There’s an old saying that share markets climb a wall of worries. In other words, every time the share market is trending upwards, there’s a multitude of arguments as to why it shouldn’t be.

Right now is one of those times. As if simultaneous wars in Europe and the Middle East aren’t enough to give markets pause for thought, there’s a trade war started by the Trump administration that must be throwing fistfuls of sand in the markets’ gears, and President Trump is so mercurial that we don’t know from day to day what direction the world’s biggest economy is going to head in.

It all adds up to bucketloads of uncertainty. And yet share markets across the world are trading at or close to all-time highs. How can that be?

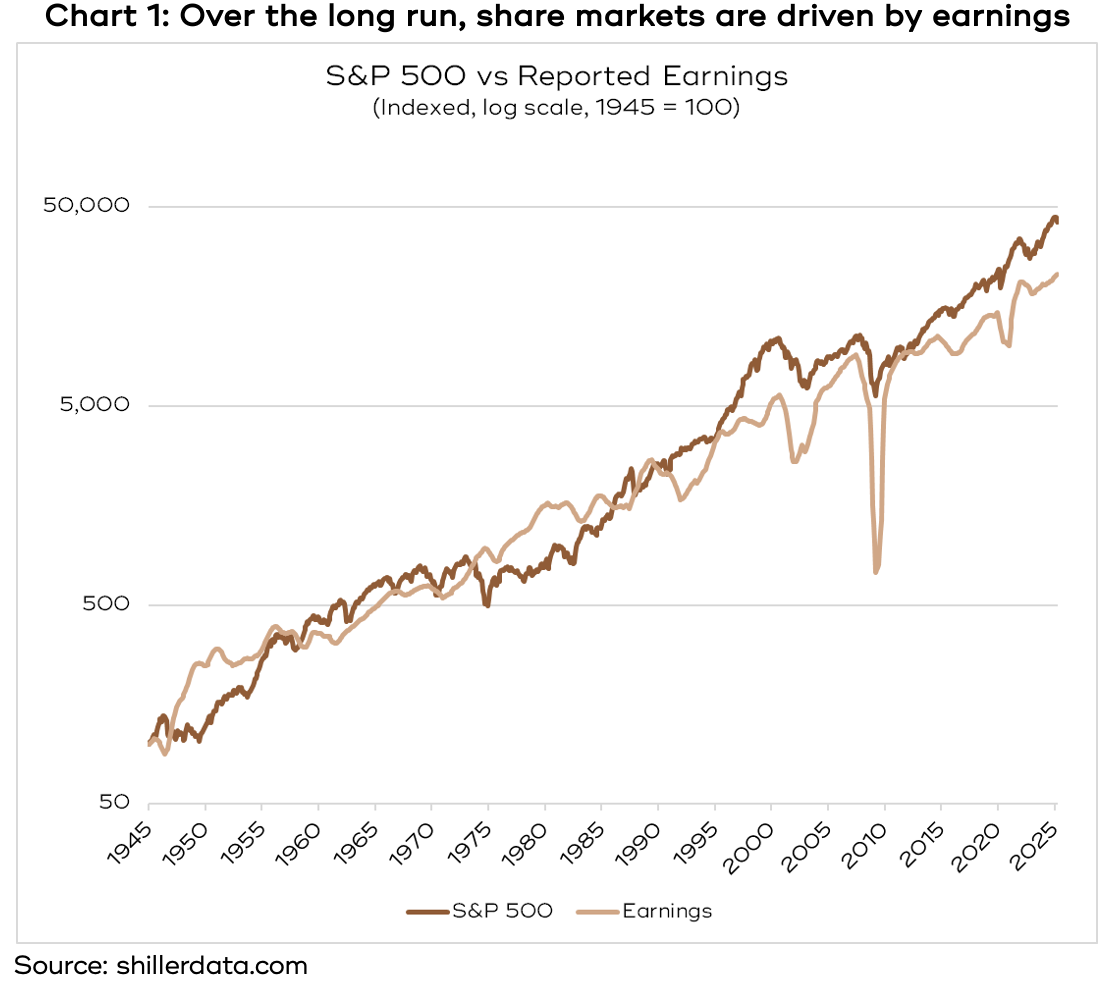

It’s very easy to be distracted by geopolitical events and assume that they must be impacting market psychology. But for ages now we’ve been banging on about how over the long-term, share markets are driven by earnings, which is nicely illustrated by chart 1.

