I was lucky enough to have just had a lengthy holiday and while I was away there were some pretty bumpy days in the global financial markets thanks largely to the UK voting to leave the European Union, now known of course as Brexit. I got back to the office yesterday and was surprised at what I found.

From the limited amount I was able to read and hear at the time of the vote it seemed the world was about to fall apart, but then I was left wondering if it wasn’t the usual media response which loves a dramatic headline much more than it does a balanced consideration of what’s actually happening. The initial uncertainty had obvious effects on stock markets, with the UK and US markets falling 6% at their worst.

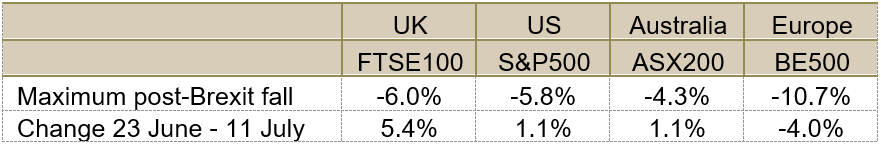

What surprised me was that by about 11:00am yesterday the financial markets had by and large returned to the pre-Brexit levels and in some cases are comfortably ahead. In fact last night the US’s main stock market index, the S&P500, hit an all-time high and the UK’s FTSE100 is at an 11 month high. The table below sets out what has happened in the past three weeks:

There are a couple of main reasons for this. First, there has been a rush into bonds as a safe haven and as bond prices get bid up so their yield falls to new record lows. The extra return required by investors to take on the extra risk of buying equities compared to the safety of bonds is called the ‘equity risk premium’ (“ERP”). If bond yields fall but the ERP stays the same then equity prices will rise.

Secondly, our old friends the central banks jumped in quickly to reassure markets they would take whatever steps they need to to make sure no wheels fall off. For example the Bank of England has promised it will inject £250bn (A$425bn) of extra liquidity into capital markets, it has lowered retail bank capital requirements which is expected to release up to £150bn of extra lending and markets are pricing in a 75% chance of them lowering interest rates by 0.25% to an all-time low of 0.25% this Thursday. Likewise the US central bank has held off on any further talk of raising interest rates. That’s a lot of extra money in the system, so perhaps it’s not surprising equity markets have gone up.

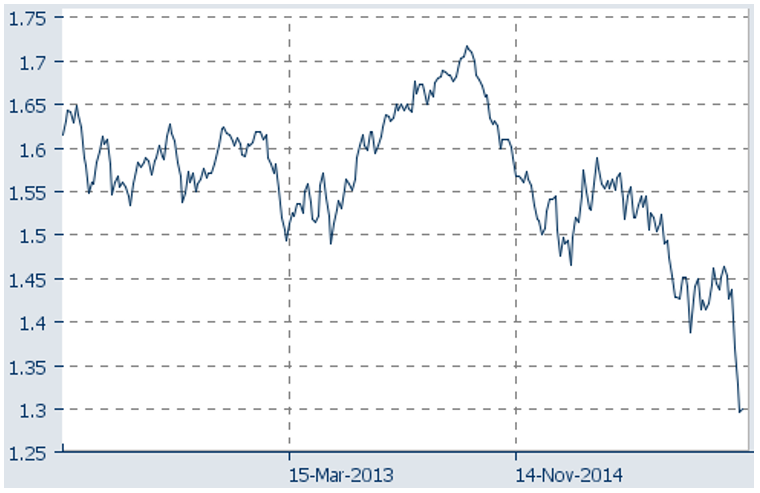

One thing of course that has been hit and stayed hit is pound sterling. It has dropped to a 30-odd year low against the US$ and appears to be staying there for now – see the chart below. That will help the UK economy by making exports cheaper.

British pound sterling vs. the US$

Source: IRESS

It will be very interesting to see if some of the dire prognostications about Brexit come true, like the UK’s GDP falling 10%, company investment coming to a standstill and 800,000 jobs to go from London’s financial sector (I can’t help but think the big investment banks and law firms have sunk an awful lot of money into setting up shop in London and will be loathe to move, plus I wonder if it’s unwise to underestimate the importance of the language connection between the US and UK).

We will revisit how things are going after 12 and 24 months to see just how good some of the media and strategists’ forecasts were.

A final observation is that this episode has underscored the difficulties of timing markets. Jumping out of markets on the back of specific events like Brexit, or choosing not to jump in because of perceived risk, brings the chance of getting it wrong both ways. It’s a far better approach to assess whether markets offer value or not and stick with a strategy.