Refinancing, when does it make sense?

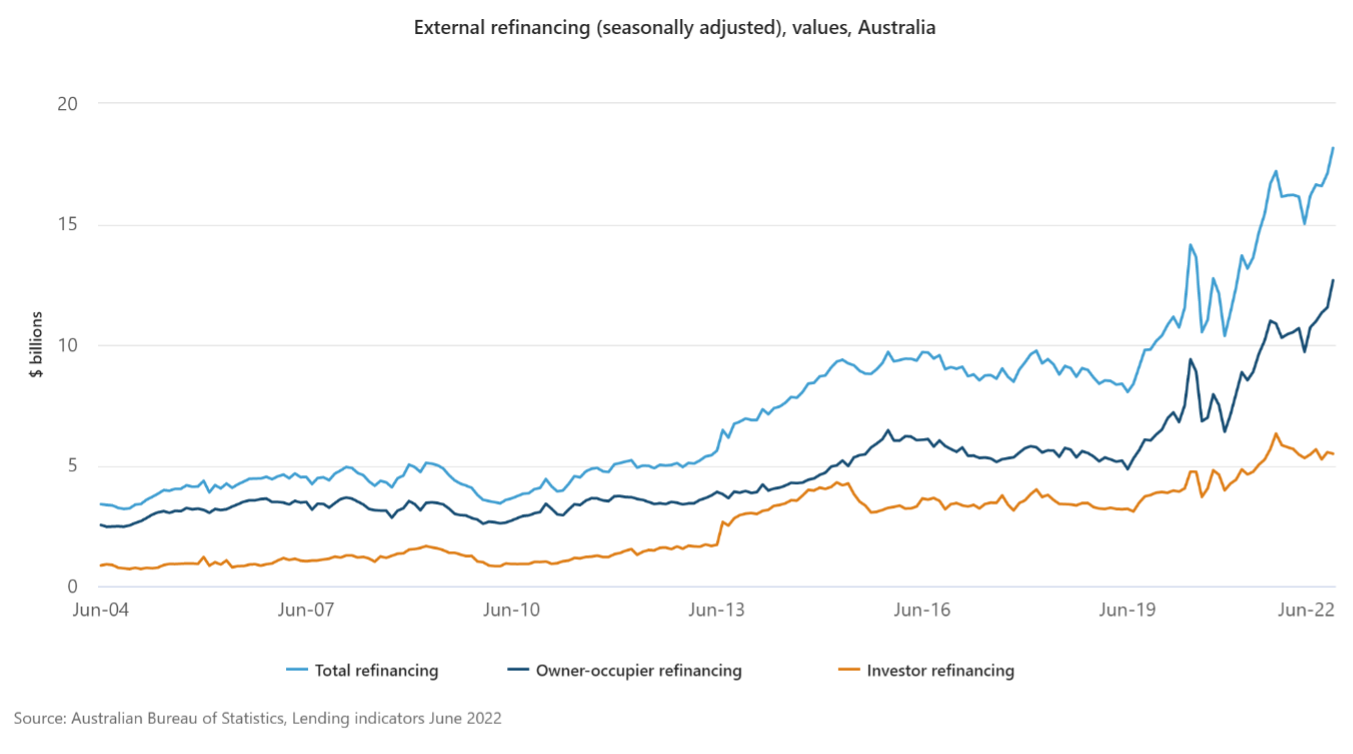

In June 2022, in seasonally adjusted terms, the value of lender to lender refinancing for owner-occupier housing rose 9.7% to a new record high of $12.7 billion. It was 24.6% higher compared to the year before. With rising variable rates and the maturity of historically low fixed rates being meaningful contributors to household affordability, more Australians are assessing their current loan to ensure they are not paying more than they need to. So, what do you need to consider before refinancing your own loan?

The benefits of refinancing

1. Getting a better interest rate

The first task before refinancing is to contact your current lender and request the best rate they can offer. Most lenders have a ‘retention rate’ aimed at keeping your business but is generally not as competitive as rates designed to attract new borrowers. From there, you can accurately compare the rates on offer elsewhere and it may well be that your current lender is still the best place for you.

It’s important to note that the rates widely advertised are generally available to a limited niche of borrower types and may not necessarily be applicable to your personal circumstances and objectives. A good mortgage broker will be able to help find the most appropriate loan and rate.

