The post-GFC economic environment has been characterized by low inflation. Despite so-called money printing (quantitative easing) and record low interest rates, the general price level has stubbornly refused to run away on us, leaving central banks instead expressing more concern over the past few years about the risks of deflation.

Inflation is critically important for investors and financial markets: for those on a fixed income, rising prices means your standard of living declines; and inflation is like kryptonite for bond markets, forcing yields to rise, which in turn affects how all assets are valued. So when the annualised inflation rate around the world rose dramatically over the past nine months it rightly captured lots of attention (the US went from 0.8% to 2.7%, the Euro Area went from 0.2% to 2% and Australia went from 1% to 2.1%).

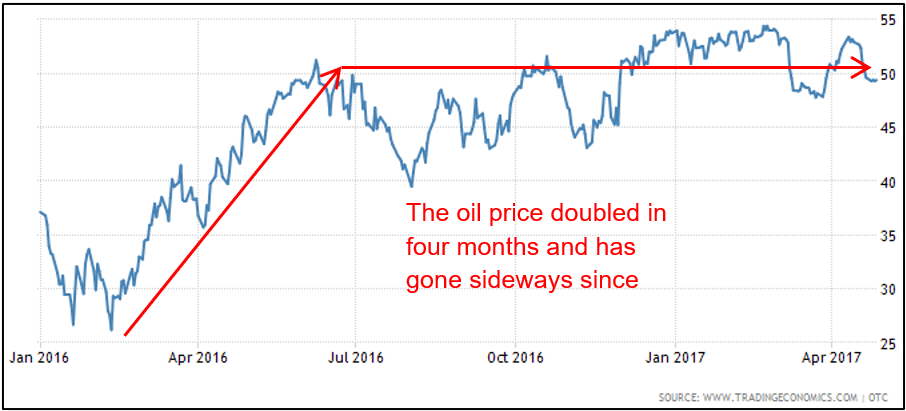

But there were pressures over the past year from rising commodity prices that are now starting to fall out of the system. The biggest of those is oil, where prices doubled between February and June last year, but have been flat since – see the chart below.

Crude oil prices over the past 12 months

It’s a similar story across many of the commodity markets. That means in a couple of months, if commodity prices are still trending sideways, the inflationary effect of those dramatic year on year price rises will fall away.

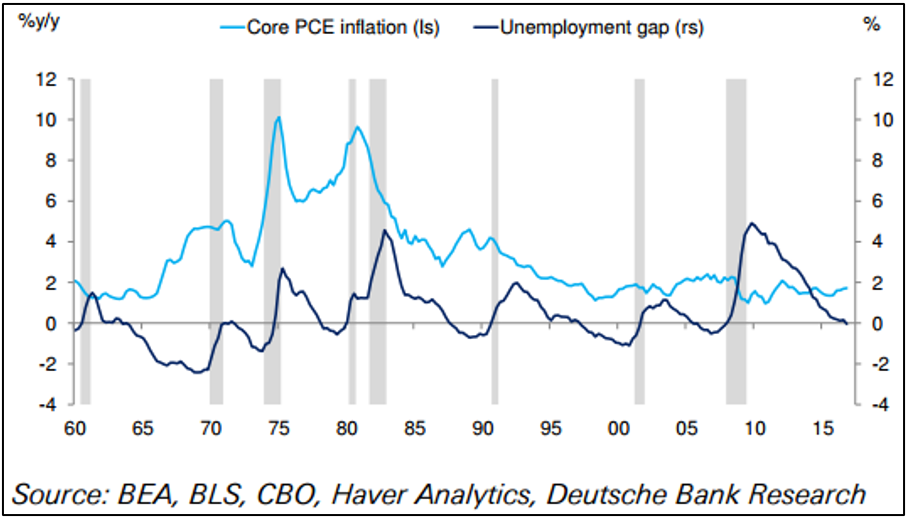

However, it needs to be borne in mind there are many different components to the inflation data, commodities being just one of them. No fewer than four PhD’s at Deutsche Bank penned a joint article this week arguing that inflation is on its way back in the US and Europe. The main reason they point to is the very low unemployment rate in the US which is likely to lead to increasing wage growth. This is reflected in the chart below, which compares the “Non-Accelerating Inflation Rate of Unemployment” (NAIRU – a fancy word for full employment and a bit of a favourite amongst economists and central banks) to core inflation (which usually excludes the more volatile prices like energy and food).

In the past when unemployment got very low, wages went up and took inflation with it

The simple premise is that as unemployment gets lower, wages tend to go up and takes inflation with it. That makes intuitive sense, and I’m reluctant to argue against that kind of collective intellectual fire power, but one thing I’d point out is that the ingredients in the economic pot are very different now compared with the 1960s and 1970s.

The Australian March quarter inflation data, which was released yesterday and came in at 0.5%, lifted the annual rate to 2.1%, just scraping in to the Reserve Bank’s targeted range of 2-3%. While a 5.7% rise in petrol prices was the main driver, a 13% jump in vegetable prices helped a lot too.

Again, it’s possible things like Cyclone Debbie will affect fruit and vegetable prices in the next quarter and keep the overall CPI elevated, or wages growth might suddenly turn a corner, but at the moment the trend is sideways at best, which probably means the Reserve Bank is under that much less pressure to change interest rates.