As a general rule, if earnings are growing, the markets are happy, and after the quarterly earnings reporting season the US just had, they should be jubilant.

Going into the reporting season, earnings growth was projected to be about 3 per cent, but it ended up coming in at more than 11 per cent, which was the third consecutive quarter of double-digit earnings growth. What’s more, 82 per cent of companies delivered a positive earnings surprise, compared to the long-term average of around 70 per cent. As a result, analysts have revised their earnings forecasts for the next couple of years sharply upwards.

In fact, a Citigroup index that tracks the number of US earnings per share estimate upgrades versus downgrades is at its highest since the heady days of the post-COVID fiscal injection boom of December 2021. For the next 12 months, the consensus forecast for US earnings growth is a very impressive 12 per cent, then 11 per cent for the year after that.

When the momentum of earnings upgrades is so positive, it’s hardly surprising share markets are going to respond enthusiastically.

So why are earnings going up when it’s so easy to find reasons why they should be going down?

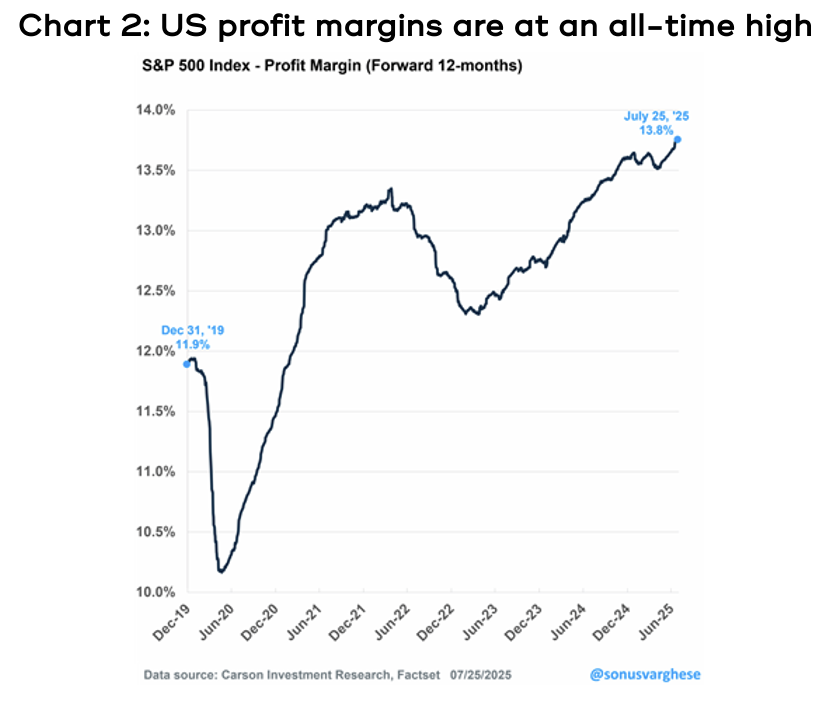

A critical part of the reason reported earnings are so strong is because US companies are enjoying record high profit margins. At the end of 2022, before the onset of COVID, the profit margin for the S&P 500 index was 12.3 per cent, and by the end of July this year, it was 13.8 per cent – see chart 2.

But as we’ve become accustomed to, it’s the tech companies that are enjoying the lion’s share of the spoils, with margins in excess of 18 per cent.

Those colossal companies, the likes of Nvidia, Broadcom, Apple, Google, Microsoft and Amazon are able to exercise such extraordinary pricing power that, right now, the market finds it difficult to see what will stop them.

But even smaller companies are using the cover of rising inflation expectations, thanks to the Trump administration’s tariffs, to increase prices. The evidence for that was in the recent Producer Price Index data, which was such an extraordinarily high number that it was eight standard deviations above the consensus forecast, meaning it should happen once every 6.2 billion years!

The biggest contributor to that surprise number was services, and the biggest contributor to the services increase was profit margins (referred to as trade services in the data).

On top of the strong earnings forecasts, the macro tailwinds in the US are also supportive, with the fiscal injection from Trump’s One Big Beautiful Bill and the prospects of interest rate cuts, plus you can throw in the hundreds of billions being spent on AI that acts as a stimulus as well.

