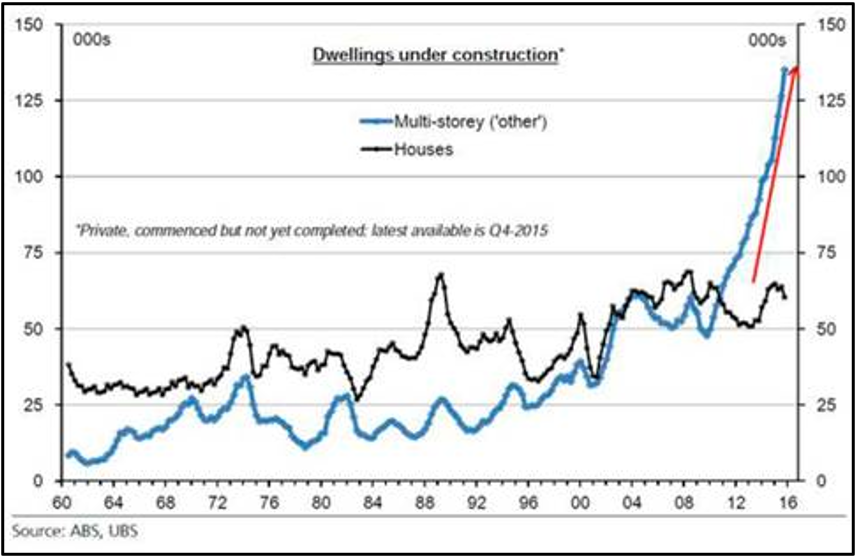

Lower interest rates are almost certain to fire up a housing market and property developers will make out like bandits as they rush to bring on new projects to meet the fueled up demand. This certainly appears to have happened here in Australia where a record number of unit approvals have now rolled into commencements. One look at this chart from UBS Asset Management shows why this may be spelling trouble: whenever you see a chart go all but vertical you have to stop and wonder, particularly when you’re talking about the supply of dwellings, since there are only so many people to buy them and live in them.

One analyst estimates there is about 12 month’s oversupply of new dwellings, which is hardly surprising given, as the chart shows, there are more than four times the number of apartments being built now than in 2000. Of those being built, 88% are in Queensland, New South Wales and Victoria, leading to assertions of an apartment glut. For example, there were 2,700 apartments a year added to the Melbourne CBD over the past 14 years. Right now, however, there are 19,640 apartments under construction in the City of Melbourne, with an additional 18,800 approved for development.

If the property market does cool down it’s quite possible apartments will be the catalyst. By the end of June there had been 96,000 completed apartments settled in the previous 12 months and there were 92,000 pre-purchased apartments due to be settled. One problem though is the banking regulator, APRA, firstly instructed the banks to reduce their investment lending activity overall, so they have been lowering the amount they will lend against apartments and some lenders have listed specific postcodes they are avoiding altogether and, secondly, pressured the banks to reduce their lending to non-residents. The decline in funding availability means some buyers are having to resort to non-bank lenders, which comes at a cost.

Also, while it’s unclear how many apartments have been purchased by Chinese buyers, Meriton in Sydney is reporting that following the Chinese government’s crackdown on capital leaving the country they are seeing off the plan buyers walking away from their 10% deposits, which hasn’t happened before.

If an apartment is bought as an investment and is to be rented out, the estimated yield in Melbourne is now 3%. Once you deduct costs the net yield is about half that, so 1.5%, which is lower than a government guaranteed term deposit. That means the only possible justification to purchase a Melbourne rental property is expected capital gain. If supply is about to rise markedly, that expectation will look increasingly like speculation.