There’s a conversation every parent can have with their kids that could be worth literally million of dollars to them.

My own kids won’t listen to me about finances and money, but for some reason their friends do. I had a good chat to my son’s best mate recently, and you could literally watch his expression change as he understood the implications of what I was saying.

Let’s call him Jack (not his real name); he wanted to get on top of his spending, which involved a conversation about actually monitoring the incomings and outgoings and keeping tabs on his bank balance. That bit’s hard because it involves a change of mindset: from instant to delayed gratification.

But the more impactful part for him was when we talked about his superannuation. I suspect Jack’s not all that different to many kids of his age (early 20’s): he wasn’t sure of his super balance and had no idea which investment option he was in. He’d filled out a form and figured the experts who run his industry superfund would know best, so he chose the default option.

That’s a choice that could end up costing a young person millions of dollars.

A quick explainer before we look at the numbers. A ‘balanced’ investment option can be 50 to 70 per cent invested in growth assets, like shares, with the balance in defensive assets, like bonds.

The idea being the higher the allocation to defensive assets, the less dramatic the potential ups and downs in returns, so a smoother ride, but with the trade-off being lower returns.

The thing is, over the long-term, growth assets, as the name implies, will always outperform defensive assets. For example, over the past 20 years Australian shares have returned 8.1 per cent per year, and international shares have returned 9.3 per cent, whereas Australian bonds have returned just 4.2 per cent.

For someone like Jack, his single biggest advantage is time. The longer you can let your investments grow, the greater the benefits of ‘compounding’, which is where you reinvest any growth in the investments, so you get growth on your growth.

For someone in their early 20’s, it makes no sense having any allocation to defensive assets in their superfund, given they’re not going to be able to get their hands on it for around 40 years.

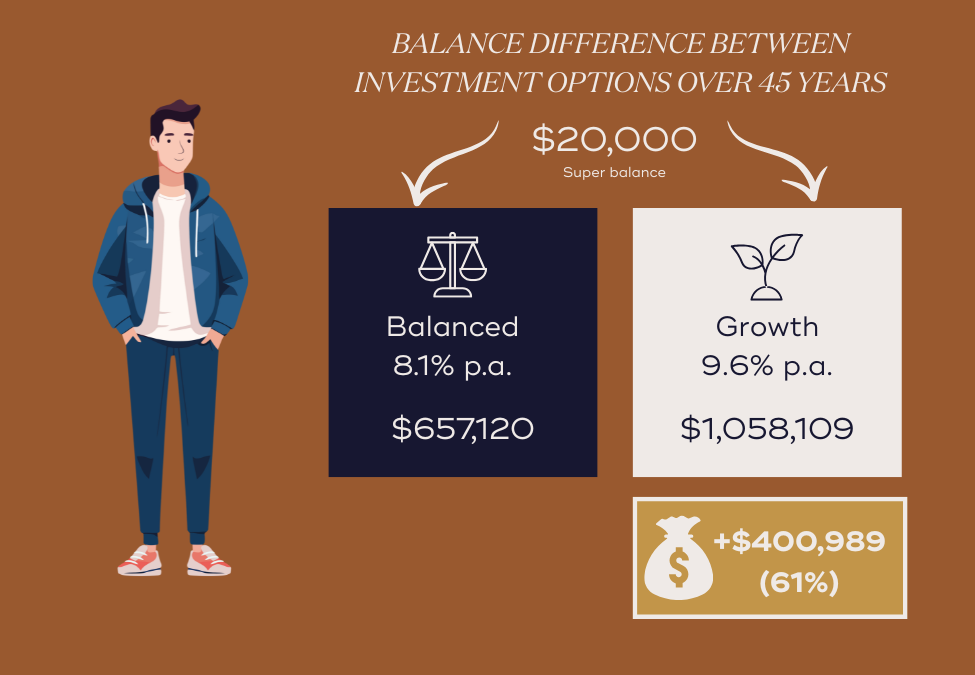

Now for the numbers. Jack’s balance was about $20,000 and at 22, he’s got another 45 years until retirement.

If we use the average industry balanced fund return over the past 10 years of about 8.1 per cent, in 45 years that $20,000 will have grown to $657,120.

If it was invested at the average 10-year growth fund return of 9.6 per cent, it will be $1,058,109. That’s a difference of more than $400,000. Or looked at in another way, an extra 1.5 per cent per year resulted in a 61 per cent higher balance.

That’s the magic of compounding.

Those numbers are based on Jack’s current super balance and doesn’t account for further contributions over his working life.

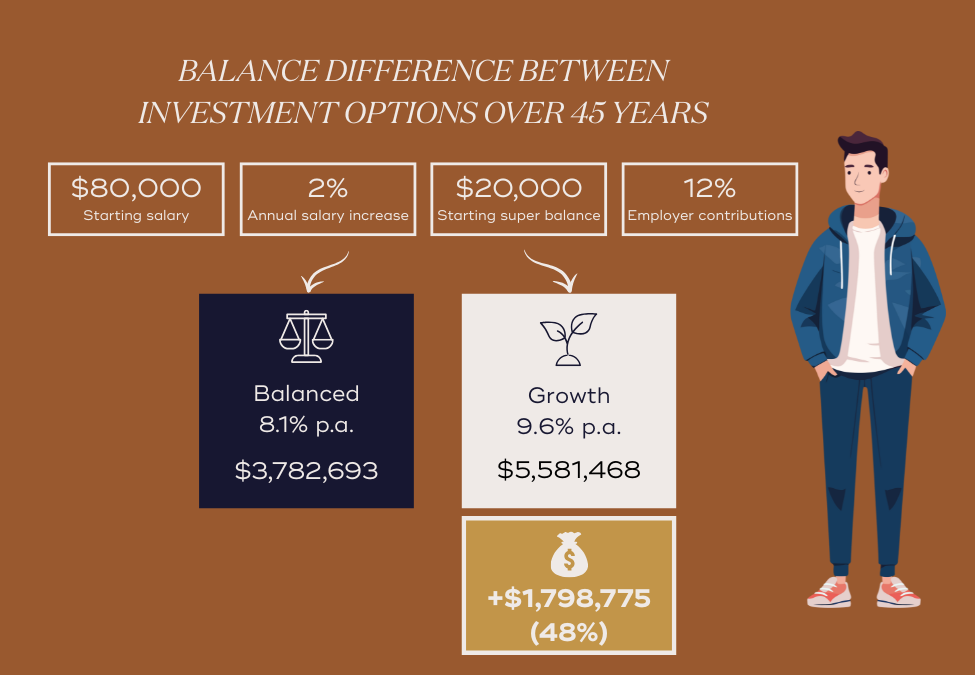

If we assume his salary starts at $80,000 and goes up by 2 per cent per year until he retires at 67, and his employer super contributions remain at 12 per cent of his salary, then under the balanced option he’d have $3.783 million in super.

Under the growth option he’d have $5.581 million. That’s almost $1.8 million, or 48 per cent more, just for ticking the right box.

Before your kids get too excited, there are endless assumptions that underlie those numbers for things like inflation and tax, let alone financial markets, and changing any one of them can result in a very different outcome.

Also, the end number is in nominal dollars, so it hasn’t been adjusted for inflation. Before they go and place the order for a boat, you need to remember that $10,000 in 1980 is today worth more than $52,000. In adjusted terms, the outcomes are $1.259 million versus $1.853 million, still a difference of about 48%.

George Bernard Shaw said that youth is wasted on the young, but by selecting the highest growth option available for their superannuation account, at least those years won’t be entirely wasted.