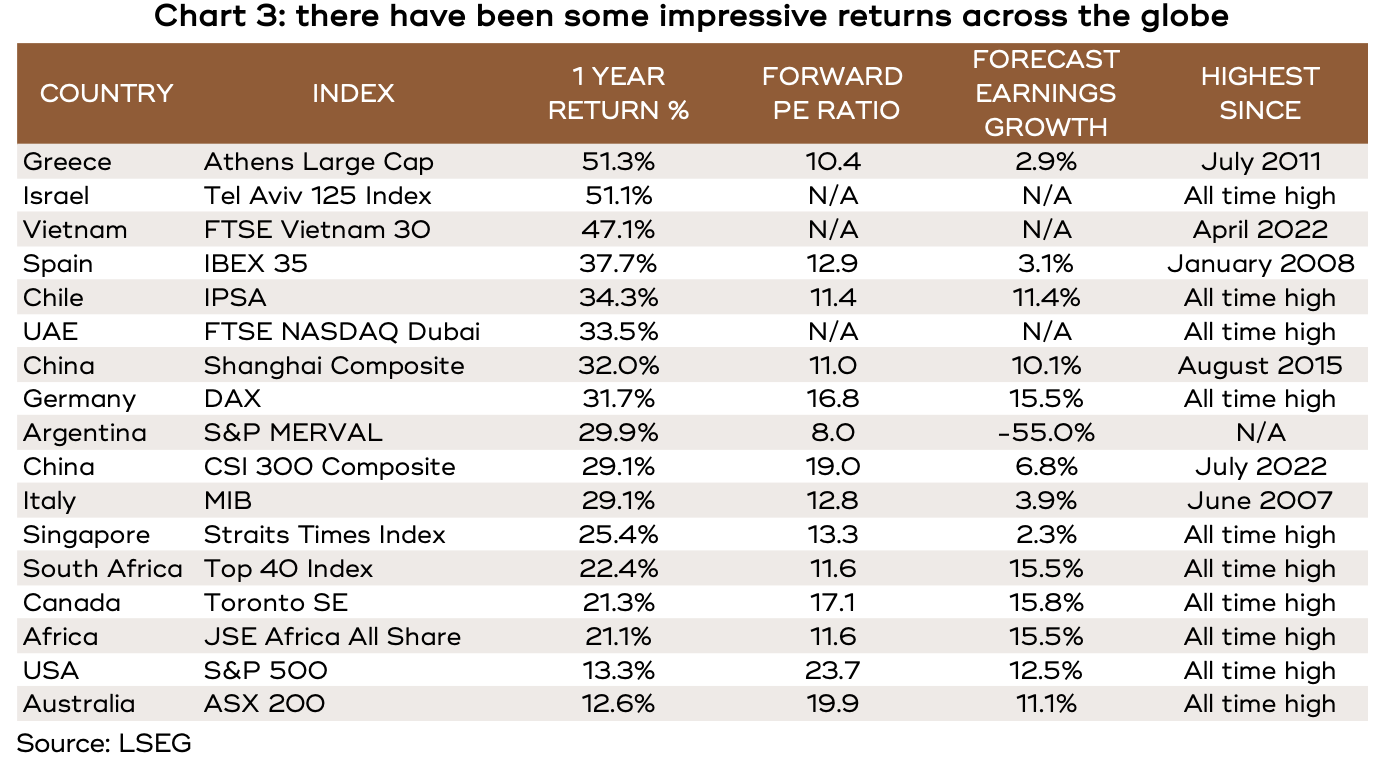

It’s easy to focus on the US market, since it’s the proverbial 600-pound gorilla when it comes to global markets, however, chart 3 shows there is genuine global momentum behind the current bull market. It lists a selection of markets from around the world that have returned more than 20 per cent over the 12 months to the middle of August (as well as the US and Australia by way of reference), and where each market sits against previous peaks.

From Europe, to Africa, to South America, and Asia, there is a wave of momentum delivering some impressive returns right around the world, and it’s notable that all but one of the markets listed above are at either all-time highs, or multi-year highs.

The lesson for investors is that your instincts might be telling you that geopolitics is making the investment landscape look pretty miserable, but as far as markets are concerned, the only time to get worried is when earnings are under genuine threat.

That’s not to say it’s time to be complacent either, some of those worries are worth worrying about. For the time being though, enjoy the ride.