2. Reducing your minimum monthly repayments

Borrowers often solely associate a reduced rate with reducing their monthly repayments yet in many cases extending the term of the loan, usually back to 30 years, contributes to most of the reduction. It is important to recognize that the loan will therefore take longer to pay down without making extra payments in addition to the minimum. Alternatively, you can choose a shorter loan term if you feel you are comfortably able to afford the extra repayments.

3. Consolidating your debt

Often, for example, credit card, automotive finance or ATO debt is charged at a much higher interest rate than that of your home loan. Refinancing provides an opportunity to consolidate this debt into one cost-effective monthly repayment.

4. Accessing the equity in your property

If you have available equity and can service the additional repayments, refinancing can provide an opportune time to borrow additional funds for non-structural home renovations, to go on a holiday or even provide the deposit to purchase a new investment property.

5. Other circumstantial benefits

This can include benefits such as removing a guarantor or changing lenders after fixing past credit issues.

The cost of refinancing

Refinancing follows a similar application process to that of a new home loan so therefore will require an investment of time and effort. You must provide the lender, or your mortgage broker, with a number of supporting documents to enable the assessment of your application. Once approved, you are required to discharge your current mortgage and update items such as your building insurance policy to reflect the new lender’s details. Lastly, you will need to set up and familiarise yourself with a new online access and update any existing direct debits. A good mortgage broker can help you with the specifics and timing of these administrative tasks.

The benefits of a reduced rate can often be absorbed by the costs of refinancing. These fees may include, but are not limited to the following:

- Loan application fee: Charge for applying with a new lender.

- Settlement fee: The new lender may charge a fee to cover the legal costs of issuing your new mortgage.

- Discharge fee: A discharge fee of around $150 to $400 is usually charged by the current lender in order to release you from the mortgage.

- Break costs: This may be applicable if you are on a fixed rate and wish to refinance before the term expires. The fee is calculated based on the set borrowing costs of the lender as well as factors such as time to maturity. It’s important to gain a break cost estimate before deciding to refinance.

- Government fees to register and transfer the property: The applicable state’s Land Titles Office will charge a fee to update the registration of your mortgage on the property title record.

- Ongoing fees depending on the lender, and loan, you choose: These charges could include monthly account keeping fees, annual package fees or even fees for accessing your additional repayments.

-

- Lenders Mortgage Insurance (LMI): A one-off fee only applies if you borrow more than 80% of the value of your property.

Is it worth it?

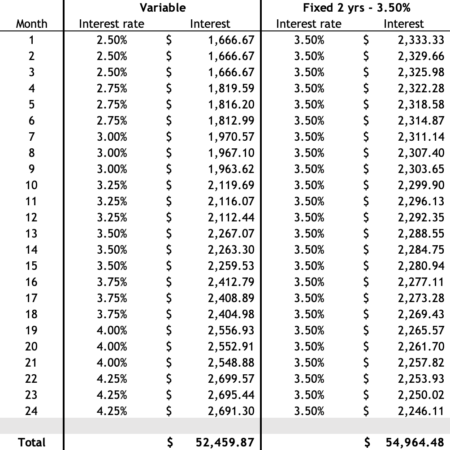

The ultimate decision on whether to refinance clearly comes down to your personal circumstances. If you are refinancing for a better rate it’s imperative to consider the potential interest saved in relation to the cost of refinancing. This is largely influenced by the reduction in rate and the size of your loan. Let’s consider an example in the following table:

| Loan balance | Reduction | Maximum interest saved per annum | Cost of refinancing |

| $150,000 | 0.3% p.a. | $150,000 * 0.3% = $450 | $1,000 |

| $1,000,000 | 0.3% p.a. | $1,000,000 * 0.3% = $3,000 | $1,000 |

Clearly, the second example makes financial sense however the benefits of refinancing a $150,000 loan will not be realised for 2-3 years. In this case, other factors need to be considered such as whether you intend to pay down the loan ahead of time or if you’re refinancing for other objectives than simply a better rate.

Lenders looking to attract new customers often offer financial incentives to refinance in the form of cash-back offers. These range from between $1,500 and $5,000 and are cash payments made directly to the borrower to assist with the cost of refinancing. In the above $150,000 example, a lender with the same terms, however offering a $1,500 cash back, could significantly influence your decision.

Each cashback offer has specific and varying qualifying criteria and it’s important to ensure you meet eligibility. At the risk of sounding like a broken record, a good mortgage broker will be familiar with the current offers and eligibility to help you with a cost-benefit analysis.