Corporate profit margins in the U.S. are close to multi decade highs, which stock markets love, but arguably it’s workers that have paid the price. When you join some apparently disparate dots, the model looks unsustainable and leaves you thinking is it any wonder we are seeing the political backlash?

Legendary market observer Jeremy Grantham has built a model that uses published economic indicators to explain where the US share market is trading. So it’s not making forecasts, rather he tried to analyse what indicators are most persuasive for the market at any point of time, and he got it to a remarkable 90% accuracy. The two most overwhelmingly influential metrics are prevailing inflation and corporate profit margins: the higher the margins, the higher the market.

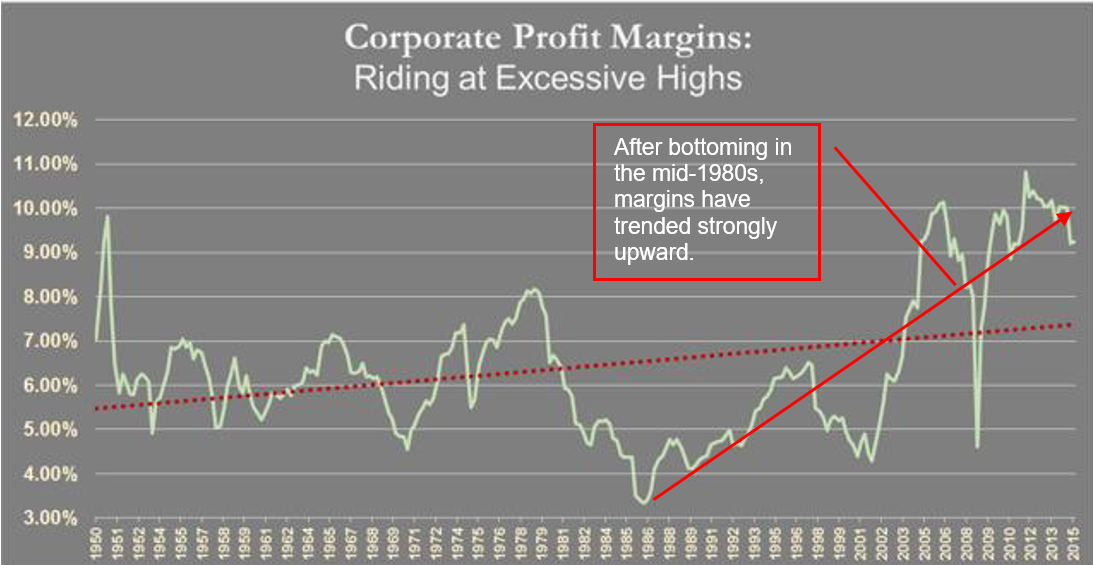

Corporate margins have been trending slowly upwards for the past 60 years, but after bottoming in 1985 the rate of increase picked up sharply and they’ve been near record highs for much of the last 10 years – see the chart below. Together with the very low global inflation rate Grantham’s model suggests they largely account for the record US stock market.

So what has driven margins higher? There are various contributors, technology being an important one, plus an interesting infographic from the Wall Street Journal looking at changes in the U.S. workplace over the last 30 to 40 years also adds some perspective:

- In 1973 6% of workers complained of long hours, by 2016 26% said they worked more than 48 hours per week.

- In 1973 6% of workers said they found it difficult to complete work in the allotted time; by 2016 50% said they occasionally had to work in their spare time and 66% said they had to work at high speed more than half the time to meet deadlines.

- In 1980 97% of workers at medium and large companies had free health care coverage, by 2016 it was 61% and only 3% got it for free.

And according to the Economic Policy Institute, in return for doing all that extra work, from the 1970s to 2016 the average worker’s inflation-adjusted wages rose by a total of 10.9%, or about 0.15% per annum, meanwhile CEO compensation increased by 997% over the same period.

Is it any wonder then that we’re seeing this reflected in a political backlash where voters are using the best modern means at their disposal to change the status quo? From the election of Trump in the US (and the popularity of an avowed socialist, Bernie Sanders, in the preliminaries), to Brexit, to the Liberal government calling an Australian election thinking they had it in the bag and scraping in with a one seat majority, to the Conservative UK government doing the same and losing their majority, and so on.

There is undeniable political pressure for things to change, one of those may be US corporate profit margins.