There’s an old saying that the stock market goes up by the stairs and down by the elevator, except this time it’s been more like jumping out the window. The ASX 200’s gut-wrenching 30% plunge from its late February peak was clocked up in a brutally quick 17 trading days and has left punch drunk investors wondering if things will ever get better and occasionally even wondering if they can continue to bear the pain. Let me assure you, things will get better, regrettably, however, nobody knows when.

Every investor needs to have a plan, or a strategy, that reflects their ability, willingness and need to take on risk. If share markets didn’t face the risk of falling, they would not offer long-term returns above cash. While bear markets will always test an investor’s resolve, hopefully some historical context will be helpful, not just in terms of how bad it can feel at the time, but the inevitability of recovery afterwards.

Notably, this hasn’t been the sharpest selloff we’ve ever had in Australia, that ignominious title goes to 1987, a near five month correction that saw the All Ordinaries almost halve and included Black Monday (which was actually a Tuesday when the tsunami of selling hit Australia) where shares dropped 26% in a single day.

Then there was the GFC, where the All Ordinaries fell 55% over an excruciating 14 months from its peak in November 2007 to its final bottom in early March of 2009.

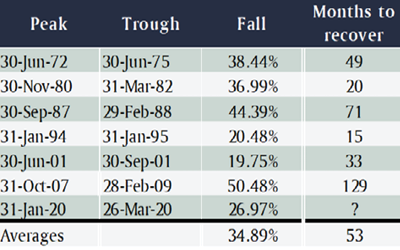

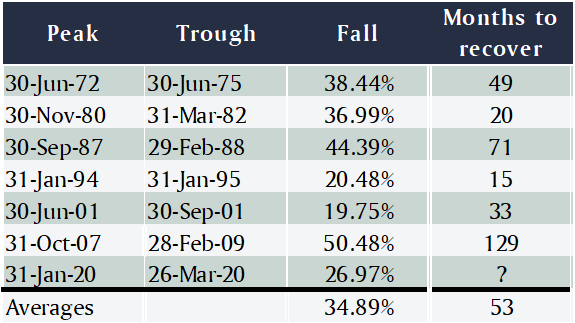

All up, if you use the rule of thumb that a bear market is a fall of at least 20%, over the past 60 years Australian shares have experienced seven of them, including the current one. The average time it took to recover the losses was 53 months, though it’s varied between 15 in the mid-1990s to more than 10 years after the GFC (the length of the recovery period is highly influenced by how overvalued the market was going into the selloff). That means the average return over the recovery period has been better than 10% per annum, or almost 13% if you exclude the GFC as an outlier.

Again, for some context, in the US there have been 12 bear markets since 1965 with an average fall of 31%, and an average recovery period of 21 months (less than half Australia’s). That means once the bear market is finished the average returns over the recovery period have been more than 23% per annum.

The question everyone’s asking is when will the current correction stop, and the honest, but entirely frustrating, answer is nobody knows. The analysts at Heuristic Investment Systems have looked at the history of US share market corrections and concluded that mid-sized recessions have typically resulted in the market falling 25-30%, which is where we are now. Deeper recessions, like the GFC tend to see falls of 40-50%, so arguably the market’s pricing in a 60% chance of a deep recession.

Looked at another way, company earnings typically fall 15% in an average recession and the ‘forward price to earnings multiple’, that is the PE ratio the market trades on based on forecast earnings for the year ahead, can go down between two and seven points. From where the US market was immediately prior to this correction starting, a 15% cut in earnings and the PE dropping to 15 would take the S&P 500 to 2,250.

An alternative way to assess how share valuations stack up is the ‘equity risk premium’ (ERP), which measures the extra return shares are offering compared to a risk-free investment in bonds. Even after accounting for expected cuts in earnings forecasts, for the ERP to be as high as it was during the GFC and the European debt crisis would imply 2,600 on the S&P 500.

What those estimates tell you is the share market is already pricing in a serious economic slowdown. Even though there are some commentators arguing this slowdown could be worse than the GFC, we’ve had 10 years of slow but steady growth in between, so don’t expect the index to retreat all the way back to the same level. Plus, central banks and governments, having learned from the GFC, are coordinating their efforts to throw the kitchen sink at supporting economies.

For those that have not sold their shareholdings, there is arguably a lot of value in shares at current levels and to sell now would simply lock in a loss, and for those lucky enough to be holding cash, you have the kind of opportunity that comes along maybe once a decade to build a great, rest-of-your-life portfolio.

If you’re wondering when to invest, don’t for a minute think you’ll be able to pick the bottom, the odds on that are about the same as winning the lottery. And remember, the market will start to turn when the odds of recovery are 50.1%, as opposed to 49.9%, so if you wait for certainty, the market will have taken off well ahead of that point. You should also bear in mind, you don’t have to be all in or all out so you can hedge your bets: if you think there’s a 30% chance the market has bottomed, then you can invest 30% of your resources.