With market volatility hitting multiyear highs on the back of the implications of COVID-19 and the oil price dropping, we convened an extraordinary meeting of the Investment Committee yesterday to talk about what’s going on and whether any action needed to be taken.

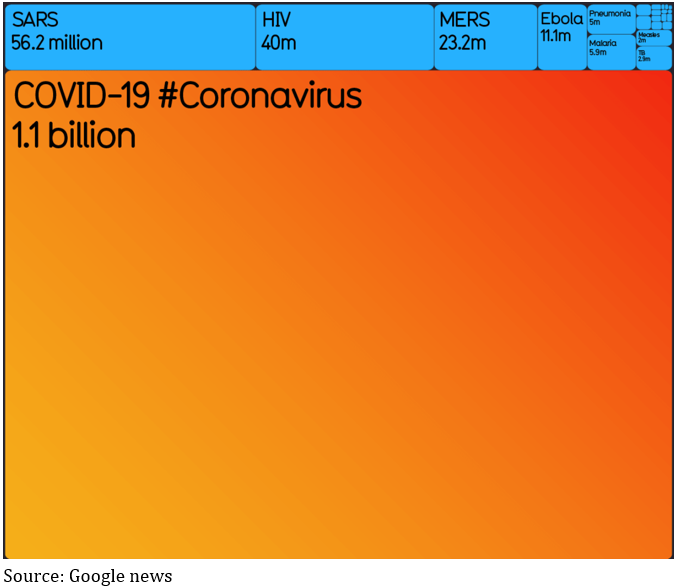

The noise level is reaching fever pitch, with all forms of media talking about little else – see the chart below – which exacerbates the sense of panic, and footage of women wrestling over toilet paper drives home the astonishing effect this is having on people.

Media mentions of COVID-19

Last weekend Russia and Saudi Arabia were unable to agree on production cuts, which saw the oil price fall almost 30% over the following week and then on Monday was blamed for a rout on international share markets. Whilst the lower oil price will have clear implications for energy companies and whatever debt they might have, you’d have thought it should otherwise be a good thing for most companies and pretty much all consumers.

Obviously the greatest concern for share markets is the impact the various quarantining measures will have on company earnings and global economic activity, and that is, as yet, completely unknown, and unknowable. Share markets have fallen anywhere from 10-20% from their recent peaks, setting records for the fastest retreat from all time highs in history, which could well be overcompensating for potential earnings declines or not enough. Likewise, government bond yields have plummeted to the point where all US bonds, all the way up to 30 years, have a yield of less than 1%.

In considering whether any action should be taken on portfolios, there are many, many factors at play, and it’s full of ‘on the one hand, but on the other’. For example, we know governments and central banks have indicated they will provide support, but on the other hand, we don’t how effective those actions will be. The challenge is to focus on those things we can be sure of, as opposed to those where we are just guessing.

Another important factor is how a portfolio is structured and what’s called its ‘beta’, which is simply the technical name for how sensitive it is to the changes in share markets. A beta of 1 means a portfolio is perfectly correlated to share markets, and a beta of zero means it has no correlation at all. Steward Wealth’s portfolios include investments that are designed to reduce beta, such as the alternatives and non-secure debt, and, of course, secure debt (which is the very low volatility, ‘cash-plus’ funds).

Also, not all share markets have been as weak as the Australian, which has been a terrific example of the benefits of geographic diversification. For example, after Monday’s correction the ASX200 had declined 20% from its peak, but the Japan ETF in the portfolio (UBJ.ASX) had fallen only 8%, and the Europe ETF by 10%. Those results have been helped by the Australian dollar weakening against the big three currencies: since the start of the year it’s fallen 6% against the US$, 7% against the Euro and 11% against the Yen.

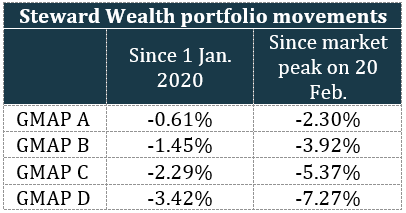

The table below summarises the movement in the four benchmark GMAP portfolios from the start of the year and since markets peaked on 20 February. This data is as at the close of business on 10 March and doesn’t include adviser charges.

We hope you are as pleased with that outcome as we are.

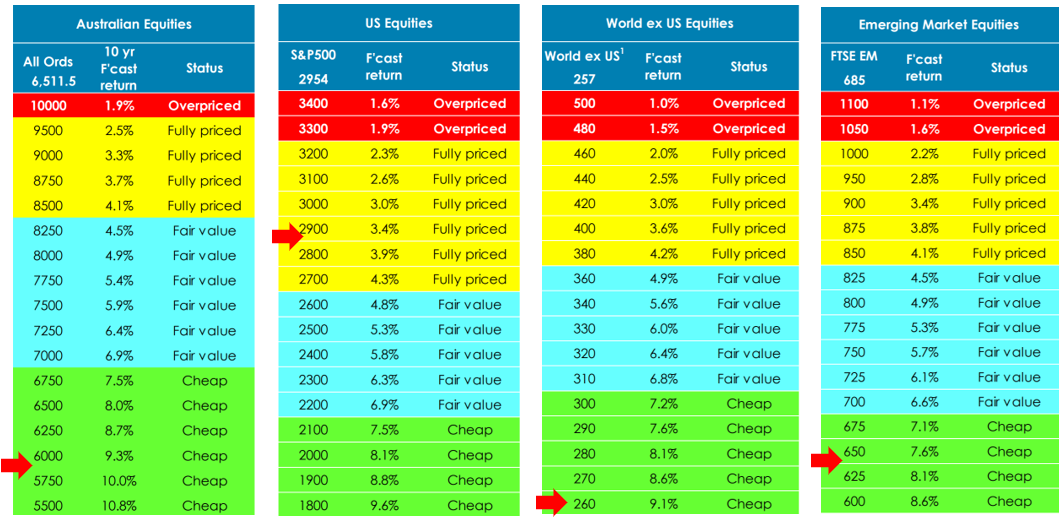

Another thing we can have a little more certainty about is valuations, which is where our asset allocation consultant, farrelly’s, is very helpful. As you’ll remember, we take a long-term approach to examining relative value, between asset classes as well as geographies. The latest tipping point tables indicate markets are uniformly offering attractive value, again, with the exception of the US.

As we keep saying, there is no way of knowing when the current market volatility will subside, or where markets will be once it does, which makes trying to time ducking in and out of the market very risky. We much prefer to base portfolio moves on valuations, but we feel there are buffers in place to protect portfolios from the worst of what’s happening.

As always, please do call us if you’d like to discuss your portfolio or have a chat about what’s going on.