The Australian economy is accustomed to catching colds from other economies and nervous investors have a natural fear the sniffles will be contagious and spread to the share market. So when your biggest trading partner, which also happens to be the second biggest economy in the world, experiences a collapse in its stock market in a matter of a few weeks, it’s understandable if people ask whether they should be retiring to bed with a long, hot glass of lemon and honey. In this instance, we think it’s pretty safe to soldier on.

The Shanghai Composite Index has fallen about 28% since its recent peak on June 12, a fall that has been likened to the U.S.’s 1929 crash in its ferocity. As it happens, the underlying cause for the sharpness of the selloff is similar as well: margin lending. Debt is fantastic as long as things are going the right way and gains are magnified, but once things turn bad it’s the losses that get magnified and things can get very ugly, very quickly.

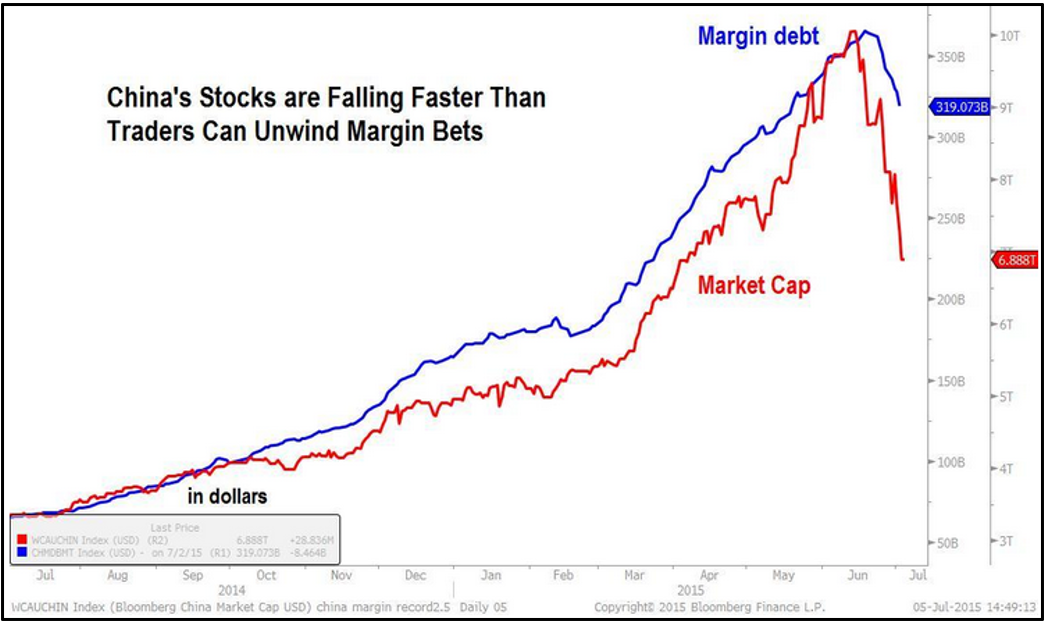

Margin lending was only introduced into the Chinese stock market in 2010, and restrictions were relaxed last year when the government was encouraging people to buy shares and discouraging property investment. The government also lifted restrictions on how many stock broking accounts investors could open. The plan worked really, really well – as you can see from the chart below. Margin loan balances went up more than seven-fold in less than 18 months and the market shot up.

Chinese investors opened a lot of stock broking accounts and margin loans

Source: Goldman Sachs

At the start of 2014 the Chinese stock market was cheap, trading on a price to earnings ratio of less than 9 times, compared to the U.S.’s S&P500 on about 17 times. By June of this year the market had gone up by about 145% and the median PE of mainland stocks was trading at 73 times. The chart below appears to indicate margin lending had a lot to do with that astonishing rise.

Source: Bloomberg LLP

There’s a bit of a learning curve for the Chinese authorities on margin lending though: whilst stock broking companies are more easily regulated and typically require RMB500,000 of capital, enterprising and (more importantly) unregulated online lenders started offering the equivalent of low doc loans to punters with as little as RMB2,000 and the promise of being able to leverage up five times – all for the bargain cost of up to 22% p.a. interest rates. Eventually, it’s estimated that margin loan balances were equivalent to between 9-12% of the stock market’s total value, compared to about 4% in the U.S.’s dot com boom of 1999-2000. What could possibly go wrong?

In a classic case of selling begetting more selling, margin traders have been closing out positions for a record 10 straight days, and they’re still going. In an effort to shore up the market the Chinese government has allowed companies to buy their own shares and encouraged pension funds to buy shares. But who wants to stand in the way of an oncoming train? In their efforts to find a scapegoat the authorities have blamed foreigners and short sellers, but in fact short positions were at their lowest level since June 2014 at an almost meaningless 0.03% of the market, and foreign managers have been buying on weakness.

This is a great illustration of how dangerous a combination debt and momentum investing can be. But do investors, particularly those here in Australia, need to worry? In our view, not a lot.

The gyrations of the Chinese stock market don’t have much to do with anything other than debt and internal factors. Yes, it’s caused some short-term volatility on the ASX, which has been exacerbated by what’s happening with Greece and the Eurozone, but that too is unlikely to have much consequence for Australia. It’s a well-established fact that share markets have pretty much zero correlation with GDP growth, so we shouldn’t take this as an indication that our exports to China are in danger of falling off a cliff. Valuations on the Australian market are cheap right now, with our models forecasting a ten year annualized return of more than 10%. Likewise, European shares are also cheap.

How are the Steward Wealth portfolios being affected by the Chinese selloff? We use two emerging markets funds. The first is the Robeco Emerging Conservative Fund, which has 15% of its portfolio in Chinese shares, compared to the index weighting of more than 25%. The other is the Aberdeen Emerging Opportunities Fund, which holds 7% in China. On a combined, weighted basis we are at about half the benchmark weighting to China, plus both have strict policies of only investing in quality companies, so we can safely presume there were no holdings on PE’s of 73 times. Whilst they won’t be immune to the gyrations, they won’t be as exposed.

Overall, we’re keeping a close eye on what’s going on but we see nothing to panic about. Not that the media would have you believe that’s the case. But as we’ve said many times, the media knows their audience is far more likely to read an article with a headline screaming “CRISIS!” than one that says “relax, things aren’t as bad as they seem”.