It’s a question that comes up from time to time, however, it’s one which superfund members should understand as it’s an important consideration for tax purposes when your estate planning strategy is put in place.

So, what does happen with my super when I die? Well, it really depends upon several factors including:

- Age

- whether you are in pension or accumulation phase

- who is considered a ‘dependent’ under both superannuation (SIS) definition and the ATO definition

- the amount you have in super

- the ‘taxable’ and ‘non-taxable’ components of your super

- what your trust deed allows.

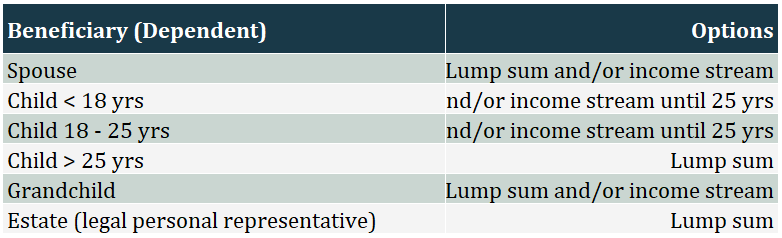

Generally, the options on how your benefit can be paid to beneficiaries upon death are:

Who is a ‘dependent’ and a ‘non-dependent’?

One thing you need to be aware of is that there are two definitions of who is deemed as a dependent. One relates to the SIS Act (Superannuation) and the other under the ITAA 97 (ATO). This is an important distinction because while a dependent receives the benefit tax free, a non-dependent under the ITAA will incur tax on super benefits.

Under the ITAA, a death benefit paid to a beneficiary will be deemed a ‘dependent’ and therefore will be tax free if it is paid to the deceased’s:

- spouse;

- child under the age of 18;

- any person over 18 years and financially dependent or in an interdependent relationship.

An interdependent relationship is a close personal relationship between two people who live together, where one or both provides for the financial and domestic support, and care of the other. This definition can include parent-child relationships that don’t fall within the usual definition of dependent and can also include sibling relationships.

Any person who does not fit within these categories can only receive the superannuation benefit via the deceased fund member’s estate.

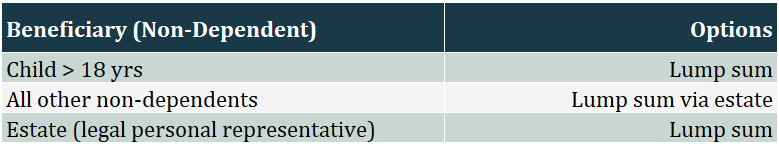

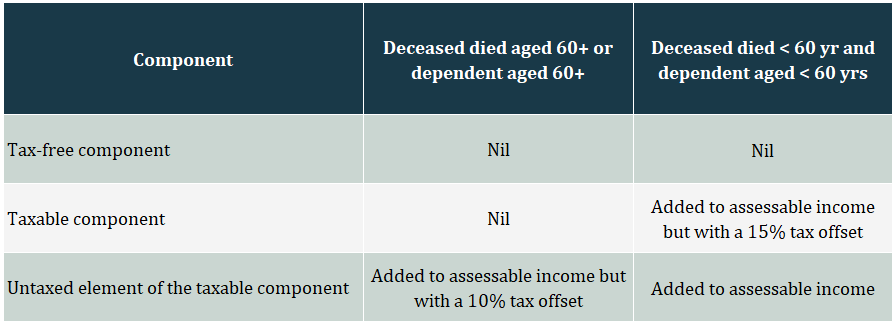

Super Taxation

Superannuation benefits consist of different components for tax purposes:

- a tax-free component;

- a taxable component; and possibly

- an untaxed element of the taxable component.

We have established that if you are a dependent under the ITAA definition, your lump sum benefit will be tax free. However, if you are receiving the super benefit as a pension rather than a lump sum, you may be required to add the taxable component of your pension income to your assessable income. This will depend on your age.

However, if you are a non-dependent for tax purposes, the above components will be taxed as follows:

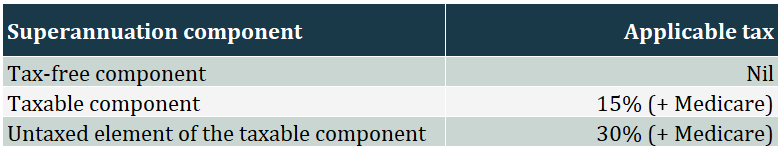

The new transfer balance cap (TBC) and death benefits

From 1st July 2017, the transfer balance cap (TBC) will apply to limit how much a member can have in retirement phase over their lifetime. For 2017/2018 the TBC is $1.6m. When a member dies, their TBC is not transferable to a dependent or even their spouse.

When the deceased member’s superannuation benefits are cashed as a lump sum, there is no impact on anyone’s TBC and the relevant death benefit taxes we previously discussed will apply.

However, if the benefit is used to continue paying a reversionary pension to a spouse, the surviving spouse will need to add its value to his/her super asset balance. This can only be paid as a death benefit pension if it doesn’t cause the dependent to exceed their TBC. Any excess will need to be paid out as a lump sum death benefit and cannot be retained within the super environment.

To reduce any excess and retain it in the superannuation environment, the receiving beneficiary will need to commute their own benefit first as it can still be held in the superannuation environment as an ‘accumulation’ interest. The death benefit pension they receive from the deceased can be retained up to the $1.6m TBC and it is only any surplus that will need to be paid out as a lump sum.

When did you last review your SMSF trust deed?

Many trustees of superfunds don’t realise that when super legislation changes the trust may require updating. This is particularly critical when dealing with payments of death benefits.

While most trust deeds are written to provide the trustee with wide discretion, to be 100% certain, we strongly recommend they be reviewed. An updated deed will provide complete flexibility when it comes to dealing with excess transfer balance caps, the rollover of death benefits, reversionary and child pensions and effective binding death nominations.

Summary

Superannuation continues to be the most attractive vehicle to grow your wealth. It can also be a very tax effective estate planning tool. For a spouse and financial dependent, a lump sum benefit death benefit is tax free. For non-dependents (as defined by the ATO), there may be taxes of up to 30% on a lump sum super death benefit. Having said this, there are strategies you may be able to implement to significantly reduce, or even eliminate, this tax for non-dependents such as your adult children.

You must also be very careful when a reversionary beneficiary is dealing with a deceased’s pension when it will exceed their transfer balance cap.

If you would like to have a chat about it, we are more than happy to have a look at this for you.