very similar to the dotcom era, when money was being thrown at anything with a “.com” tag. There was a handful of exceptional companies that came out of that, but the underlying technology of the internet was profoundly transformative. In this instance, the blockchain could very well have a similarly transformative effect.

You don’t ‘invest’ in something that’s risen thousands of percent in a short space of time, you join the other speculators and hope they’re right. The best advice in a situation like is just don’t invest any more than you can afford to lose.