Source: Leith van Onselen, Macro business “link to full article”

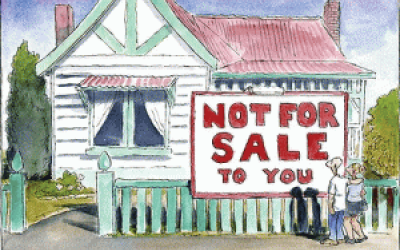

The 10th Annual Demographia International Housing Affordability Survey has just been released and, once again, it ranks Australia as having one of the most expensive housing markets out of the countries surveyed.

This year’s report assesses 360 urban markets in nine countries: Australia, Canada, Hong Kong, Ireland, Japan, New Zealand, Singapore, United Kingdom, and the United States. The survey employs the “Median Multiple” (median house price divided by gross annual median household income) to rate housing affordability. This measure is widely used for evaluating urban markets, and has been recommended by, amongst others, the World Bank and the United Nations, and is used by the Harvard University Joint Center on Housing.

The Survey ranks urban housing markets into four categories based on their Median Multiple, from “Affordable” (3.0 or less) to “Severely Unaffordable” (5.1 & Over) [Table ES-1]. Average multiple data (average house price divided by average household income) is used in Japan, since data for estimating medians is not readily available.

According to the Survey, housing affordability deteriorated somewhat in the major metropolitan markets in 2013.

At the national level, Hong Kong has by far the most unaffordable housing, with a median multiple of 14.9. Australia and New Zealand are tied for second most unaffordable market out of the nations surveyed (both 5.5), followed by Singapore (5.1), United Kingdom (4.9), Japan (4.0), Canada (3.9), United States (3.4), and Ireland (2.8):

As shown above, all of Australia’s 39 markets captured in the survey are ranked as either “Seriously Unaffordable” (14) or “Severely Unaffordable” (25). Australia currently has no housing markets ranked as “Affordable” or “Moderately Unaffordable”. The result represents a slight improvement on last year’s survey, where 30 markets were ranked as “Severely Unaffordable”. A break-down of Australia’s rankings are provided in the below table:

Looking at the major metropolitan areas only – i.e. those with more than 1 million inhabitants – you can see that Australia ranks as third most expensive after Hong Kong and New Zealand (Auckland):

Overall, Australia has moved down the league tables, registering 5 out of the 20 most expensive housing markets identified in the Survey, versus eight in last year’s survey:

The overall decline of housing affordability in Australia over the past few decades (and the modest recent improvements) is clearly evident in the below Demographia chart, which shows the change in Median Multiples in Australia’s major urban markets. The RBA has previously shown similar findings.

Whereas all major Australian markets, except Sydney, had Median Multiples of three in the early 1980s, today all are ranked at around five or above.

One of the key contentions of the Demographia Survey is that higher land prices are the principal contributor to the rapidly increasing home prices in unaffordable markets, as well as increased speculative activity. These land prices include the cost increasing influence of land supply restrictions (such as urban growth boundaries), excessive infrastructure fees and other overly strict land-use regulations:

Operating at cross-purposes, many governments have adopted urban containment land regulations (also referred to as “densification,” “compact development,” “urban consolidation,” “growth management,” “smart growth,” or “livability” policies) that ration land for development… [These policies lead] to materially higher land prices, which makes houses more expensive, just as rationing oil increases the price of petrol…

Regrettably, virtually no government administering urban containment policy effectively monitors housing affordability…

Typically, land use policy authorities fail to compare credible measures of housing affordability with historical standards [above]. Moreover, when faced with the reality that housing costs rise disproportionately relative to incomes, they seek to identify virtually any cause except for the principal cause itself: the destruction of the competitive market for land…

Severely unaffordable markets are also more attractive to buyers seeking extraordinary returns on investment and short term profits. This further raises prices in markets where urban fringe development is largely prohibited by urban containment’s land rationing policies. Substantial international investor activity has been reported in London, Vancouver, the US West Coast markets of Vancouver, Seattle, the San Francisco Bay Area, Los Angeles and San Diego and others. These price increases make such metropolitan areas less livable for average and lower income households.

The key to preserving housing affordability is a “competitive land supply,” which appears to be incompatible with urban containment policy both in economic theory and practice. Further, out-of-control house price escalation destabilizes economies, retarding metropolitan area economic growth and job creation.

