One of the worst kept secrets in Australian business was confirmed yesterday when Amazon, the omnipresent US online company, announced it is establishing a retail business in Australia. From humble beginnings as an online bookstore just over 20 years ago Amazon now accounts for an estimated 5% of total US retail sales and 38% of online sales, with businesses including cloud computing services, media and entertainment. Its Australian business will be at least the fourteenth country where it has an on-the-ground presence.

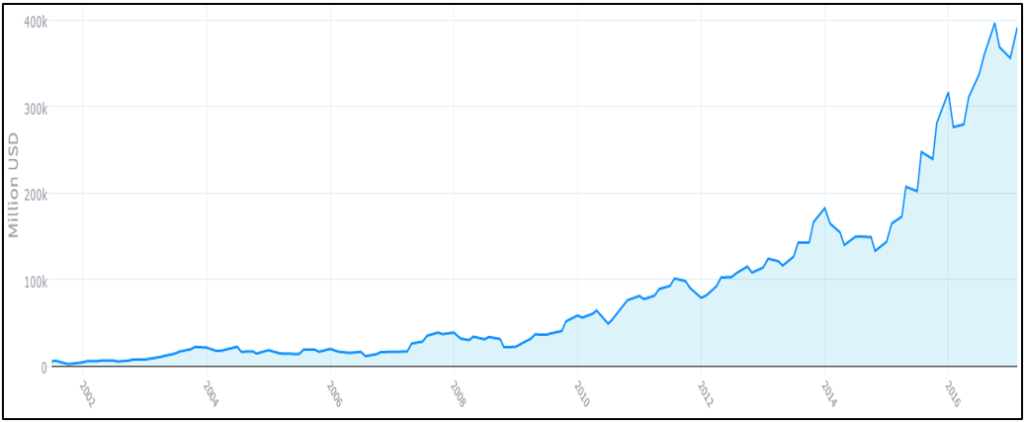

The very impressive and entertaining presentation by Scott Galloway found below, a Professor at NYU Stern School of Business, maps out his view as to why Amazon is completely changing the business of retailing. No less than Warren Buffett has described Amazon’s boss, Jeff Bezos, as a business genius, because he has redefined how a company executes a growth strategy. Despite revenue of US$136 billion Amazon reports barely any profits, preferring instead to plow all its spare cash into growth, a strategy that has seen its market capitalisation grow 14-fold in the last 10 years to more than US$420 billion.

The effect this is having on the US business landscape is being monitored by no less than the US Federal Reserve, which refers to the ‘Amazon effect’: a gradual reduction in bricks and mortar shopping malls (which had grown at double the pace of US population growth for 45 years but have now seen a halving of foot traffic in the past 7 years) and retail employment (retail bankruptcies have been accelerating over the past 3 years).

Amazon’s market capitalisation 2002-2017

Source: Quandl.com

Jeff Bezos is on the record as saying: your margin is my opportunity. It will indeed be interesting to see how Amazon’s presence in Australia affects the likes of JB Hifi, Harvey Norman, Woolworths and Wesfarmers.