Over the past 10 years, investing in technology companies has been a great way to make money. And when we think about investing in tech, it’s almost natural to think about the world conquering US technology behemoths, the likes of Nvidia, Apple, Microsoft, Meta, Google and Amazon.

The US’s NASDAQ Composite index has become synonymous with tech investing, and USD100,000 invested there 10 years ago would now be worth more than USD$430,000.

Or at a stretch you might think about the Asian tech giants, the likes of Baidu, Alibaba, Tencent and Xiaomi out of China, or even Korea’s Samsung and Taiwan’s TSMC.

It’s less likely when you think about investing in tech companies that Australia comes to mind, after all, that’s where you go for some of the world’s biggest resources companies, or reliable dividend payers like the financials, which between them account for more than half the total market. Given the S&P/ASX Information Technology index accounts for just 3 per cent of the market, it’s easy to see how it can be overlooked.

However, the same peculiarities with the way the US tech index is constructed that stops Meta (Facebook), Amazon and Google from being included as “tech”, are applied to some companies that would seem obvious inclusions for the Australian index, such as REA Group, Pro Medicus and CAR Group, and they happen to be some of the best performing too.

Whilst Australia’s tech sector is relatively small, it boasts some high-quality companies that come with decades of history which have produced outstanding returns. To illustrate, we can take full advantage of the benefit of hindsight to see how a portfolio of a selection of Australian tech-oriented companies would have performed compared to the market.

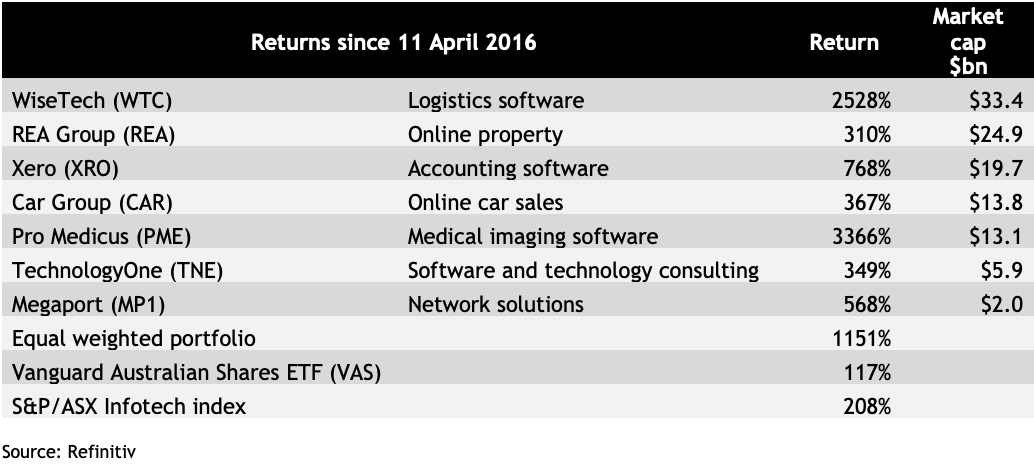

The portfolio is comprised of seven of the best known tech companies from the ASX 200 ranging in market cap from $33 billion down to $2 billion: WiseTech (WTC), REA Group (REA), Xero (XRO), CAR Group (CAR), Pro Medicus (PME), TechnologyOne (TNE) and Megaport (MPT).

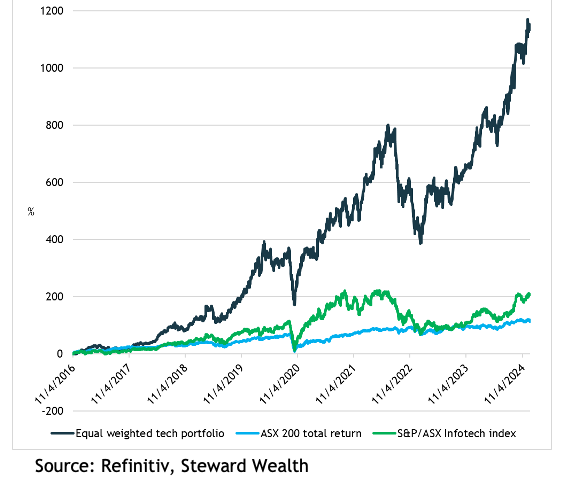

A portfolio equally weighted to each of the seven companies starting from the date that WiseTech listed on the ASX, 11 April 2016, would have returned an astonishing 1151 per cent to the end of May this year, against the Vanguard Australian Share (VAS) ETF’s total return (including dividends) of 117 per cent and the S&P/ASX Information Technology index’s 208 per cent – see chart 1.

That’s an incredible compounded annualised return of more than 36 per cent, which is more than double that of the NASDAQ Composite over the same period, and well over triple that of the broader Australian share market.

The catch is, however, this is a portfolio of “growth” companies, meaning their earnings growth is not so dependent on the economic cycle, and the market typically looks out years ahead when valuing them, and the higher the potential growth, the further out it will look. Consequently, just like their international tech peers, this portfolio of stocks comes with a high forecast price to earnings (PE) ratio for next year, with an average of 70x, compared to the ASX 200’s 17x.

A drawback of their high valuation multiples is that growth stocks are usually more volatile than the broader market. For example, during the COVID crash of 2020, this portfolio of stocks fell by 53 per cent, compared to the broader market’s 39 per cent; and in the market correction of 2022, it was a 51 per cent drop versus 28. So investors need to be sure they have the risk tolerance to see those corrections through in order to benefit from the long-term growth.

It is also unusual that high growth companies pay much of a dividend, if they pay one at all, because normally they are reinvesting earnings into their growth pipeline where they would expect to earn a high return on the equity invested. The average dividend yield on this portfolio is less than 1 per cent, so investors have to be resigned to returns being dependent on capital growth.

Obviously, the old proviso of past performance not being an indicator of future returns applies to this portfolio of tech stocks, but there has been an impressive degree of consistency. Whilst it might be a brave investor who would allocate a large portion of their portfolio to high growth companies, a smart investor should see the merit of some allocation.