The ACCC recently told Google and Facebook they have to negotiate with Australian media sources to effectively pay them for their news. This has sparked a furious response from both companies because they are conscious governments all over the world are watching very carefully, and if they give in to Australia it could well open the proverbial floodgates – much like the fight over plain paper packaging for cigarettes.

As well as sucking a huge amount of advertising revenue out of domestic media franchises, these transnational companies are renowned for utilising every legal loophole they can to avoid paying tax, especially the tactic of attributing revenue to low tax, offshore locations like Ireland, the Netherlands or Cayman Islands.

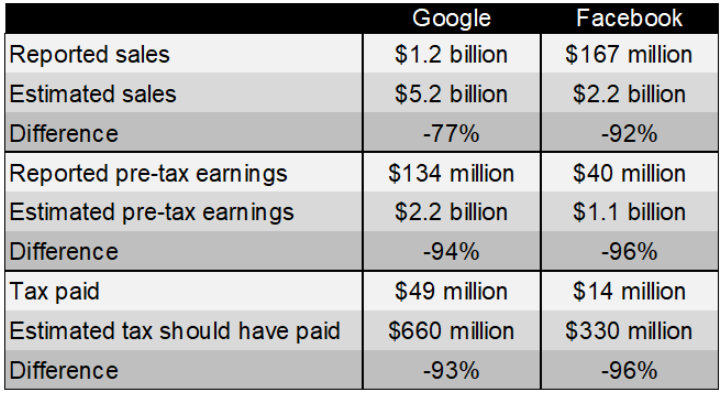

According to Neil Chenoweth of the AFR, Google’s CY2019 Australian ‘customer receipts’ were reported as $5.2 billion, but ‘revenue’ was $1.2 billion, so $4 billion of sales made in this country were somehow attributed to offshore offices.

Google reported pre-tax earnings of $134 million and ended up paying tax of $49 million. Chenoweth writes that if its Australian division is as profitable as the rest of the company’s non-US businesses, pre-tax earnings would have been $2.2 billion, which means Australian tax should have been more like $660 million, or 13 times more than what it paid.

Facebook reported CY2019 Australian revenue of $167 million and paid tax of $14 million. Chenoweth calculates revenue was probably more like $2.2 billion. Again, using average non-US earnings rates, pre-tax profit should have been $1.1 billion, which should have resulted in tax of $330 million, or 24 times more than what it paid.

Michael West compiles an annual list of the worst tax dodging companies, and interestingly neither Google nor Facebook make the top 40.

These are but two example of what is a farcical international tax regime. A classic example of just because it’s legal doesn’t mean it’s right.

P.S. For anyone curious about the ramifications of social media, The Social Dilemma on Netflix is an interesting take on it.