And in the 2011 Survey, Demographia noted the following about Australia:

In Australia, 95 percent of the increase in inflation-adjusted new house (and land) costs were attributable to land, rather than construction from 1993 to 2006. In more restrictively regulated San Diego, house prices were 250 percent higher than in Dallas-Fort Worth in 2007, yet cost only 15 percent more to build…

Demographia’s contention that Australia’s rising home prices have been caused primarily by escalating land costs is supported by evidence. The below chart shows aggregate Australian housing values relative to GDP broken down by the land component and the structure component. As you can see, almost all of the growth in Australian housing values (relative to GDP) has been in rising land values:

Further, this escalation of land costs has occurred across Australia’s housing markets, as evidenced by all capital city markets experiencing strong growth in vacant land values in the decade to 2012, according to RP Data:

A key reason for this land price escalation in Australia (as well as in New Zealand, the United Kingdom, and the expensive markets of the United States and Canada) is that the market’s ability to quickly provide low priced new housing supply is being hampered by restrictive land use regulations, many of which have come into effect since the mid-1990s (Sydney has had long-standing limits on housing development on the urban fringe). Demographia describes the key features and consequences of restrictive housing markets as follows:

Urban containment (More Restrictive Land Use Regulation) relies on intrusive land use regulation, and includes markets where residential development (new construction) is strongly controlled by comprehensive plans or development limits. Generally, it is an urban planning objective to make urban containment the only legal regulatory structure. There is a strong campaign to make the principal alternative, liberal regulation (below), illegal.

Urban containment may also be characterized by terms such as “densification policy,” “compact development”, “urban consolidation”, “growth management” “and ” smart growth.” Generally, urban containment regulation is “plan-driven,” as planning departments and governments determine where new housing is allowed to be built. There is a “negative presumption,” with new development generally prohibited, except in limited areas where it is permitted by government plans.

By severely limiting or even prohibiting development on the urban fringe, urban containment eliminates the “supply vent” of urban fringe development, by not allowing the supply of housing to keep up with demand, except at prices elevated well above historic norms. In addition to higher housing costs relative to incomes, the higher densities in urban containment markets are associated with greater traffic congestion and longer average work trip journey times.

Urban containment policies are normally accompanied by costly development impact fee regimes that disproportionately charge the cost of the necessary infrastructure for growth on new house buyers. There is particular concern about the cost increasing impacts of these fees, especially in Australia, Canada (Canadian Mortgage and Housing Corporation), New Zealand (New Zealand Productivity Commission) and California.

By contrast, affordable housing markets, like Texas and Georgia in the United States, utilise open market-based land use structures whereby plentiful new housing supply is able to be built quickly and cheaply on the urban fringe, thereby preventing rapid house price escalation. Demographia describes these markets as follows:

Liberal Land Use Policy (Less Restrictive Markets) applies in markets not classified as “urban containment.” In these markets, residential development is allowed to occur based upon consumer preferences, subject to reasonable environmental regulation. Generally, liberal land use regulation is “demand-driven”. There is a presumption allowing land to be developed, except in limited areas, such as parks and environmentally sensitive areas. By allowing development on the urban fringe, liberal land use regulation allows the “supply vent” to operate, which keeps house prices affordable. Less restrictive regulation can also be called traditional or liberal regulation. In addition to lower costly housing costs relative to incomes, lower population densities in liberal markets are associated with less intense traffic congestion and shorter average work trip journey times.

So under an open market-based model (provided there are not also substantial physical barriers to housing supply), increased demand, such as from reduced lending standards and easier availability of credit, quickly leads to the building of additional low priced housing on the urban fringe, which helps keep house prices in check and reduces the likelihood of speculative housing bubbles developing. Further, highly leveraged speculators are less likely to be encouraged into open land markets, since there is little prospect of achieving strong capital gains. Investing in open land markets is, instead, more about rental yield.

I will add that restrictive urban planning structures should not be viewed as a one-way bet for house prices, with unresponsive land supply also more likely to result in higher levels of house price volatility and boom/bust price cycles – a fact also acknowledged by Demographia. Why? Because strict land-use policies (planning) steepens the supply curve, which makes house prices more sensitive to changes in demand, increasing the likelihood of the housing market experiencing boom/bust price cycles as demand rises/falls.