Sylvia Bloom was a legal secretary in New York who died last month at the age of 96 and left behind a fortune of A$12 million. She’d worked for the same law firm for 67 years and quietly bought shares in companies she overheard her bosses were buying. Her big secret: she never fell victim to the “behaviour gap”.

An instinct to follow the herd has been very handy for human survival over generations, it basically helps prevent us being eaten. However, it’s also why most humans are hard-wired to be poor investors: we get swept up in excitement or panic and end up buying high and selling low. Not surprisingly, studies have shown if you’ve done the research, once you’ve settled on an investment strategy you’re better off sticking to it.

A few weeks ago I wrote a post about Peter Lynch, one of the best fund managers ever, and his investing principles. But Lynch’s employer, Fidelity, calculated that although his Magellan fund returned an astonishing 29% per annum over the 13 years he managed it through to 1990, the average investor in the fund actually lost money! How? Buy buying in when returns had been great and selling when they weren’t.

Likewise, legendary US hedge fund manager, Joel Greenblatt, whose Gotham Capital returned an incredible 40% per annum between 1985-2006, calculated over the period 2000-2010 the best mutual fund delivered 18% per annum, but on a dollar-weighted basis the average investor in the fund lost 11% per annum over the same time. Again, the money poured in when the market was up and disappeared when it fell.

Greenblatt went on to examine the best institutional managers over that 10-year period and found that at some point 97% of the best funds spent at least three of those 10 years in the bottom half of performers; 79% spent at least three out of the 10 years in the bottom quarter, and half spent at least three years in bottom 10%! When the market’s going up and you’re staring at an investment in the bottom 10% it takes real fortitude not to pull the trigger and jump out.

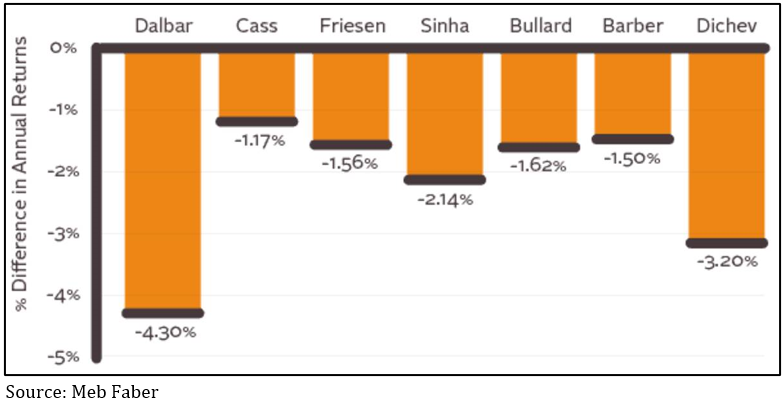

There have been a number of studies looking at “the behaviour gap”, which measures the loss the average investor incurs as a result of emotional responses to market conditions compared to sticking with a strategy – see chart 1. Obviously minus 1.17% to minus 4.3% is a big range, which leaves you wondering how they could come up with such varying results, but the message is consistent: allowing yourself to be captured by the herd mentality can cost you a lot of money. For example, if you start your investment strategy with $100,000 and you could get 7% for 20 years you’d end up with $387,000, reducing that by the median ‘behaviour gap’ you’d end up with a 4.3% per annum return and finish with $231,000!

Chart 1: The seven studies below looked at “the behaviour gap”, to assess the annualised reduction in returns the average investor incurs due to emotional responses to market conditions

There will, of course, be times when it is perfectly justified to sell an investment. We’ve sold out of funds when the manager hasn’t stuck to the original model (something called style drift), or we’ve come across a different manager that we believe quite simply does a better job. But our underlying objective is always to find the best manager for a particular asset class and stick with them. Over the long run it works better that way.