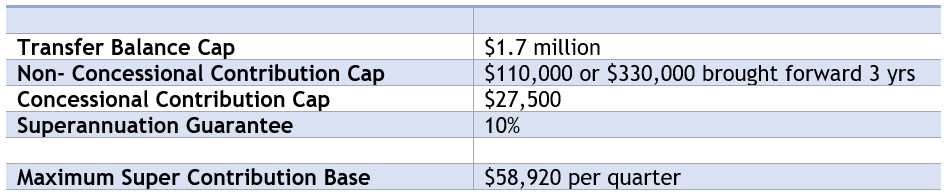

Transfer Balance Cap

The transfer balance cap rules commenced on 1 July 2017. It is a limit on the amount of superannuation a member may use to commence a tax free pension in retirement phase. It is also the level at which you may not make any further non-concessional superannuation contributions. From 1 July 2021, this transfer balance cap will increase from $1.6 million to $1.7 million.

Non-Concessional Contribution Cap

The non-concessional superannuation contribution cap will also be indexed up from $100,000pa to $110,000pa and so the 3 year bring forward rules will enable you to make a $330,000 non-concessional contribution.

Concessional Contribution Cap

The concessional superannuation contribution cap will also be index up from $25,000pa to $27,500pa. Concessional contributions include employer SG (super guarantee), salary sacrifice or deductible super contributions.

Superannuation Guarantee (SG)

The contributions you will receive from your employer will rise to 10%pa from 1 July 2021. Employers will need to pay this on salaries of up to $58,920 per quarter.

The increase in contribution limits is always a noteworthy event, given it tends to only occur every 4-5 years. For those considering utilising the 3 year bring forward provisions, it may be worth considering deferring these payments for 6 weeks. This also applies to those who were considering using their superannuation to purchase a retirement income stream prior to 1 July 2021. If you would like to discuss these changes and how to best take advantage of them, please feel free to contact us. We will be more than happy to assist.