It seems there’s a constant stream of geopolitical issues forever leaving financial markets teetering on the brink of crisis. Not surprisingly each new episode invariably sees some investors ask themselves if they shouldn’t be reducing their exposure to riskier assets like shares, but looking back, reacting to geopolitical events has not been the right strategy.

Last week the US investor sentiment survey reported pessimism was above 40% for only the second time this year, with most respondents citing rising concerns about trade. There’s no doubt the risks presented by a full-on trade war between the US and its trading partners are huge and it’s difficult not to be concerned when you have a one man geopolitical event in charge of the US firing tweets at will. No wonder you’ve got commentators saying things like ‘the risks have never been higher’.

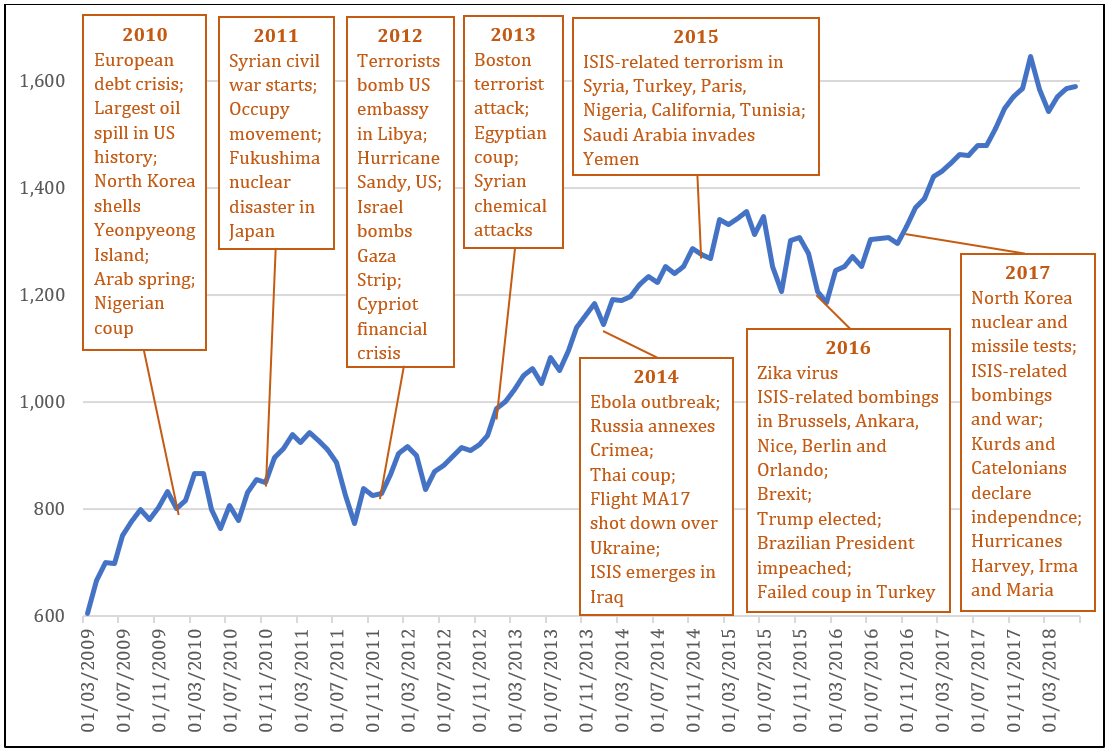

The fact is though, selling equities in anticipation of geopolitical fallout is fraught with risk. Just since the GFC there have been multiple issues of international significance, from military adventurism, natural disasters, diseases and financial crises, in each case any reasonable person would have been forgiven for thinking reducing risk exposure was the safe thing to do, but it turned out not to be the case, given the MSCI World index has risen 163% since then, or almost 11% per year – see chart 1.

Chart 1: Despite an apparent never-ending stream of disasters the MSCI has risen 163% over the past 9 years

What usually makes markets fall is the prospect of declining company earnings. By and large most geopolitical scares don’t actually affect how much companies make outside of the immediate area of the threat and when something comes along that could, like a trade war, there’s still no way of really knowing how bad the effects will be.

Just think if your crystal ball had correctly told you that Trump would win the 2016 election, every commentator was arguing it would be a disaster for the US market, so you’d have felt pretty confident selling your US shares. Since then the S&P500 has risen 30%. Likewise, Brexit was described as the biggest own goal in the UK’s modern economic history, yet the FTSE has gone up more than 20% since.

Some people are confident they can sniff an approaching selloff and will be insightful and disciplined enough to buy back in when things are clear again, then again some people believe there are fairies at the bottom of the garden. When it comes to geopolitics and the financial markets, while it always pays to be alert, the last nine years have shown it rarely pays to be alarmed.