HOW TO REDUCE VOLATILITY IN YOUR PORTFOLIO

Market ups and downs are inevitable, but there are proven ways to reduce the impact on your portfolio. By focusing on time in the market, diversification and a disciplined investment approach, it’s possible to create a smoother investment journey without compromising on long-term outcomes.

Volatility and risk

As we noted earlier, the words volatility and risk are often used interchangeably when talking about investing. Certainly, volatility, the extent to which you might expect a portfolio to fall in the event of a share market correction, is seen as a proxy for risk. That’s why it’s common to reduce the portfolio’s weighting to shares to reduce ‘risk’.

But there’s also the risk of running out of money, and we’ve seen that shares have historically delivered the highest returns.

This is where working out each investor’s risk profile becomes a balancing act.

Play the long game

The longer your investment horizon, the less consequential is short-term volatility.

The next chart shows that from year to year, the rolling 12 month return for Australian shares jumps around enormously, but the variability of the rolling 10-year returns is much, much lower.

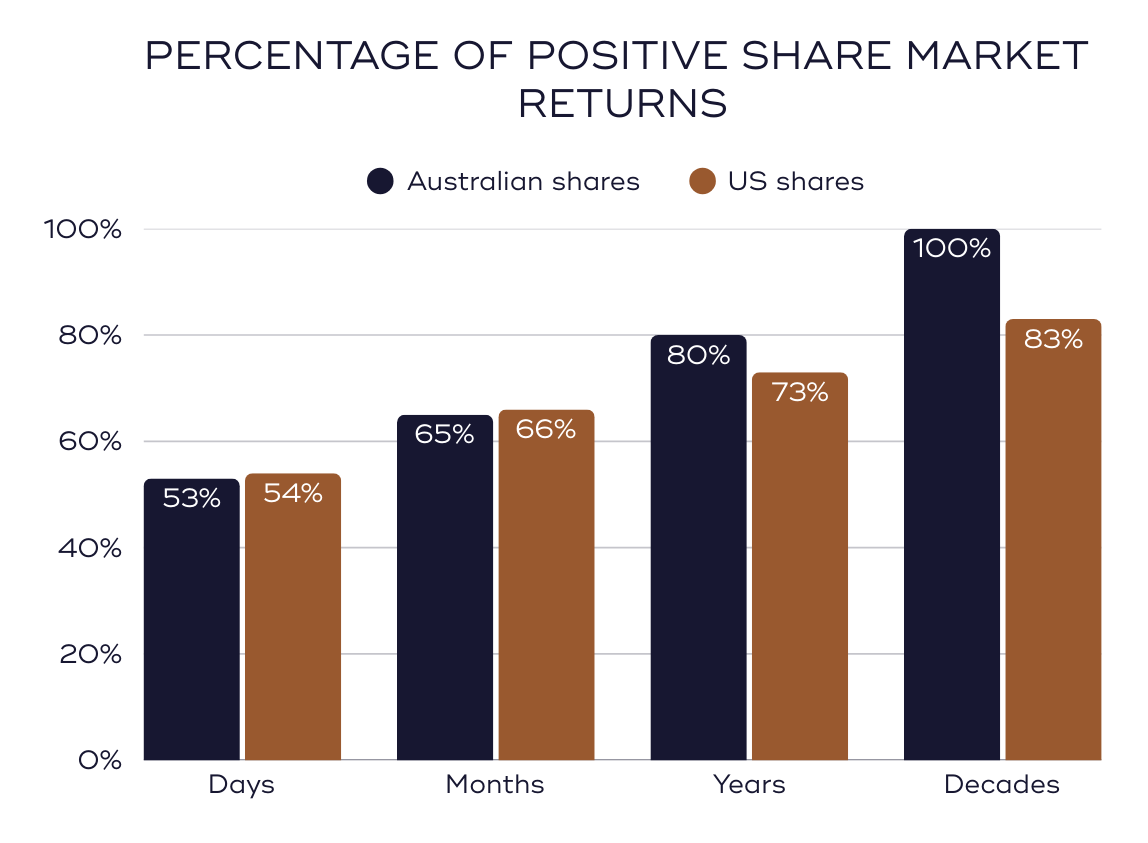

The reason for that decline in volatility over time becomes evident when you consider that on a day-to-day basis, the market goes up just over half the time, on a monthly basis it’s about two-thirds of the time, yearly it’s about three-quarters and over 10 years it’s near certain.

Diversification is the only free lunch in investing

diversify, diversify, diversify

It’s a simple fact that the more concentrated a portfolio is, that is, the higher the amount invested in a single asset, the riskier it is, because if that dominant asset falls in value, it will have a significant effect on the whole portfolio.

Of course, the opposite is true as well, if the dominant asset does really well, happy days.

