Prior to national lockdowns many were expecting the Australian housing market to correct anywhere from 10% to 30%. Moving forward a mere nine months and record low interest rates, home loan holidays and working from home have led to a remarkable resilience. With consumer confidence now at record highs, coupled with forecast low interest rates, stamp duty reforms (in NSW and Victoria) and talk of vaccines, all indications are that house prices across the nation are on the rise again.

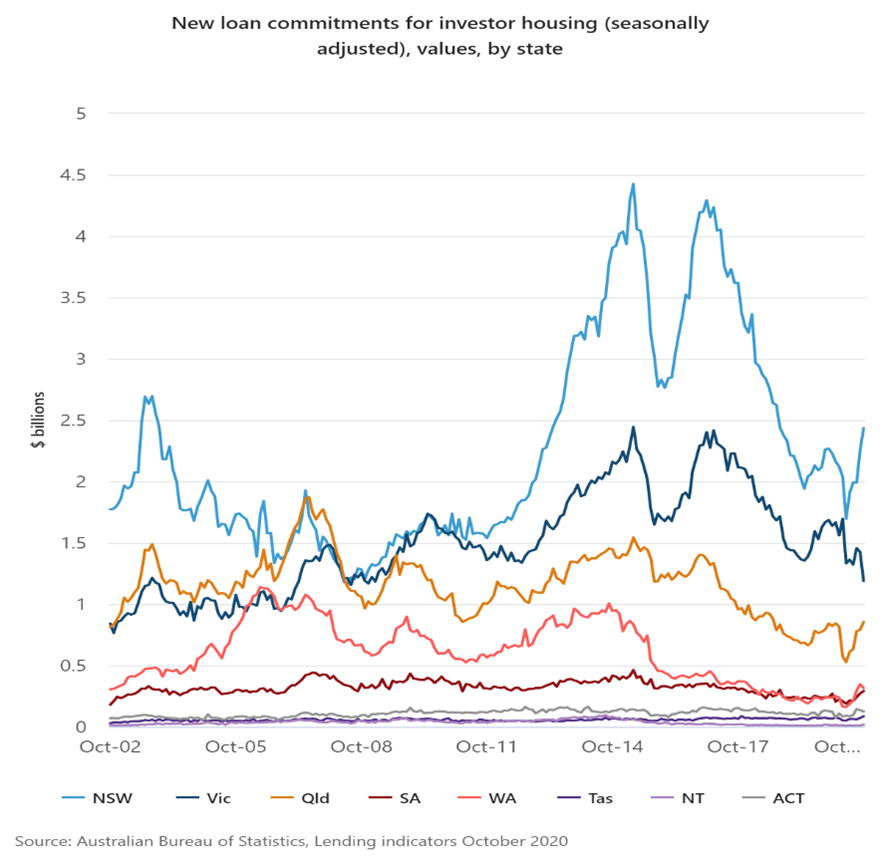

After several years of decreasing investor appetite, the October 2020 ABS statistics show a significant uptick in investor loan commitments in all states except Victoria (see chart below). Whilst it is clear many believe now is the right time to be investing in property, a common question is asked is whether units/townhouses or free-standing houses provide the best investment opportunities. You will not be surprised to learn that there is no definitive answer so below we consider the advantages and disadvantages of each.

Units and townhouses

Advantages:

- Units prices are generally more affordable than those of houses in the same area. This also means that the deposit needed to enter the market is also lower.

- The lower cost of units allows property investors greater means to diversify their portfolio across different markets.

- Historically units offer greater rental yield over the long term, so they suit investors with a yield focus. They tend to be more attractive for tenants in urban areas, due to demographic trends and preference towards high-density urban accommodation.

- Units and townhouses suit investors who wish to take a hands-off approach to the maintenance of their property as most of the upkeep is taken care of by strata management.

- Units often contain more fixtures and fittings than a house. This generally allows the owner to claim against a greater number of depreciable items in the unit (e.g. carpets, light fittings and dishwashers). Additionally, owners of units may be able to claim depreciation deductions for common property; that is, assets shared by all property owners in the development. Deductions will always vary, and you should seek the advice of your accountant prior to making a purchase.

Disadvantages:

- Strata fees can be a high ongoing cost depending on the level common facilities.

- Any possible renovations or changes must be approved by strata management which results in a limited ability to add capital value to the property.

- Most banks consider units in general, but more specifically those less than 50m2 (excluding balconies and carports), to be far riskier and hence it can be quite difficult to receive approval for your loan application. Banks are also more hesitant to lend against units anchored to a specific purpose, like student accommodation, as the factors that influence these are largely beyond their control.

- Historically units offer less potential for capital growth

- Units are generally suited to single or coupled tenants without children so tend to attract shorter term rental agreements.

Houses

Advantages:

- When you buy a house, you own both the land and dwelling, which both have the potential to appreciate and produce a significant capital gain when you sell. As a result, historically houses offer greater potential for capital growth.

- As you own 100% of the property, apart from council approval, you have an unlimited ability to renovate and add capital value to the property.

- Houses generally come with extra space, more bedrooms and features sought after by families. As such they tend to be longer term tenants providing a less volatile yield.

- As houses have both a land and dwelling value, banks consider these less risky and are more accommodating when applying for a loan.

- While individual situations may vary, houses, usually, tend to be more negatively geared than units mostly due to their higher financing and maintenance costs, and lower rental yields.

Disadvantages:

- House prices are generally less affordable than those of units in the same area. For property investors this can lead to a less diversified portfolio.

- Historically houses offer a lower rental yield than units.

- Upkeep and maintenance of the property is your sole responsibility and can prove to be time and cost intensive.

- Large one-off maintenance costs, for example roof replacement, can prove to be very expensive and cannot be shared amongst others.

Conclusion

Choosing between investing in a unit, townhouse or house is only one in a long list of factors to consider. Each have their advantages and the decision should be based on what strategy or objective you are striving to achieve. For example, an investor who has the time, cashflow and inclination to improve the property may be more suited to a house. A time poor investor seeking diversification and an income stream may prefer a unit or townhouse. Other factors such as demographics, supply and demand, affordability and broader economic factors should all be considered.

It’s important to remember that direct property is only one sub-asset class and there could be others that are more suited to your risk/return expectations. For this reason, we recommend you speak to a professional, like Steward Wealth, to ensure that your investments are aligned to a broader financial plan.