Diversifying a portfolio can take many shapes. In a diversified multi-asset portfolio, you would normally have a blend of growth assets (shares, property, etc) and defensive assets (fixed income) spread across multiple different investments and a range of asset classes.

The higher the allocation to growth assets in a portfolio, the higher the level of volatility you would expect from it.

Owning multiple investments is easily done by either selecting a group of different shares, or owning a managed fund (which is where you pay a professional portfolio manager to choose the investments), or buying an Exchange Traded Fund (popularly referred to as an ETF), which can cover a sector, a style of investing, a country, right up to the whole world, in a single instrument.

“Asset classes” refers to the different areas you can invest. We divide portfolios into eight asset classes:

Australian equities

Show More

Listed securities that trade on the Australian stock exchange.

Developed markets equities

Show More

This includes the US, Europe and Japan.

Emerging markets equities

Show More

China, southeast Asia, South America and parts of Eastern Europe and Africa.

Real assets

Show More

Property and infrastructure.

Alternative assets

Show More

A grab bag of things that don’t normally trade on public markets and whose returns are not typically correlated to share markets, like private equity.

High yield debt

Show More

Private credit and high yielding bond funds.

Credit

Show More

More liquid investments that are not necessarily chasing a high yield.

Cash

One of the reasons you diversify across the various asset classes is because it’s impossible to know which one/s will be the best performing from year to year. This point is illustrated by the colourful tables below.

Each table is broken into eight slightly different asset classes (there are no alternative assets). The first lists the different asset classes, each with its own colour, with their annual returns over the 20 years to 2023. The second ranks the annual returns for each separate year, from highest to lowest.

“Diversified portfolio”: 15% Australian shares, 20% international shares, 25% US shares, 5% Australian property, 5% international property, 13% Australian bonds, 12% international bonds, 5% cash

When you look at the jumble of colours in the second table, you’ll note there is no pattern to the returns, it’s what’s called a random walk. An asset class can be best in show one year and at the bottom the next.

Because it can be extremely difficult to forecast which asset class will be the best performer from one year to the next, a way of hedging your bets, and reducing volatility, is to allocate some weighting across all of them.

The white “diversified portfolio” squares represent a portfolio that is allocated 70% to growth assets. As you can see, it’s never at the top of the pops, but nor is it ever at the bottom.

Diversifying the portfolio is a way of reducing volatility for a smoother ride.

What else helps?

Investment Committee Oversight

Steward Wealth’s investment committee, which includes an external, independent member, meets quarterly to analyse market and macroeconomic developments that might influence how we allocate across the various asset classes.

To help inform our thinking, we use two external asset allocation consultants.

We also hold an investment meeting every two weeks to discuss the best way to get exposure to those asset classes.

External Research Partners

We subscribe to two research houses and have more than 150 meetings with fund managers and product providers each year.

Turning Down the Noise

There is no end of financial markets media vying for your attention: podcasts, newspapers, dedicated 24/7 TV channels, websites, blogs, journals, broker research. And the old saying applies: for most people no news is good news but for the media good news is no news. They know their audience is hard wired to be more inclined to read an article about “why the next crash is coming” than “hey relax, there’s nothing going on”.

They also play to their audience’s basic human foible of craving certainty: we want to know why things happen. So the guy on the CommSec evening report will try to sound like he knows the exact reason why the market went up by 0.4% today, because the truth – “there was no specific reason for today’s move” – wouldn’t sound too catchy.

A psychologist called Philip Tetlock has done some interesting work on the science of forecasts. He found that experts who are honest enough to acknowledge the future is inherently unknowable are perceived as ‘less trustworthy’, but the media wants to sound authoritative to appease our craving for certainty, so they tend to favour those commentators who are most confident and adamant in their views – those who are the loudest, so to speak. However, Tetlock found it’s those unequivocal ‘experts’ who tend to perform poorly, and those with the highest media profiles have some of the worst track records.

In the US there’s a thriving industry of stock picking gurus. They profess all kinds of methods and strategies and, of course, promise all kinds of returns. Between 2005 to 2012 a group called CXO assessed 6,582 forecasts for the US stock market published by 68 different gurus. The result: a success rate of 47.4% – you get better odds from a coin toss!

The lesson is, you’re best off ignoring the noise, or at least treating media calls with a healthy dose of scepticism.

Thinking about your risk profile?

Understanding your comfort with risk is key to building the right portfolio. Revisit the key factors or Learn about volatility, global diversification, and how we build portfolios that balance risk and return.

What Happens After We Understand Your Risk Profile?

Once we understand your risk profile, we can shape a portfolio that aligns with your goals and comfort level. Learn how we combine asset allocation and active oversight to build your investment strategy.